EXANTE Review – Full professional review of the broker

| General Information |

|

|---|---|

| Broker Name: | EXANTE |

| Broker Type: | Forex & CFDs |

| Country: | Cyprus |

| Operating since year: | 2011 |

| Regulation: | CySEC, FCA |

| Address: | 28 Oktovriou, 365 Vashiotis Seafront Building 3107, Limassol, Cyprus |

| Broker status: | Active |

| Customer Service | |

| Phone: | +357 2534 2627 |

| Email: | [email protected] |

| Languages: | English |

| Availability: | 24/7 |

| Trading | |

| The Trading platforms: | Proprietary |

| Trading platform Time zone: | N/A |

| Demo account: | Yes |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | No |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit: | €10,000 |

| Maximal leverage: | N/A |

| Spread: | From 0.3 |

| Scalping allowed: | Yes |

EXANTE REVIEW CONTENT

- General Information & First Impressions

- Fund and Account Security

- The Trading Accounts

- EXANTE’s Trading Platform

- Funding and Pricing

- Assets at EXANTE

- Customer Service at EXANTE

General Information & First Impressions

EXANTE is one of the more experienced forex and CFD brokers out there. As the company itself claims, it’s a company run by professionals that aim to attract experienced traders. In our EXANTE review, we’ll look at how it handles as well as how powerful it is trading-wise.

And we’d like to dwell on our previous claim a little bit. EXANTE is a broker that targets professional traders. As such, it requires a significant initial deposit of €10,000 that jumps to €50,000 for corporate clients. That much is understandable, and although we believe it’s a bit outdated, not many brokers have innovated in that direction.

However, it also feels like EXANTE is using its pro trader attraction as a mask. It looks like the broker didn’t really bother much with accessibility and is trying to pass that off as intentional.

By that, we mean that its website is fairly confusing and disorganized, with relevant information scattered about.

Financial Instruments, Deposit, and Withdrawal

Trying to find out specific details is a bit difficult, making the broker’s approach somewhat confusing. Other brokers with similar focus groups have done a much better job at presenting their service comprehensively.

So to start off our EXANTE.eu review, the broker doesn’t leave a fantastic first impression. A disorganized website isn’t a dealbreaker, but it does indicate a lack of care for customers. And the fact that the broker targets luxury clients means it should pay more attention to it, not less.

We guess the reasoning was that professional traders would find their way around regardless. However, that isn’t an excuse not to try and streamline your service. We feel like the experience would be much less frustrating with even a bit of effort on EXANTE’s end.

Start Trading with EXANTE

Begin trading with EXANTE and take advantage of real-time market data, diverse currency pairs, and convenient bank transfers.

EXANTE offers various financial instruments, including forex, stocks, and commodities, ensuring portfolio diversification. Access real-time market data for informed trading decisions.

Trade a wide selection of currency pairs, including major, minor, and exotic options, to suit your preferences.Complete registration, make an initial deposit (minimum €10,000), and enjoy secure bank transfer options.

In the EXANTE.eu review, you can see that it prioritizes risk management and provides negative balance protection, safeguarding your investment during market volatility.

With this broker, you can trade diverse financial instruments, access real-time data, and enjoy convenient bank transfers. Prioritize risk management with negative balance protection.

Fund and Account Security

While the previous section was marred by the broker’s tardiness, it definitely didn’t pull any stops security-wise. And as we always say, safety is one of the most crucial things for online brokers. As it stands, the safety conditions improve the poor first impression significantly.

One of the most reassuring facts about EXANTE is that it has two regulators watching over it. One is CySEC, and the other is the FCA, and the two drastically cut down the chance of the broker misbehaving.

However, even as an entity independent of its regulators, the broker does seem like a safe company. It’s been around for over a decade, and scams get wiped out long before that. Even if it is lazy in displaying its info, it does so in a clear manner, without hiding features to promote itself. Overall, it seems truthful and honest in its intentions.

As we said earlier in our EXANTE review, we would like to see it make improvements in the clarity department, but that doesn’t outweigh all the positives. If we were to point out one slightly more serious complaint, it’s that the broker intentionally operates in a low-regulation area.

Is Cyprus more or less safe than on-shore locations or not?

