FXCM Review 2023 Update – Is it a good broker or not?

| General Information |

|

|---|---|

| Broker Name: | FXCM Ltd. |

| Broker Type: | Forex |

| Country: | United Kingdom |

| Operating since year: | 1999 |

| Regulation: | AMF, ASIC, BaFin, CONSOB, FCA, FSB |

| Address: | 0 Gresham Street, 4th Floor, London EC2V 7JE, United Kingdom |

| Broker status: | Regulated |

| Customer Service | |

| Phone: | +1 646 253 1401 |

| Email: | General Inquiries: [email protected] |

| Account Specific Inquiries: | [email protected] |

| Languages: | English, Chinese, German, French, Italian, Spanish, Vietnamese, Arabic. |

| Availability: | Monday to Friday. 24/5 |

| Trading | |

| Trading platforms: | MT4 |

| Trading platform Time zone: | International |

| Demo account: | YES |

| Mobile trading: | YES |

| Web-based trading: | YES |

| Bonuses: | YES |

| Other trading instruments: | YES |

| Account | |

| Minimum deposit ($): | $50 |

| Maximal leverage: | 1:30 |

| Spread: | YES |

| Scalping allowed: | YES |

Review Contents:

- FXCM General Information;

- Tradable Products;

- FXCM Trading Accounts;

- Deposit & Withdrawals Options;

- Research Tools;

- Platforms and Tools;

- FXCM Review Conclusion.

FXCM General Information

A FXCM Ltd, also known as Forex Capital Markets, is a Broker Company based in the UK. Originally founded in New York in 1999, London-based FXCM grew rapidly. Its head office is located at 20 Gresham Street, fourth Floor, London EC2V 7JE, United Kingdom. Following the 2010 acquisition of UK-based ODL Group FXCM is one of the world’s largest retail forex broker.

FXCM online broker company faced some allegations, starting with fines triggered by accusations of slippage mismanagement and ending with a long-lasting ban on United States operations as part of a February 2017 agreement with Commodity Futures Trading Commission (CFTC).

Jefferies Financial Group, formerly Leucadia National Corp, holds a majority interest.

The brokerage firm also maintains offices in several other locations, like Australia, several EU countries, and South Africa. It currently runs ten sales offices on five continents. So, the broker is quite popular in the online trading community. It won various awards.

In 2015, FXCM had a big loss when the Swiss franc was no longer tied to the US dollar. Since then, FXCM has been focused on helping both new and experienced traders with their trading needs.

What does FXCM platform support?

FXCM platform choices support all types of trading styles and account levels. It has an impressive educational portal that focuses on lower-skilled clients and beginner traders. Thought, the research section is less comprehensive, lacking webinars, and videos.

Bottom line trading costs are a little bit complicated to estimate from site documentation. This generates transparency issues for both standard and active trader accounts.

Investor Protection & FXCM Regulations

In terms of regulatory oversight, the UK’s Financial Conduct Authority (FCA ) regulates FXCM. The FCA is one of Europe’s leading financial regulatory agencies. Moreover, it is highly regarded. It offers a high level of protection to traders.

Besides, the Financial Services Compensation Scheme (FSCS) protects UK clients of FXCM. Moreover, in case of scam and theft the company reimburses up to a maximum of 50,000 pounds. Furthermore, other regulatory agencies collaborate with FXCM such as European AMF, BAFIN, CONSOB as well as in Australia by ASIC.

It doesn’t operate a bank

To sum up everything, FXCM is publicly traded, does not operate a bank, and is authorized by three tier-1 regulators (high trust): Australian Securities & Investment Commission (ASIC), Investment Industry Regulatory Organization of Canada (IIROC), and the Financial Conduct Authority (FCA). Also, two tier-2 regulators (average trust), and zero tier-3 regulators (low trust).

Reliability

FXCM is a well-known forex trading company among its peers. However, in 2017, the broker suffered a setback to its reputation in the US market. Over the last few years, FXCM has been working hard towards rebuilding its reputation and brand.

