Fundiza Review 2023 Update – Is it Worth the Money?

|

General Information |

|

|---|---|

| Broker Name: | Fundiza Ltd |

| Broker Type: | Forex, Commodities, Stocks |

| Country: | Vincent and Gredaines |

| Operating Since (Year): | 2019 |

| Regulation: | N/A |

| Address: | Victoria Park Road, Kingstown, St Vincent & Grenadines, Kingstown POB 4457 |

| Broker Status: | N/A |

| Customer Service | |

| Phone: | +1-(888)-964-7227 |

| Email: | [email protected] |

| Languages: | English |

| Availability: | Monday to Friday |

| Trading | |

| Trading Platforms: | MT5 |

| Demo Account: | Yes |

| Mobile Trading: | Yes |

| Web-based Trading: | Yes |

| Bonuses: | N/A |

| Other trading instruments: | Indices, Shares |

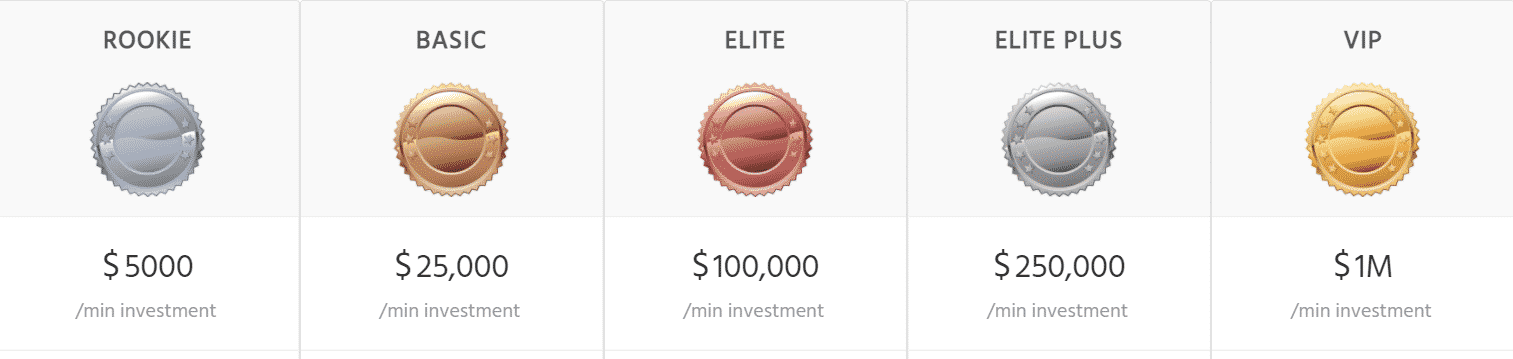

| Account Minimum Deposit ($): | $5,000 |

| Maximum Leverage: | 400:1 |

| Spread: | N/A |

| Scalping Allowed: | Yes |

Overall

4.6

-

Support

(4.5)

-

Platform

(4.5)

-

Spread

(4.5)

-

Trading Instrument

(5)

Comments Rating

( reviews)

Superb trading platform

Superb trading platform. Easy to use and very efficient in organizing trading portfolio.

Did you find this review helpful? Yes No

Good trading broker

They’re exactly what I am looking for in forex trading. I need a trading partner to help me gain a good profit. I am glad to have them as my forex broker.

Did you find this review helpful? Yes No

Very good broker

Fundiza always exceeds my expectation. They achieve more than what they project in their market analysis. Very good broker.

Did you find this review helpful? Yes No

Reliable trading advice

Reliable trading advice. I never regret trading with this broker, all their trading advice is worthwhile.

Did you find this review helpful? Yes No

Outstanding broker service

Outstanding broker service. They always take time to make sure everything is well understood and they take extra effort to find better opportunities to earn a profit.

Did you find this review helpful? Yes No

customer service is terrible

I found the broker a decent enough guy and was very supportive ( just found out trading wasnt for me ) – trying to withdraw my funds was like getting blood out of stone… i felt fobbed off, i didn’t even get an email when my account was verified, so i have zero hope of getting any email when my funds were suppose to be transferred back.

Irony is they call you straight away to take your money but when you want it back they fob you off for days.

Broker – great – supportive

Support – Terrible

Did you find this review helpful? Yes (2) No

Convenient to trade with

Convenient to trade with. I can use my phone and trade anywhere I am. They are also very responsive online.

Did you find this review helpful? Yes (2) No (1)

Responsible and good

Really happy with the service from this broker. They are very responsible and good.

Did you find this review helpful? Yes No

Good broker

I found this broker good in all terms. Services are efficient, signals are profitable and withdrawal is smoothly processed.

Did you find this review helpful? Yes No

Good broker performance

The overall performance of this broker is good. Customer service is attentive and helpful. Signals are always profitable and accurate.

Did you find this review helpful? Yes (1) No

Skilled broker

The account managers are friendly and skilled. Broker signals guarantee 99% of winning most of the time. Recommended broker.

Did you find this review helpful? Yes (1) No

Accurate trading signals

I am very lucky to have traded with these brokers. They have great and accurate trading signals.

Did you find this review helpful? Yes (1) No

Reliable signals

A broker signals that you can depend on. Very accurate and reliable.

Did you find this review helpful? Yes No

Good broker

In every concern I had, I always get prompt answers from them. They are always available to help and support me in my trading concerns.

Did you find this review helpful? Yes (1) No

Fast withdrawals

Ultra-fast withdrawals. The process has always been so smooth and quick. I never encounter issues on withdrawals.

Did you find this review helpful? Yes (1) No