Cyprus is slightly less safe than on-shore locations for brokers in Europe. It lets some brokerages pull off cheap tricks while still being regulated. Still, that complaint fades in the face of the fact that EXANTE is safe regardless.

If there were other reasons for concern, the previous statement would be much more significant and worrying. However, for a broker with two regulators, transparent communication, and clear information, it’s no cause for panic.

Altogether, we’re satisfied with EXANTE’s security setup and are confident they’re one of the safer brokerages in Europe.

The Trading Accounts

While the broker had a short soar with its security, we’re back to underwhelming with the account structure. More precisely, with the lack of any account types or personalization in the broker’s offer.

As we said earlier in our exante.eu review, it’s a broker targeting professional traders. As such, it should be aware that its potential customers are used to high-end accounts. They usually come with luxury features that either improve the trading experience or assist the trader in another way.

But some dislike such features, so let’s put that aside for now. There’s still the fact that developed traders have distinct trading styles. As such, the broker could have made an account structure that favors certain strategies. It would be a reason for the professional traders it’s trying to attract to join EXANTE over other options.

Instead, it only offers the same baseline service to everyone who joins. And even that would be excusable if the broker was a bit more budget-friendly. That way, it could play the “we offer an even playing ground” card, which is reasonable.

Exante asks for a 10.000 EUR deposit

Instead, EXANTE makes no effort to stand out, and asks for a €10,000 deposit just to get you started. And while the baseline has some benefits, as we’ll cover later in our EXANTE review, the price point is a bit insane. We believe it may be a consequence of the broker’s age, as it looks like it failed to innovate and is sliding behind competition.

The silver lining is that EXANTE does offer a demo account. That will let you inspect the full service and determine whether its worth it for yourself.

EXANTE’s Trading Platform

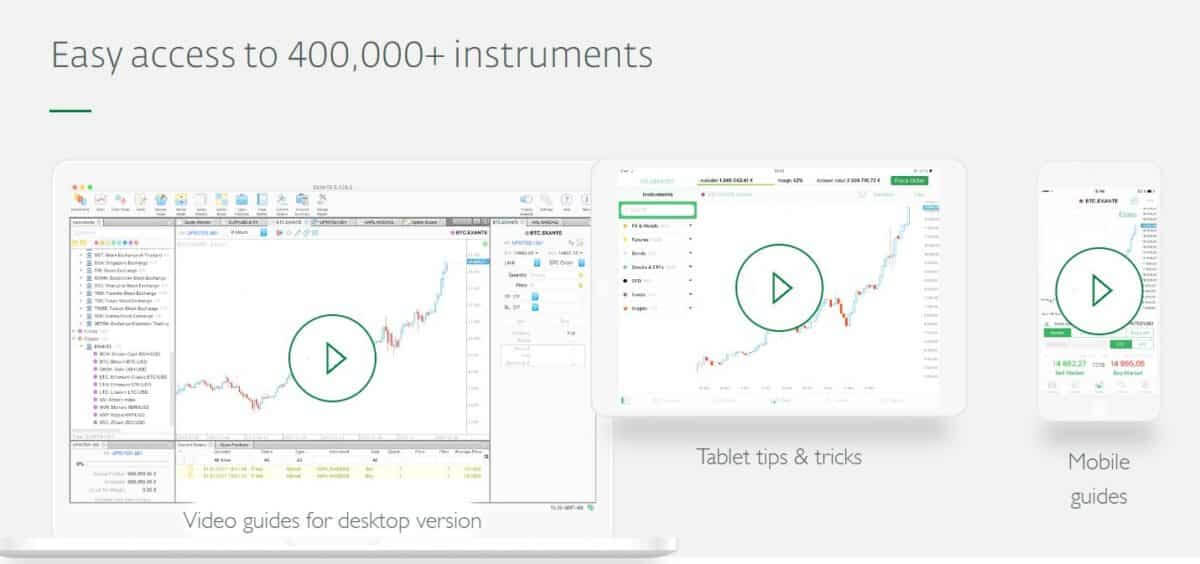

EXANTE has a proprietary platform as the trading tool it offers to its customers. However, as we said, there’s very little personalization within the service itself. And since there aren’t many features outside the platform, there’s not much to do inside the platform either.

One noteworthy thing is that the software lets you integrate excel sheets, somewhat helping your analysis procedures. Beyond that, it also has some standard features, such as stop losses and take wins. That lets those that don’t like to spend all day being attentive to markets still react to sudden shifts.

