Forex lot sizes – Meet Micro, Mini, and Standard Lots

Trading lots, standard lots, and micro lots in a particular trading platform are one of the most popular activities online.

You might have stumbled upon these terms during your Forex trading education. These are basic concepts that you need to grasp when entering the Forex market.

In this article, we will see what these lots represent, the specificities of trading lots types, and how to choose the lots in trading. Also, we give you many examples to illustrate the whole concept of trading lots in Forex.

How is trading of currencies done?

Trading of currencies is done in increments grouped into sets known as “lots.” At the retail level, lots are broken down into three segments: trade-size (standard lots), mini lots, and micro-lots.

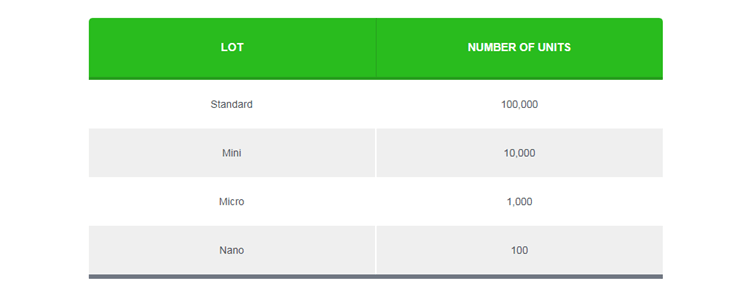

A standard lot consists of 100,000 units of the base currency of a pair. A mini lot contains 10,000 base currency units, and a micro lot comprises 1,000 units. A mini-lot has a size that is one-tenth of a standard lot, and a micro-lot is one-tenth of a mini-lot.

Let’s take a look at one example

When buying a micro lot in GBP/USD, we can buy 1,000 pounds sterling and sell an equivalent amount of dollars. Suppose the current GBP/USD exchange rate is 2.4500, and you want to buy $10,000 of this pair. The formula would look like this:

Size of the desired position / current exchange rate = number of units.

That is #100,000/2.4500 = 40,816.32 units of GBP/USD.

USD as a base currency in the Forex market

It is much simpler to compute when one obtains a pair that has the USD as the base currency. Why? For these cases, you merely need to buy the desired number of units since we are dealing with the base currency of the pair, which is in dollars.

In the case of a cross-pair transaction, if we want to buy $100,000 in the GBP/CHF pair, we will buy 40,816.32 units of GBP/USD at the above exchange rate, and we will sell 100,000 units of USD/CHF.

Choosing between several lot sizes is a great advantage that retail Forex trading offers the small investor. It allows you to better adjust and tailor money management to suit your trading style better.

Opting for mini lots for small trading account

If you have a small trading account, opting for mini lots can be a prudent choice to manage your risk profile effectively. Even highly experienced traders often steer clear of standard lots to ensure greater precision when determining their position sizes. This precision is crucial for minimizing the potential for significant profit or loss.

In its most fundamental sense, a lot refers to a specific quantity designated for trading in the Forex market. This article will discuss various types of lots. It will also help you choose the appropriate lot size for your resources and trading accounts.

The units you use in Forex trading are important for your profit or loss. It’s crucial to choose the right lot size for your situation.

Standard lots

When a forex trader talks about lots, they are usually talking about the normal lot size. Normal size is traded with sufficient account margin.

Even if you have made a good profit, you will never want to end up with an empty account, so it is better to reduce the size of traded lots when you are in short supply of margin.

To give you an idea, with a normal lot worth $100 000 of the base currency and a leverage of 1:100, you need to have $1,000 in your account to be able to pass it. With this configuration, you, therefore, risk gaining or losing $10 for each move of 1 pip.

To be able to engage in this kind of trading activity, forex brokers generally require an initial deposit of $10,000. Not everyone has this amount, so there was a time when currency trading was only for the rich. This is no longer the case today, as other types of lots can be traded.

Mini lots – explained

Mini lots, ideal for underfunded or novice traders, allow for risk management. Experienced traders may also reduce lot sizes to explore new strategies.

Mini lots, valued at $10,000, offer a 1:40 leverage, impacting profit or loss with each pip movement. Even though the amounts are smaller, continuous losses can still result in significant loss; be careful to avoid too much loss.