Actually, over the last couple of years, FXCM has won several awards. It is a reliable proof of its commitment to regaining its prestige among the online trading community. In 2017, FXEmpire nominated it for “Best Customer Support.”

Tradable Products

FXCM offers six different classes of assets in total across 39 currency pairs, 13 indices, two cryptos, one treasury, metal, and nine commodities. In other words, terms of tradable products

FXCM offers to trade in the forex market commodities and indices. UK clients also have an opportunity to participate in spread betting on currency pairs.

FXCM Trading Accounts

When it comes to trading accounts, FXCM provides a selection of three options: Mini, Standard, and Active Trader accounts. Each account type has its own minimum deposit requirement, spread variations, and access to specific currency pairs.

To assist in selecting the most suitable account for individual needs, FXCM offers an online wizard that guides traders through the process of account selection based on their specific requirements and preferences.

This ensures that traders can choose the account that aligns with their trading goals and preferences with ease.

Mini trading account

The FXCM Mini account is specifically designed for newcomers to the FX market. With smaller contract sizes of 10,000 units, 1/10th the size of a standard account, it offers traders the opportunity to engage in live trading with reduced risk and exposure. Additionally, the Mini account allows traders to familiarize themselves with FXCM’s dealing practices, the stability of the FX Trading Station, and the overall quality and reliability of FXCM’s services.

This account type is suitable for various individuals, including new FX traders transitioning from stocks or futures, those with account balances below $10,000, traders seeking to test FXCM’s execution and services, experienced traders refining their trading strategies, and traders looking for free access to FXCM Trade Ideas.

Standard trading account

FXCM is available under the regulation of CySEC, FCA, ASIC, and FSCA, ensuring a regulated and secure trading environment. Traders have access to a diverse range of markets, including Forex, forex baskets, commodities, indices, stocks, stock baskets, and cryptocurrencies, with over 100 assets in total.

The commission structure involves floating spreads starting from 1.3 pips on forex, without any additional commissions, although a rollover fee is charged for positions held overnight. Traders can choose from multiple platforms, including MT4, Trading Station, TradingView, and Capitalise AI, offering flexibility and advanced trading features.

The trade size starts from 1 micro lot, allowing for precise position sizing. Leverage of up to 1:30 is available, providing increased trading power. Opening an account is convenient, with an unlimited demo account for practice purposes, and a minimum deposit requirement of $50 (ASIC, FSCA) or $300 (CySEC, FCA) for a live account.

Active trading account

FXCM is a trusted broker available under the regulation of CySEC, FCA, ASIC, and FSCA, ensuring a safe trading environment. With a wide range of markets, including Forex, forex baskets, commodities, indices, stocks, stock baskets, and cryptocurrencies, traders have access to over 100 assets to diversify their portfolio.

The commission structure features spreads starting from 1.3 pips, and rollover fees apply to positions held open for consecutive days. Traders can choose from top-notch platforms like MT4, Trading Station, TradingView, and Capitalise AI to suit their trading preferences. The trade size starts from 1 micro lot, allowing for precise position sizing. Leverage of up to 1:30 is available, providing opportunities for increased trading power.

Special features include:

- Dedicated support

- Up to 2 free withdrawals per month

- Expedited processing times

- Rebate pricing (available with ASIC regulation).

Opening an account is hassle-free, with the option to start with an unlimited demo account for practice. For a live account, the minimum deposit required is $50 (ASIC, FSCA) or $300 (CySEC, FCA).

Live Trading Account

It takes three simple steps to open a live trading account on FXCM.

STEP 1:

An investor selects the country of residence. Chooses a preferred trading platform. Proceeds and clicks on “Begin Application.” Afterward, the client is redirected to a secure server to complete the registration form.

STEP 2:

The clients fill out the registration form with all the required details. Once the application form has been completed and submitted, FXCM will then process the application and email an account number.

To complete the application, the FXCM user will be required to submit two documents, a government-issued ID and proof of residence. Once every step is completed, only a last and final step is left, which is to fund the trading account.

STEP 3:

The final step of the account opening process is to fund a trading account after which the trading begins immediately.

