Federal Solar Tax Credit: How Much Will You Get Back? (2022)

The solar investment tax credit (ITC), or federal solar tax credit, has been one of the most successful federal incentives in spurring the growth of solar energy in the U.S. Aimed to offset the initial cost of solar, the incentive allows you to claim 26% of the total cost of your solar project on your federal taxes.

Hiring any of the best solar companies won’t be cheap, but the tax credit will shave thousands off your final quote. In this article, we’ll break down the federal solar tax credit to help you understand whether you qualify for the credit and calculate how much you can get back.

If you’d like to learn exactly how much you’ll save with the solar tax credit, you’ll first need a quote for your solar project. To get started, you can connect with a local installer for a free quote using this tool or by filling out the form below.

Get Free Quotes From EcoWatch Approved Solar Installers

All EcoWatch solar companies are pre-vetted for your convenience.

Disclaimer: This article is for informational purposes only. It should not be relied on for and is not intended to provide accounting, legal or tax advice.

What Is the Federal Solar Tax Credit?

The federal solar tax credit is a tax credit that you can claim on your federal returns. This tax credit is not valued at a set dollar amount; rather, it’s a percentage of what you spend to install a residential solar photovoltaic (PV) system. The tax credit is currently set at 26% of your total system cost.

Tax credits help to reduce the amount of money you owe in taxes. So, for example, if you claim a tax credit of $4,000, the total amount you owe in income taxes will be reduced by $4,000. It’s important to note that this is not a tax deduction, which reduces your taxable income rather than your total tax liability.

How Does This Tax Credit Work?

Say your solar system was quoted at $20,000. Where I live in Louisiana, this would be about an 8-kilowatt system, which is medium in size. A 26% credit would save you $5,200 on your federal returns. The tax credit rolls over year after year, should the taxes you owe amount to less than the credit you earn.

The federal solar tax credit can be claimed by any U.S. homeowner, so long as the solar system installed is for a residential location based in the United States. (It does not have to be your primary residence.)

The system must be placed in service (in other words, it must be “turned on” and generating power) during the tax year. So, if you install and begin using a residential solar system during the year 2022, you’ll claim the credit on your 2022 tax filing. If you start a solar panel installation in December of 2022 but don’t turn the system on until January of 2023, you’ll claim the credit on your 2023 filing.

Future of the Solar Tax Incentive

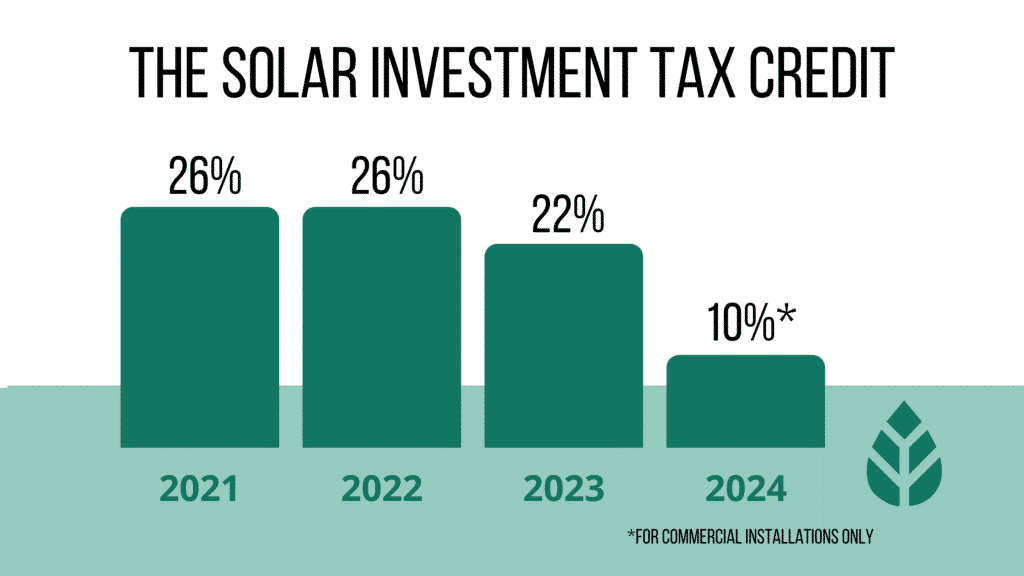

Right now, this solar incentive is being phased out, which means its value is steadily decreasing. Unless Congress renews the credit through the Build Back Better Act or other legislation, it will not be available to homeowners past 2023.

Here’s an overview of what is currently planned for the future of the tax credit:

| Year Placed In Service | Federal Solar Tax Credit |

| 2021 | 26% |

| 2022 | 26% |

| 2023 | 22% |

| 2024 | 10% (for commercial installations only) |

What Does the Solar Tax Credit Cover?