Micro lots

Micro lots are designed for traders who have limited capital. This makes it a suitable option for individuals who only have a few hundred dollars to invest in currency trading.

In Forex, lot size plays a crucial role in managing risk. It’s essential to align your lot size with your available funds to avoid unfavorable financial outcomes.

How to calculate the size of a lot?

1 lot = 100,000 units of the account currency (if your account is in euros, 1 lot = €100,000) 1 mini lot (0.1 lot) = 10,000 units of the account currency. 1 micro lot (0.01 lot) = 1,000 units of the account currency, and 1 nano lot (0.001 lot) = 100 units of the account currency.

Concretely, to find the value of the pips, you must apply the following formula: (0.0001xlot)/course. Thus, for an exchange rate of 1.256 3 and a variation index of the EUR/USD pair of 0.000 1, the lot size would therefore be €12,563.

What is the minimum trade size in lots?

“1.0” corresponds to a standard lot. The minimum trade size is 0.01 lot (i.e., one micro lot). In addition to a lot, when trading, you may be dealing with terms such as “leverage” and “point.”

Selecting the right lot size in Forex trading is a crucial decision.

Many beginner traders choose the micro lot as a smart option. The micro lot is equivalent to 1,000 units of the base currency or 0.01 lot on MT4. For instance, a 1 micro lot position on the EUR/USD pair represents a value of 1,000 EUR.

Once a trader can effectively set stop loss orders, understand the relationship between lot size and pip value, and grasp the significance of lots in Forex trading, they can calculate lot size based on their desired risk level. This calculation allows traders to determine how much currency to buy or sell, aligning with their risk tolerance.

How does it look like in practice?

In practice, calculating risk per trade is straightforward. For instance, if you have a $1,000 capital and aim to risk 2% of it per trade, you’d be risking $20.

This approach ensures that traders can manage their risk effectively while considering lot size as a key factor in their trading strategy.

Apply the right formula

Now to get the lot size to take based on its stop loss, simply apply the following formula:

(Risk per trade) / (Stop loss in pips) = mini lots

Let’s say our stop loss is 50 pips, which gives us: $20 / 50 pips = 0.4 mini lots or 0.04 lots or four micro lots. This gives us a position whose pip will be worth $0.4 and whose stop loss will be equivalent to $0.4 x 50, or $20.

Calculating lot size based on risk level helps optimize positions and accurately position yourself in Forex market. It avoids excessive risk or being too conservative.

What do we advise you to do?

By correctly calculating the size of its positions, the decisions of purchase and sale are more coherent, reflecting the trading plan and the money management to the letter.

We advise you to create an Excel table like the one above in order to know in advance how many lots you will take on the next trades of your trading sessions and, therefore, save time.

How will you calculate your loss and profit?

Now that you understand how to calculate the PIP value, let’s explore how to calculate gains and losses.

Picture this scenario: you intend to acquire US dollars while simultaneously disposing of Swiss francs at a rate of 1.4530, representing the selling price. Your initial acquisition of 100,000 units at this rate corresponds to a standard lot.

Subsequently, after a few hours, the rate ascends to 1.4550, prompting you to conclude the transaction.

To accomplish this, you must vend at the fresh rate of 1.4550, mirroring your initial purchase for entering the trade. The discernible discrepancy between 1.4530 and 1.4550 totals 20 pips, denoted as 0.0020.

Using our previous formula:

(.0001/1.4550) x 100,000 = $6.87 per pip x 20 pips = $137.40

Keep in mind that during trade entry or exit, you encounter the bid-ask spread. When buying a currency, you use the bid price, and when selling, you utilize the ask price.

This means you pay the spread when purchasing but not when closing a trade. Conversely, when selling, you don’t incur the spread upon entry but do so when closing the trade.

Bottom line

In Forex trading, it’s important to know about lot sizes (micro, mini, and standard) to manage risk and improve your strategy. These lot sizes represent different quantities of currency units and leverage, directly impacting profit and loss.

Novice traders often find micro lots a suitable choice, allowing them to start with smaller capital and minimize risk. Calculating lot size based on risk tolerance and stop loss is a crucial step, ensuring that you can trade confidently while safeguarding your account balance.

-

Support

-

Platform

-

Spread

-

Trading Instrument