FXPRIMUS Review 2023 Update – Get All Information

| General Information |

|

|---|---|

| Broker Name: | FXPRIMUS |

| Broker Type: | Forex |

| Country: | Saint Cyprus |

| Operating since year: | 2009 |

| Regulation: | CySEC, VFSC, FSCA |

| Address: | Limassol, Cyprus |

| Broker status: | Active |

| Customer Service | |

| Phone: | +27 105004213 |

| Email: | [email protected] |

| Languages: | ENG, ESP, RUS, +8 |

| Availability: | 24/5 |

| Trading | |

| The Trading platforms: | MT4, WebTrader, MobileTrader |

| Trading platform Time zone: | GMT+2 |

| Demo account: | Yes |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | Yes |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit ($): | $500 |

| Maximal leverage: | 1:30 |

| Spread: | Variable |

| Scalping allowed: | Yes |

General Information

FXPRIMUS is a veteran in the online brokerage world, with over a decade of experience under its belt. It started operating in 2009 and celebrated its tenth-anniversary last year. The brokerage offers a range of trading services.

These services include:

- Stock trading

- Forex trading

- Digital currency trading.

The firm has multiple branches, but the primary one is in Limassol, Cyprus. However, the exact address of the office is unknown.

The fact that FXPRIMUS is quite an experienced brokerage might sound appealing to some. However, the broker seems to have fallen into the same trap that many older firms do and has become too complacent.

That has led to a lack of innovation and seemingly no desire to keep up with modern brokerage standards. The issue is apparent in many aspects of their service. But let’s start with the thing you spot first FXPRIMUS’ website.

User experience

As you enter, you might feel the need to check your internet speed since the loading is painfully slow. We assure you, the issue isn’t on your end, but rather the brokers.

The slowness of the transitions creates quite a bit of frustration when you’re trying to inspect the service or even just browsing around. But that isn’t the only issue, as FXPRIMUS is also plagued by sub-par website organization.

For example, once you look at the account-related pages under the trading drop-down, the first two things you see are PAMM for masters and followers. Those aren’t the actual account types but rather an introduction to the broker’s social trading features.

The thing you probably want to know is under the account comparison page, located at the bottom of the menu. Even that is a minor issue compared to others, which we’ll inspect in a second. Before that, however, let’s look at what the broker’s self-promoted strengths are:

· REFER-A-FRIEND

While referral programs aren’t anything new in the brokerage world, putting them on your landing page’s most noticeable image is quite odd. That’s especially true since a lot of shady brokerages use those to attract inexperienced customers.

Namely, such brokerages function similarly to MLM schemes rather than true trading service providers. While FXPRIMUS isn’t necessarily one of those brokers, putting up the referral shows that it lacks in other areas of its service.

· 100% DEPOSIT BONUS

Bonuses are another one of those things that sound better on paper than they are in reality. A novice trader might see a 100% bonus and see it as a simple way to double their money.

However, more experienced investors will know that the bonuses often come with conditions that make them barely worth anything. Combined with the previous referral function, it definitely leaves an air of suspicion regarding the broker’s intentions.

· KAIA PARV

While the previous two clauses raised some questions about the broker’s legitimacy, this one is simply confusing. The brokerage decided to put Kaia Parv, who is the Head of Investment Research, on one of its banner images.

There’s no additional info on the picture, so it just comes off as them promoting one of their employees. If you click on the ‘more info’ button, you’ll notice it’s actually promoting her analysis and education services.

However, the brokerage already has a dedicated education page, so the situation simply creates confusion and demonstrates poor organizational skills.

Funds Trading and Security

Security is a strange area of FXPRIMUS’ service. That’s because they seem to have excellent technical specifications, but a poor realistic situation. Namely, the broker is under the watch of three regulators, CySEC, VFSC, and FSCA.

You might say that the only worthwhile regulator on that list is CySEC. But still, the fact that FXPRIMUS has three watchdogs should translate to a secure experience.

However, in reality, it displays a lot of things that would indicate it’s a scam. For starters, we stated that the broker’s website is laid out in a confusing manner and mentioned the account example.

The Kaia Parv situation is another similar instance, and you can find many more if you try and use FXPRIMUS. However, the confusion is a smaller issue compared to the fact that the broker straight-up hides certain information.