Taxpayers who installed and began using a solar PV system in 2021 (and those who start using solar in 2022) can claim a federal tax credit that covers 26% of the following costs:

- Cost of solar panels

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Labor costs for solar panel installation, including fees related to permitting and inspections

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses (though some states waive sales tax on PV system equipment)

History of the Solar ITC

The solar investment tax credit was originally created through the Energy Policy Act of 2005, which has enjoyed bipartisan support since its inception. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023 for residential systems and 2024 for commercial solar. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

Are You Eligible to Claim the Federal Solar Tax Credit?

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of 2021.

- Your system must have been installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost. (If you’re leasing your solar system, you won’t maintain eligibility to claim the tax credit.)

- The solar system must have been used for the first time. You only get to claim this credit once, for the “original installation” of your solar PV equipment. So if you move residences, take your panels with you, and install them on your new roof, you won’t be able to claim a second credit.

Cashing In On Other Solar Incentives

Along with the federal solar tax credit, there are a number of rebates, programs and state tax incentives that you may be eligible for depending on where you live. In some cases, these other financial incentives may impact your federal tax credit. Here’s what you should know:

- Rebates from your utility company: Typically, subsidies from your utility company are excluded from income tax returns. In these situations, the rebate for installing solar must be subtracted from your system cost before you can calculate your tax credit.

- Rebates from state-sponsored programs: Rebates from the state government generally do not reduce your federal tax credits.

- State tax credits: Any state tax credit you get for your residential solar system will not decrease your federal tax credit amount. However, getting a state tax credit means the taxable income you report on your federal returns will be higher, as you’ll have less state income tax to deduct.

- Payments from renewable energy certificates: Any payments you receive from selling renewable energy certificates will likely be considered taxable income. As such, it will increase your gross income but will not reduce your tax credit.

How Do You Claim the Solar Investment Tax Credit?

The solar tax incentive is claimed as part of your annual federal tax return. Any reputable solar company should provide documentation and instructions on exactly how to claim the ITC as part of your solar installation. Below is a quick overview of what that process will look like. Though fairly simple, it’s best to consult with a tax professional when filing your return.

To claim the federal solar tax credit, follow these steps:

- Download IRS Form 5695 as part of your tax return. This residential energy tax credit form can be downloaded straight from the IRS.

- Calculate the credit on Part I of the form (a standard solar energy system will be filed as “qualified solar electric property costs”). On line 1, enter your overall project costs as written in your contract, then complete the calculations on lines 6a and 6b.

- If solar is your only renewable energy addition, and you don’t have any rollover credit from the previous year, skip down to line 13.

- On line 14, calculate any tax liability limitations using the Residential Energy Efficient Property Credit Limit Worksheet (found here). Then, complete calculations on lines 15 and 16.

- Be sure to enter the figure from line 15 on your Schedule 3 (Form 1040), line 5.

As a reminder, the tax credit only offsets the taxes you owe on your return. If the taxes you owe are less than the credit you earn, the credit will roll over year after year.

In addition to the ITC, be sure to file for any sales and property tax exemptions that may be available in your state.

Frequently Asked Questions: Federal Solar Tax Credit

Here are a few commonly asked questions about the ITC:

Will I get a tax refund if the solar investment tax credit exceeds my tax liability?

No, the federal solar ITC is a nonrefundable tax credit. However, if you do not use all of your tax credit, you can carry over the unused amount to the following year.

Can I use the federal solar tax credit against the alternative minimum tax?

Yes, you can use your solar tax credit either against the federal income tax or against the alternative minimum tax.

Will there be another federal solar tax incentive after the current one expires?

A new solar tax credit would require an act of Congress. While it is certainly possible, it isn’t something that can be predicted with any certainty. We’ll be sure to keep you posted on any developments in new renewable energy tax credits and the Build Back Better Act.

Can I claim the credit if I’m not a homeowner?

You can claim the solar tax credit if you are not a homeowner, but only under specific circumstances. Specifically, you must be either a tenant-stockholder at a cooperative housing corporation or a member of a condominium complex to claim the credit.

Can I claim the credit if I am not connected to the grid?

You do not have to be connected to the electric grid to claim the solar tax credit. You only need to have a solar power system that’s generating electricity for your home.

Can I claim the credit if my solar panels are not installed on my roof, but on the ground on my property?

Yes, your solar panels do not have to be installed on your roof in order for you to claim the solar tax credit, so long as they are generating solar energy for your home.

-

Support

-

Platform

-

Spread

-

Trading Instrument