Deposit & Withdrawals Options

When it comes to funding a trading account, FXCM provides support for four main types of payment methods. This includes credit/debit cards, electronic fund transfer, bank wire transfer, UnionPay, Skrill, and Neteller.

Also, all Bank Wire requests are charged with a $40 withdrawal fee. They claim to process the client’s withdrawal requests within one to two business days where possible. Deposits are free of charge.

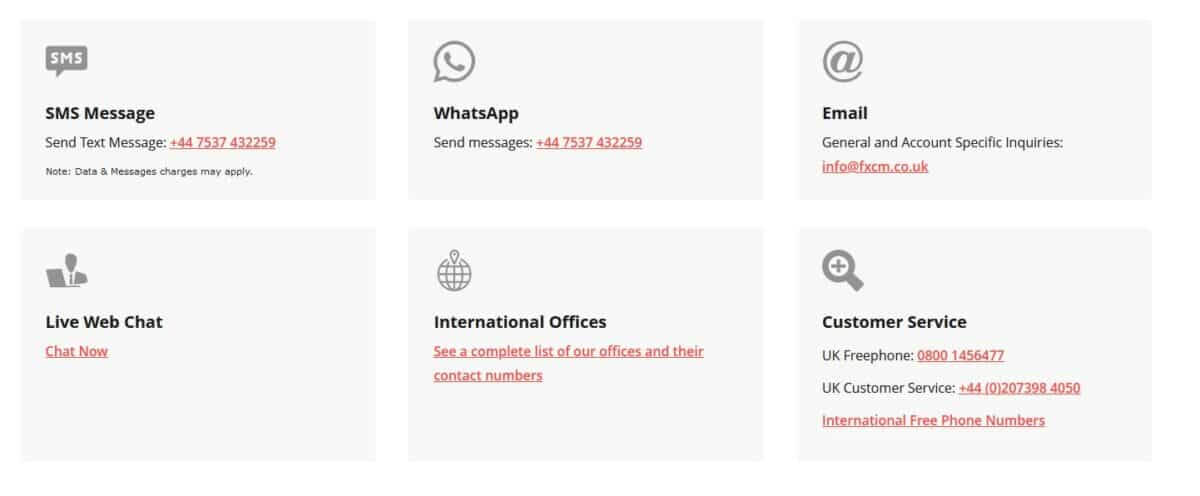

Customer Support at FXCM

FXCM online customer support system is provided on a 24/5 basis. The response of the support team is commendable. Although, any queries on live chat are attended to almost immediately.

Traders can get in touch with the support team through Live chat, email, SMS message or call them directly on the telephone. International clients can call FXCM on a localized number if they are based in the following countries:

- AUSTRALIA

- HONG KONG

- ITALY

- CANADA

- FRANCE

- SOUTH AFRICA

- GERMANY

- ISRAEL

- GREECE

- FXCM UK

Research Tools

FXCM provides forex traders with a wide range of market research tools and resources that will appease the majority.

Benefits

- In 2018 FXCM launched Quant News, featuring videos, webinars, and news articles for algorithmic traders.

- FXCM has done a good job in incorporating educational information into its research.

- Moreover, noting that FXCM’s research tools include news headlines from Investing.com, premium content from Trading Central, as well as a market screener tool and a pattern-recognition scanner developed in conjunction with Grid Sight Technologies LTD.

Considerations

- NONE

FXCM Platforms and Tools

FXCM sets a quite high bar. The FXCM broker offers a growing range of trading platforms and tools for algorithmic trading. Also, the Trading Station platform and third-party platforms such as MetaTrader4 (MT4) and NinjaTrader are accessible via desktop, the web, and mobile.

Benefits

- FXCM’s main trading platform, Trading Station, does well at catering to the forex trader needs, regardless of skill level. The Marketscope 2.0 charting feature within the platform is a powerful charting package that runs in parallel to the main platform window.

- The web version of Trading Station runs smoothly. Charts pack nearly the same number of indicators as the desktop.

- FXCM NinjaTrader platform from FXCM features numerous trading tools. It helps in creating trading strategies and indicators from scratch.