The broker’s address is unknown

For example, you might have noticed that at the start of our FXPRIMUS review we said that the broker’s exact address is unknown. An address, as you know, is basic information and should be simple to find.

There are more examples of missing information, related directly to trading conditions. Coupled with the fact that the broker uses bonuses as its main advertisement source leads to quite a bit of doubt regarding its validity. Also, the fact that it tries to hide things about its service indicates that the customer experience is sub-par.

The customer reviews seem to back those doubts, as there are many complaints of the broker scamming users. To be more exact, it seems like it was a legitimate operation up to a certain point, and then suddenly it started acting maliciously.

The turn, along with the broker’s age, makes us think that the owners are aware that they can’t compete and are attempting to cash out.

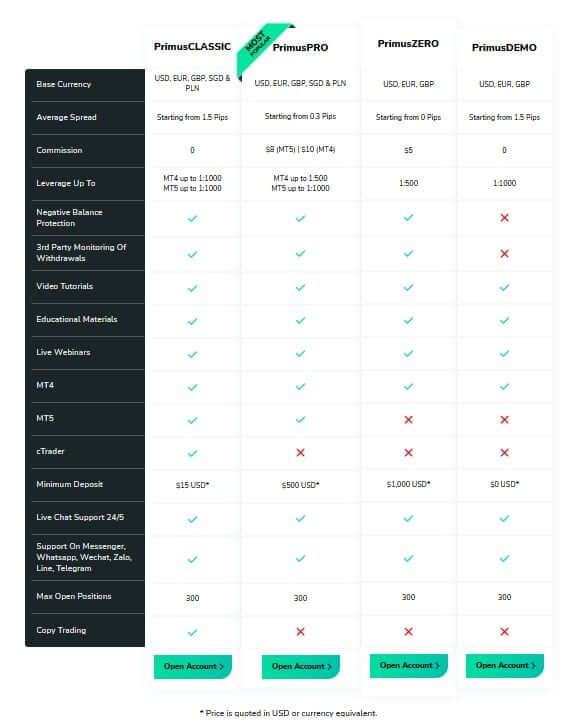

The Trading Accounts

If you are about opening an account, you always want to know what FXPRIMUS Reviews this broker is offering to its clients. Earlier in our FXPRIMUS review, we mentioned the issue with how the brokerage lays out its account info.

Although confusing at first, we can ignore that for now. First, we’d like to focus on the account quality rather than the web design issues.

Offering a demo account

It seems we do have one good thing to say about FXPRIMUS in that it offers a demo account, which can be a valuable practice tool besides any other classic account in the trading environment.

You can also employ the demo as a workaround for the broker’s lack of willingness to display info. Naturally, having to find a workaround at all is horrible news, but at least there’s somewhat of a solution.

FXPRimus Trading Accounts Available

-

PrimusCent:

- 💰 Min Deposit: $15 USD / R245 ZAR

- 🔁 Average Spread: 1.5 Pips

- 💳 Commission: 0

- 📈 Margin Call: 100%

- 🛑 Stop Out: 20%

- 📉 Leverage Up to: 1:1000

- ❤️ Negative Balance Protection: Yes

- ☪️ Swap-Free Option: Yes

- 4️⃣ MT4: Yes

- 5️⃣ MT5: 📌 No

- 🖥️ cTrader: No

- ©️ Copy Trading: No

-

PrimusClassic

- 💰 Min Deposit: $100 USD / R1600 ZAR

- 🔁 Average Spread: 1.7 Pips

- 💳 Commission: 0

- 📈 Margin Call: 50%

- 🛑 Stop Out: 20%

- 📉 Leverage Up to: 1:1000

- ❤️ Negative Balance Protection: Yes

- ☪️ Swap-Free Option: Yes

- 4️⃣ MT4: Yes

- 5️⃣ MT5: Yes

- 🖥️ cTrader: 📌 Yes

- ©️ Copy Trading: 📌 Yes

-

PrimusPro:

- 💰 Min Deposit: $1000 USD / R16200 ZAR

- 🔁 Average Spread: 0.5 Pips

- 💳 Commission: 📌 $10 USD

- 📈 Margin Call: 50%

- 🛑 Stop Out: 20%

- 📉 Leverage Up to: 1:500

- ❤️ Negative Balance Protection: Yes

- ☪️ Swap-Free Option: Yes

- 4️⃣ MT4: Yes

- 5️⃣ MT5: Yes

- 🖥️ cTrader: No

- ©️ Copy Trading: No

-

PrimusZero:

