Financio’s token is in the spotlight. What about ARTI?

Financio is a decentralized exchange created to support economies where technology is not commonplace or technical backwardness restricts development. Its platform is running on Binance Smart Chain, and it offers lots of features that will let users earn the high, passive crypto reward.

The Binance Smart Chain, also known as BEP-20, is a blockchain network built to execute smart contract-based applications, and it’s one of the best on the market. Furthermore, BEP is working in coordination with Binance Chain (BC). As a result, it allows customers to benefit from the best of both worlds: BEP’s smart contract capability and BC’s massive transaction throughput.

BEP also combines proof-of-authority (PoA) with delegated PoS to achieve network consensus and preserve blockchain security. PoA is known for its ability to prevent 51% of assaults and tolerate Byzantine attacks. Chosen validators take turns to verify network transactions. They are also the ones creating blocks in a PoA manner that considers both their stake and reputation in the network. However, a user must stake BNB to become a validator.

Where does Financio come in all of these?

This company assists the customers in earning a reward in cryptos in the form of farming, Staking, or crypto exchange. Moreover, Financio enables users to earn through liquidity, lotteries, IFO, and collectibles.

The platform launched its native utility token FIN on September 14, 2021. The sale will end on October 30, 2021. The price is 0.04 USD per FIN token during the initial coin offering, but after the sale is over, it will increase. The total supply of FIN tokens is 20000000. The team uses 60% for ICO sale from that amount, 20% is for exchange listings, 10% goes to marketing, 5% is set aside for development, 3,75% is for the team, and airdrop gets 1,25%. The company accepts ETH, BTC, BNB, and USDT in exchange for FIN tokens.

Financio decided to provide this new token so that its users would be able to learn to make fresh, bold, and profiting decisions. Its team aims to facilitate its customers through creating Defi solutions. Besides, the company’s solutions will help people make good earnings and get rewards in cryptocurrency. Financio will promote worthy users through Staking, crypto exchange through liquidity, farming, IFO, collectibles, and lotteries. It will also provide some other possible crypto lending options, along with token-burning processes.

What are the company’s goals?

The team thinks that cryptocurrencies should be a part of everyone’s portfolio. It foresees a society where wealth-building techniques are made open to everyone, restoring people’s control over existing financial institutions. To achieve that goal, they created Financio’s ecosystem. The latter will bring more people into digital assets. It will also allow users to generate a passive income through redistribution/reflection while retaining their privacy, autonomy, security, and authority.

The company plans to establish an economy based on sound monetary laws and a robust and solid decentralized basis.

Its native token FIN is a unique coin. Users can acquire it through various cryptocurrency rewards. Besides, FINANCIO is a contemporary cryptocurrency. It means users need extensive participation to get FIN.

The company boasts a worldwide ecosystem of people. It has interesting ideas on how to assist the world’s best innovators in bringing the future of lotteries, Staking, farming, and crypto exchange to perfection.

Financio entails users committing their existing crypto assets and, in exchange, offers higher returns over a set length of time. Liquidity providers will get a portion of trading fees. However, the company will define the amount according to users’ contributions to the entire liquidity pool. The customers will also be able to exchange cryptocurrencies by using FINANCIO in a regulated market easily.

What about Financio’s other features?

The company promises to disburse credit to qualified borrowers as soon as possible in coordination with its platform. It also aims to remove the need for mediators, thus, allowing the borrower and lender to negotiate the terms and conditions of the loan arrangement directly.

In addition, borrowers will be able to put up collateral to protect themselves if they fail to return the loan on time to the lenders. On the other hand, lenders will receive monthly revenue from borrowers in the form of interest payments.

Financio will stake users’ crypto assets on its exchange platform. The team claims that it is an excellent source of passive income for investors. The company has some criteria to determine the incentives given to users. According to the team, it determines the amount due to the network issuance rate, the total quantity of staked assets on the platform, the current inflation rate, and the duration of Staking.

Users can also make a lot of money by investing in the Financio platform and earning interest regularly. The company stated that no single person would have complete control over the whole quantity of pooled capital to ensure complete decentralization.

What is AI Marketplace, and how does it work?

AI Marketplace is developing Artificial intelligence models. That often requires the sharing of data from the user side. However, such data may be proprietary. As a result, an AI marketplace usually has a safety mechanism. The latter ensures that developers use that data only for training purposes.

