What Is an Exhaustion Candle in Chart Analysis?

What comes to mind when you think of an exhaustion candle?

It is an important indicator of a reversal of a trend. An exhaustion candle is sometimes also called a hammer.

Do you know why it is also called a hammer? It is also called a hammer because the market is trying to hammer out a market bottom (if it is a downtrend).

Is it hard to recognize an exhaustion candle?

We need to mention that an exhaustion candle appears during a trend (either up or down) only.

Let’s not forget that the body of the candle has a long tail or wick. Interestingly, a long tail or wick is considerably longer compared to the body.

Interestingly, there is a little, if any, tail or wick on the other side. However, the color of the body isn’t very important.

It is better not to rely only on exhaustion candles. Nevertheless, exhaustion candles give some clues as to what is going on in the market and what the current sentiment is. The exhaustion candle indicates that the trend is stalling or even reversing.

Still, an exhaustion candle is just an indication and nothing more. So, you should rely only on it.

Interesting details about forex trading strategies

Is it hard to select the best forex strategy? Let’s find out!

First of all, take your time. It takes time to find the best forex strategy. Traders like to test various forex trading strategies. It makes sense to use a demo trading account in order to gain experience.

As you can see, it is better to test various strategies. Let’s continue!

You don’t have to use the same strategy for years. It is important to adapt to the ever-changing environment.

It is worth noting that the financial markets are constantly changing. So, traders have to be prepared for all kinds of scenarios.

However, if you are a novice trader, sticking with simple forex trading strategies might be preferable.

Do you know which is one of the most common mistakes traders make?

They try to incorporate numerous technical indicators into their strategy. So, it is better not to incorporate too many technical indicators.

Price action trading strategy

Now, let’s take a closer look at two forex trading strategies. Both of them are effective.

Let’s start with price action trading.

It is a strategy that focuses on making decisions based on the price movements of a certain instrument instead of incorporating technical indicators. For instance, Bollinger Bands, RSI, MACD, etc.

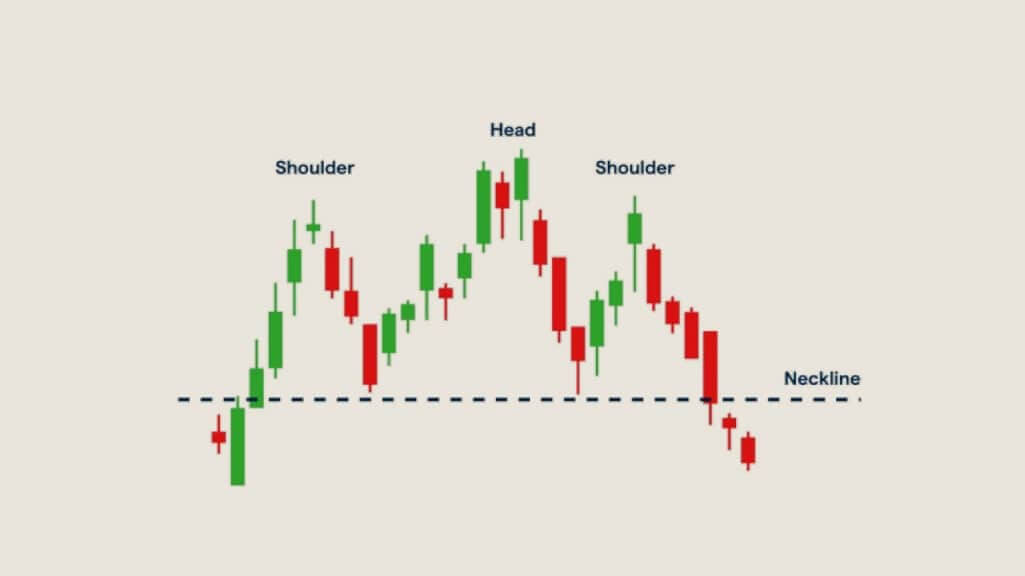

Hopefully, there are numerous price action strategies you could utilize – from breakouts to reversals to simple and advanced candlestick patterns.

It is desirable to remember that technical indicators aren’t usually part of a price action strategy.

However, if technical indicators are incorporated, technical indicators shouldn’t play a large role in a price action strategy. They should be used as a supporting tool.

Still, some traders like to incorporate simple indicators such as moving averages. Do you know

why? Simple indicators like moving averages can help identify the trend.

What makes price action trading so important is the fact that your charts remain clean. As a result, the risk of information overload is lower.

Having several indicators on your chart can send conflicting signals, which can lead to confusion, especially for inexperienced traders.

This trading strategy is very popular among day traders. This strategy has gained popularity among day traders as it is more suitable for traders who are trying to profit from short-term movements.

Day traders have to make decisions quickly, and price action strategy helps them to save time.

Scalping strategy

What about a scalping strategy? It is also a good strategy.

When scalping, traders are trying to take advantage of small intraday price moves. Interestingly, some traders even have a target of only 5 pips per trade, and the trade duration could vary from seconds to several minutes.

The scalping strategy is suitable for traders who are good at math. Moreover, they should be able to make decisions quickly, even when under pressure.

Moreover, scalpers usually spend more time in front of a computer. They focus on several specific markets.

You also need to remember that this strategy is associated with a lot of pressure, as you need to be fully focused during your trading session. Besides, it is easier to make mistakes and react emotionally when your trades are running only for minutes. So, scalping may not be the best trading style for novice traders to first start with. However, it is a good option for more experienced traders.