- 💰 Min Deposit: $10000 USD / R162’000 ZAR

- 🔁 Average Spread: 📌 From 0 Pips

- 💳 Commission: 📌 $5 USD

- 📈 Margin Call: 100%

- 🛑 Stop Out: 20%

- 📉 Leverage Up to: 1:500

- ❤️ Negative Balance Protection: Yes

- ☪️ Swap-Free Option: 📌 No

- 4️⃣ MT4: Yes

- 5️⃣ MT5: 📌 No

- 🖥️ cTrader: 📌 Yes

- ©️ Copy Trading: No

Islamic swap-free account

FXPRIMUS provides Islamic swap-free trading options through three account levels: PrimusCent Swap-free, PrimusClassic Swap-Free, and PrimusPro Swap-free. These accounts cater to clients who prefer to adhere to Islamic principles regarding interest-free trading.

Moreover, FXPrimus goes the extra mile by automatically granting Extended Swap-free status to all eligible trading accounts created by clients in non-Islamic countries. This allows clients to trade without incurring any swap charges, aligning with their religious and ethical beliefs.

Pros and Cons of FXPrRIMUS

In this FXPrimus review you will see that it offers several pros and cons. On the positive side, they provide a Sign Up Bonus and an Affiliate Program.

They are also highly-regulated, ensuring a secure trading environment. However, selected accounts may have a high minimum deposit requirement. Despite this, FXPrimus remains a reputable choice for regulated trading.

Review of FXPRIMUS Trading Conditions

Very little about FXPRIMUS’ trading conditions actually comes from the broker itself. Namely, you need to find out by either employing the demo account or looking at third-party sources. As we already stated, we gathered that the max leverage is a measly 1:30.

The info about spreads varies, with some saying they are tight and others stating the opposite. Whatever the case may be, we shouldn’t have to rely on he-said-she-said to find out. Instead, the information should come from the broker itself.

Trading Platform

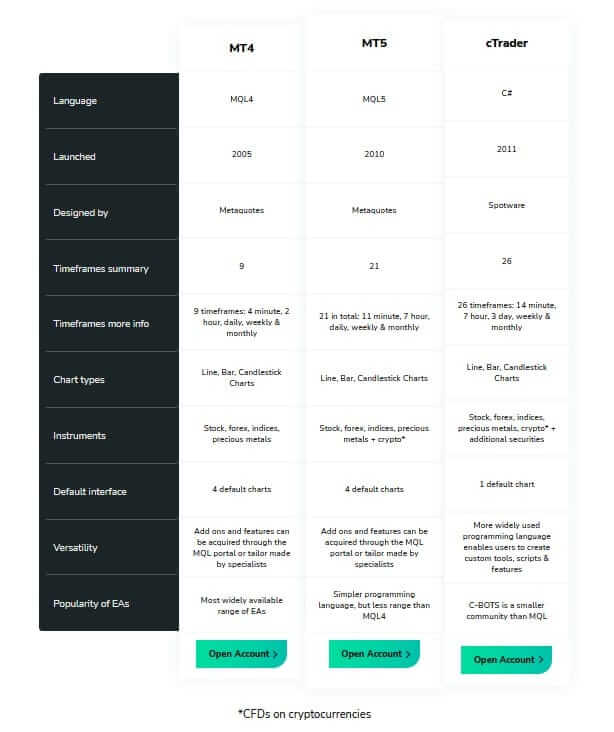

In addition to mt4 platforms, we have webtrader, mt4, mt5, and ctrader. Let’s start from the metatrader 4!

Mt4 platform

FXPRIMUS at least made a good choice in its platform by providing MetaTrader4. The software has been the go-to for brokers and traders for years now. It doesn’t seem like it’ll leave that spot anytime soon.

MetaTrader4 makes overcoming the initial hurdles of trading possible with its intuitive interface while remaining analytically capable. On top of that, it also comes with web and mobile traders, which enable browser and phone trading.

It should also be noted that FXPRIMUS has a social trading program in its PAMM platform. That lets users copy or be copied by others, making the trading process simple or boosting their earnings slightly.

Mt5 platform

The MT5 platform supports various chart types such as Line, Bar, and Candlestick Charts for 21 timeframes, including 11-minute, 7-hour, daily, weekly, and monthly intervals.