Furthermore, an AI marketplace needs a mechanism that will be able to determine the quality of a final delivered AI model. Usually, accuracy is the primary metric. But nowadays, the companies consider alternative metrics that capture robustness, reliability, and fairness important as well.

AI systems require lots of maintenance over time. In the standard software industry, the developer company is responsible for providing support for its products. Despite that, specific AI developers may not be available in the future when it comes to AI products. Consequently, an AI marketplace needs standard guidelines. The developers follow them while developing models for their consumers. With such guidelines, other AI developers can easily do the maintenance.

Unlike the app store, this marketplace will be able to allow users to request new products on the fly. After that, an AI marketplace can quickly match its customers with developers with relevant expertise. Considering that some AI models are proprietary, users or developers won’t be able to share them online with a wider audience. That would only facilitate adversarial attacks and risk leaking intellectual property.

How can customers use ARTI tokens?

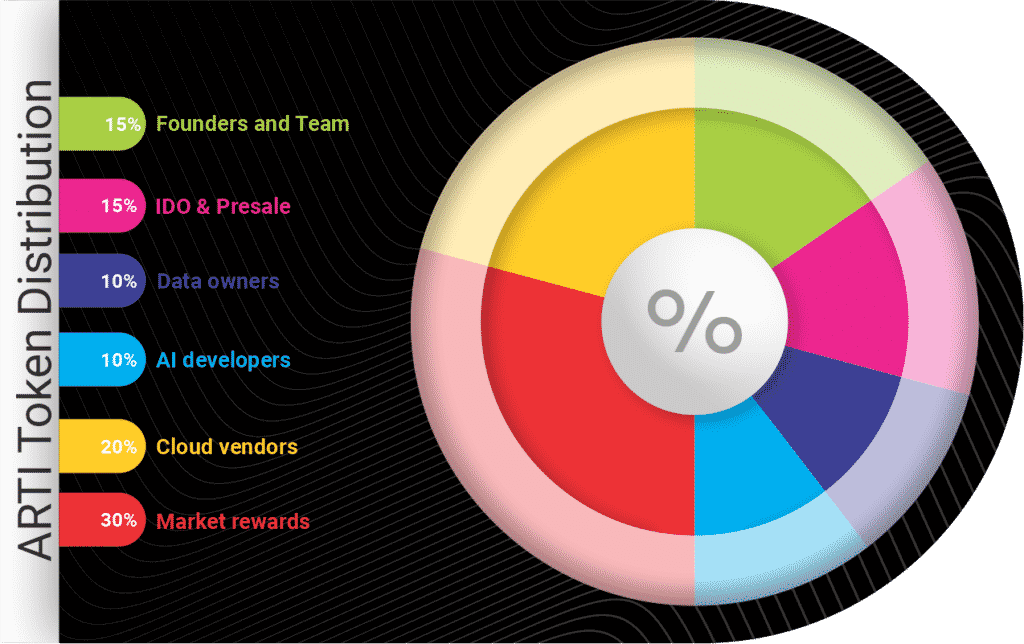

AI Marketplace launched its native utility coin ARTI on September 16, 2021. It’s currently one of the most sought out tokens on the market, with a steady high ranking on various ICO listing platforms. The sale will end on December 15, 2021. The token is trading for 0.26 USD during the initial coin offering, and the platform accepts BNB in exchange for ARTIs. Token holders will have various benefits in the marketplace. Besides, they will be able to participate in network governance.

Among the marketplace, stakeholders will be cloud owners (CO), data owners (DO), and model owners (MO). The cloud service providers or COs usually sell storage, and GPU computes resources needed to train AI models. By being part of this marketplace, they will increase their customer base and will have the opportunity to offer subscription-based compute and storage services at competitive prices.

Meanwhile, the DOs are the owners of large proprietary datasets (e.g., healthcare, compliance data, self-driving cars, etc.). The platform will enable them to monetize this data and sell it for AI training in a transparent, safe, and secure manner multiple times without losing its ownership.

The MOs are enterprise or freelance AI developers with the skills and experience to develop sophisticated AI models. By being part of a marketplace, MOs will be able to obtain access to diverse datasets that meet their training requirements.

-

Support

-

Platform

-

Spread

-

Trading Instrument