As for accessing the platform, there’s a downloadable terminal and a mobile app for different operating systems. That should cover both those that prefer the more optimized computer trading and the more convenient mobile trading.

Funding and Pricing

The broker’s funding starts off not making too much sense, as we outlined earlier in our EXANTE review. It requires a €10,000 deposit while not offering too much for the price point. And if you’re a corporate client, that minimum jumps to €50,000, which is even more senseless.

However, once you make that deposit, it does open up a relatively user-friendly pricing scheme. It’s not as good as some other brokers, but the spreads are relatively tight across all assets. We should note that most trading products have a flat charge on trading, so EXANTE isn’t the best choice for day traders.

The trading fees on individual assets are mostly minimal and should be unnoticeable to buy-and-hold traders. That’s with the exception of ETFs, where the fee is percentage-based and sits at 0.5%. Even that isn’t anything super major, so the pricing is good so far.

Does this broker include extra commissions?

One thing that left a bad taste for us is that the broker has a ton of extra commissions you can fall into. For example, there’s an inactivity fee if you don’t use the brokerage for a while, overnight fees for short positions, and more. Again, neither of these ruin EXANTE’s overall fee structure, but for a high-end brokerage, it could bear to be a bit more user-friendly.

That puts EXANTE somewhere in the middle ground. It isn’t a fantastic pricing experience you’d get with other places that require the same deposit. However, it does beat a lot of brokers, landing it somewhere in the upper end of mediocre.

As far as funding goes, depositing is easy enough, but withdrawing takes 3-5 bank days and has a fee of €30. That further downgrades the overall trading experience as it lets you keep less of your money.

Keep a healthy balance between personal and financial preferences

In addition, as you engage with your forex broker, it’s important to strike a healthy balance between your financial pursuits and personal preferences. If you have a sweet tooth but want to stay focused on your trading activities, consider exploring meal replacement options that cater to your cravings.

By finding suitable alternatives, you can satisfy your indulgences while staying committed to your trading goals. Remember, maintaining a balanced approach is key to achieving long-term success in both your financial endeavors and personal lifestyle choices.

Assets at Exante

EXANTE has a wide variety of assets that contains entries from the most relevant categories. The only thing that’s really missing is crypto, but traditional traders can disregard that. The broker claims to have 400,000 trading products within its library. We believe that’s a bit of an overstatement, as some are doubled in different classes or different execution types.

Still, we can’t take away from the fact that the broker does have a massive trading product variety. It’s a nice breather after the last few sections that each had some significant issues. Here are the trading product classes you can expect to see on exante.eu:

- Stocks & ETFs

- Bonds

- Metals

- Futures

- Options

- Funds

Customer Service at Exante

EXANTE has extended customer support and live chat operating time over other brokers. Whereas most work during the work week, EXANTE also includes weekends. And not only that, but it keeps its communication lines open 24 hours, so you can reach the broker whenever.

It’s nice that you can use that to postpone your issues to when you’re not as busy with trading. Of course, that’s assuming the issue isn’t something that’s a showstopper such as not being able to access your account. To reach EXANTE, you can either call the broker or send an email.

For additional information, you are always able to visit exante.eu review and get all the necessary features and benefits of this fantastic broker!

Final thoughts:

EXANTE is an experienced forex and CFD broker targeting professional traders. While its high initial deposit requirement of €10,000 is understandable, the website’s disorganization and lack of accessibility are concerning. However, the broker’s security measures, including regulation by CySEC and the FCA, instill confidence. The account structure lacks personalization and variety, offering the same baseline service to all clients. The proprietary trading platform lacks customization but integrates excel sheets and standard features. Funding requires a substantial deposit, but the pricing scheme is relatively user-friendly with tight spreads. However, the broker has additional commissions, and withdrawing funds incurs fees and takes several days. EXANTE offers a wide range of assets but lacks crypto options. Customer service is available 24/7, providing extended support via live chat, phone, and email.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Brilliant broker company

Brilliant broker company. I am happy with both profit and services.

Did you find this review helpful? Yes No

Excellent brokers

I am impressed with their support, their broker signals as well as their platform. I gain good profit, too.

Did you find this review helpful? Yes No