Traders can access stock, forex, indices, precious metals, and crypto* markets on MT5, making it a versatile platform. The platform comes with four default charts, but users can expand its functionality by acquiring add-ons and features from the MQL portal or by seeking custom solutions from specialists.

Ctrader platform

The platform supports 26 timeframes, including 14-minute, 7-hour, 3-day, weekly, and monthly intervals, and offers Line, Bar, and Candlestick Charts.

Traders using the Spotware platform can access various markets, including stocks, forex, indices, precious metals, crypto*, and additional securities.

The platform provides one default chart, but users have the flexibility to create custom tools, scripts, and features using the more widely used C# programming language. It’s worth noting that the C-BOTS community, dedicated to Spotware’s C# programming language, is smaller in comparison to the MQL community.

Review of FXPRIMUS’ Trading Products

Information about FXPRIMUS’ trading products is more readily available than info about other parts of its service. However, it makes it apparent that the reason FXPRIMUS is secretive is because of its sub-par specifications.

As for its assets, while the broker does cover all the major categories, the selection itself is quite poor. The total number reaches about 100, which is way less than other modern brokerages. Here’s a list of FXPRIMUS’ asset categories:

- Forex

- Metals

- Energies

- Equities

- Cryptocurrencies

- Indices

- Futures

Customer Service

FXPRIMUS’ customer support setup is nothing out of the ordinary. If you are having any issues with your live account, trading, or something related to it, they are here to help any time!Their customer service team works 24/5, and you can reach them via phone, email, or the live chat feature integrated into the website.

- Phone: +27 105004213

- Email: [email protected]

Deposit and withdrawals

FXPrimus provides various deposit options for clients to open an account and securely manage their funds. These options include Bank Wire, Local Transfers, Credit Cards, and e-wallet solutions. Clients can conveniently deposit funds using their preferred method.

When it comes to withdrawing funds, the minimum amount across all options is $100 USD. It’s worth noting that FXPrimus does not impose any deposit fees.

Negative Balance Protection Available

At FXPrimus, client protection is of paramount importance. They provide Negative Balance Protection (NBP), a crucial feature that ensures clients’ funds are safeguarded and prevents their account balance from being exceeded. This valuable safety net shields traders from potential losses beyond what they have in their accounts, offering peace of mind and financial security.

In addition to prioritizing client protection, FXPrimus offers competitive spreads that start as low as 0.3 pips. These optimized trading costs enable clients to execute trades at favorable prices, potentially enhancing their profitability and minimizing expenses associated with their trading activities.

FXPrimus also recognizes the value of learning from successful traders. Through their copy trading functionality, clients have the opportunity to replicate the strategies and trades of experienced and accomplished traders.

This innovative feature saves time and effort for clients while allowing them to benefit from the expertise and insights of top performers. By following successful trading strategies, clients can potentially enhance their own trading results and improve their overall performance in the markets.

FXPRIMUS Review: Conclusion

Everything about FXPRIMUS screams “dying brokerage intending to cash out.” The company is secretive about its conditions while using multiple newbie-baiting tactics. As for the specifications that you can see, they are far below the industry standards.

While we’re not calling the broker a straight-up scam, its current state definitely isn’t far from it. We recommend avoiding FXPRIMUS, as it’s dangerous and has a sub-par trader experience.

There are many better alternatives, and since you’re already online, you shouldn’t have a difficult time finding one. For additional information you can visit fxprimus.com review official page!

-

Support

-

Platform

-

Spread

-

Trading Instrument

Awesome services

Trading terms are fair. The services are awesome.

Did you find this review helpful? Yes No

Primus Broker stands out for its dedication to trader education

Primus Broker stands out for its dedication to trader education and support, providing a solid foundation for both new and experienced traders aiming to navigate the markets more effectively.

Did you find this review helpful? Yes No

Amazing brokers

Their customer service is truly amazing. They are helpful and attentive most of the time.

Did you find this review helpful? Yes No

Good broker

When it comes to reliability in online trading, FXPRIMUS shines with their feature-packed platform. They provide essential tools and excellent support, making them a preferred choice for traders.

Did you find this review helpful? Yes No

Good broker

Always maintain good connection with me. Trading results are good and I am happy with customer service.

Did you find this review helpful? Yes No