- The FXCM App store provides various technical indicators, add-ons, and automated trading robots for Trading Station, FXCM MT4, and NinjaTrader platforms.

- Also there is a dedicated technical support team to assist traders in developing their MetaTrader4 Expert Advisors (EAs).

Considerations

- FXCM’s Trading Station platform and the company’s Active Trader offering can captivate and engage the sophisticated trader, but newcomers may face an arduous learning process due to the advanced platform features that may require getting used to in tie-up with FXCM’s educational materials.

- While NinjaTrader does not come pre-loaded with trading strategies, users can make their own or use the third party developed NinjaScripts, similar to how the MT4 platform operates.

FXCM Review Conclusion

Therefore, the question “is FXCM good for traders?” has an easy answer. Yes, it is. Overall, FXCM has been able to offer its traders a fulfilling trading experience on its trading platform. FXCM is a great choice for active forex traders.

Besides, it has competitive spreads, as well as automated trading strategies. All of FXCM’s platforms offer traders the ability to run algorithmic trading and access advanced charting tools.

Advantages

- Regulated Broker

- Low minimum deposit requirement

- Numerous free trading tools provided

- MetaTrader and home¬have grown Trading Station

- Algo trading APIs and third-party specialty platforms

- Social/Copy trading platforms

- Multiple choices of trading platforms

Disadvantages

- Specialty platforms incur fees

- Weak CFD coverage

- After losing US regulatory license doesn’t accept US clients

- No share coverage.In short, FXCM is a publicly traded company that is authorized by three top regulators: ASIC, IIROC, and FCA. It is not a bank.

Conclusion

In conclusion, FXCM Ltd, a renowned broker company, has established itself as a major player in the global forex market since its founding in 1999.

Despite facing some challenges, including fines and a ban on operations in the United States, FXCM remains a popular choice among traders worldwide. With its headquarters in London and offices in multiple countries.

It includes Australia, several EU countries, and South Africa, FXCM has a strong global presence. Traders benefit from features such as competitive average spreads, an economic calendar, trading signals, and a variety of account types to suit their needs.

FXCM’s association with Jefferies Financial Group further enhances its credibility in the industry. The numerous awards it has received attest to its commitment to providing quality services to the online trading community. For additional information visit the fxcm-markets.com review page!

Overall

-

Support

(4.5)

-

Platform

(4.5)

-

Spread

(4.5)

-

Trading Instrument

(4.5)

Worst trading signals

Huge slippage and the worst trading signals I have ever used.

Did you find this review helpful? Yes No

Avoid this broker

Avoid trading with this broker, they are not a good company.

Did you find this review helpful? Yes No

Worthless broker

Worthless broker company. Dealing with them is just a waste of money and time.

Did you find this review helpful? Yes No

Unhappy with trading results

I am not happy with my trading results. I have used the service for a month, I wonder if I need longer time to see good result,but I really have to quit becuse I am afraid to incur so much losses.

Did you find this review helpful? Yes No

Expensive

Huge price difference compares to other brokers. They have the most expensive per-lot price and they keep on increasing their prices.

Did you find this review helpful? Yes No

Very slow withdrawal

Not a good broker service. Have traded with them and withdrawal is very slow.

Did you find this review helpful? Yes No

Disappointed with this broker

I am truly disappointed when I traded with this broker. They have set very high standards as if services are all great. But extremely unhappy on actual trading, false promotions.

Did you find this review helpful? Yes No

Do not deal with them

Funny how these people believe that they can get bank details over the phone. Do not provide anything when they called.

Did you find this review helpful? Yes No

Not a good broker

Not a good trading broker to deal with. Withdrawal is very slow and signals are not that good.

Did you find this review helpful? Yes No

Poor offers

Poor offers. Do not deal with them.

Did you find this review helpful? Yes No

Slow withdrawals

Slow withdrawals. Very frustrating wait time I have ever experienced.

Did you find this review helpful? Yes No

Poor communication skills

Poor communication skills. These people lack comprehension and do not listen to concerns.

Did you find this review helpful? Yes No