EURUSD, GBPUSD Pairs Continue to be Under Pressure

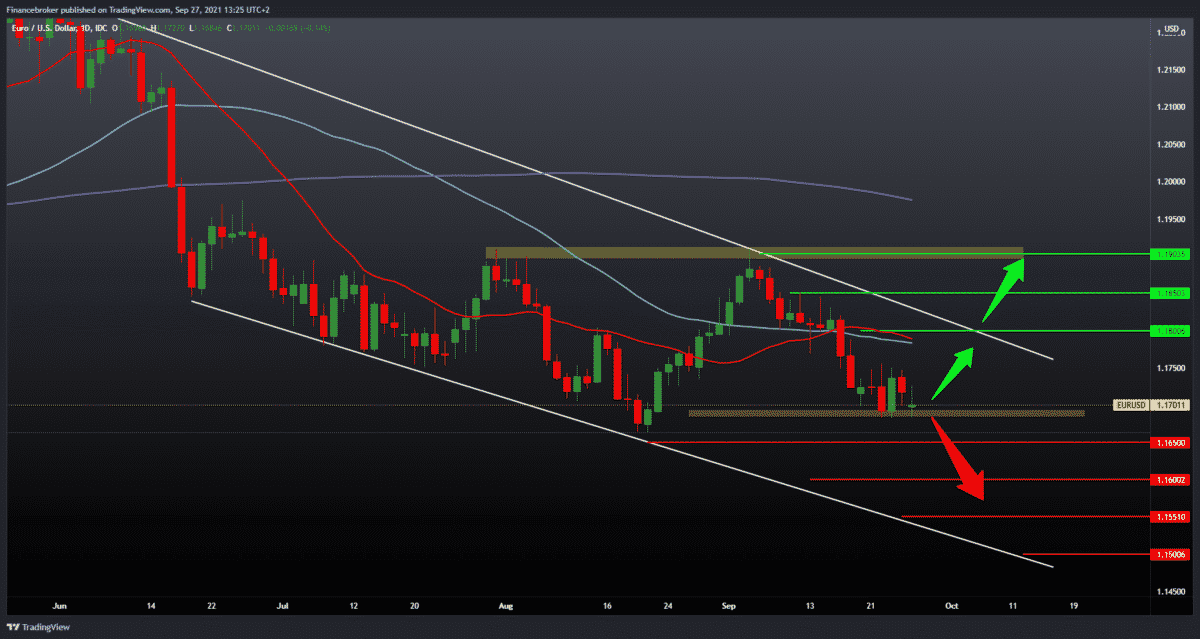

Looking at the EURUSD chart on the daily time frame, we see that the pair is on crucial support at 1.1700. If we do not see a positive consolidation that will push EURUSD to higher levels on the chart, the bearish trend may continue below the previous low at 1.16650. All of this is part of a more significant declining consolidation. This is so that we can draw a support line and a resistance line on the chart.

For the next bearish target below the previous low, we have 1.160000 and then 1.15000 as psychological support and a place of potential more significant consolidation. We need a break above the bullish trend’s 20-day and 50-day moving average and a break above the top line. After that, our next target is the previous high at 1.19000. A 200-day moving average follows this in the zone around 1.20000.

GBPUSD chart analysis

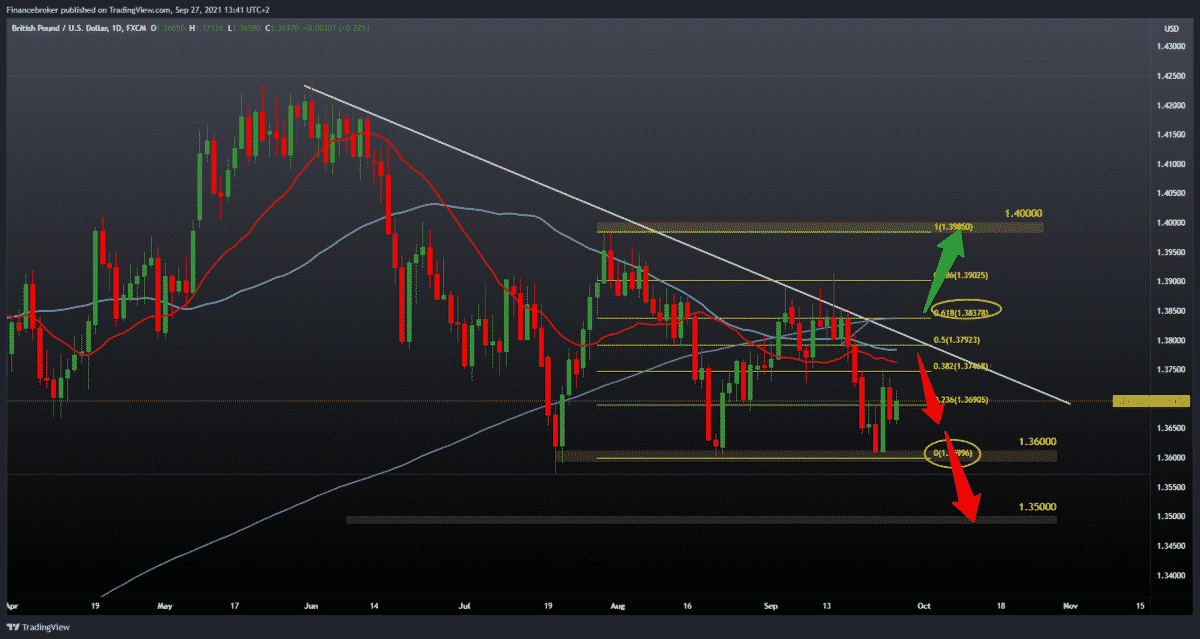

Looking at the GBPUSD chart on the daily time frame, we see that as a current obstacle to continuing the bearish trend, we have certain support at 1.36000 for the third time. To continue on the bullish side, it is important for us that GBPUSD makes a break above the moving averages, the upper resistance line, and 61.8% Fibonacci levels at 1,38400. Only then can we expect to visit the previous high at 1.39900.

For the bearish scenario, we need a deviation from moving averages. This is a negative consolidation on the daily chart and a retest of support at 1.36000. A break below that support zone leads us to the psychological support zone at 1.35000.

Market overview

The euro has moved as much as expected with the announcement of yesterday’s elections in Germany. Complicated negotiations on forming a government should take several months. But the euro is expected to remain troubled, according to MUFG Bank strategists.

“The difference in the victory of the SPD creates even greater uncertainty about the probable formation of the next government and leaves potential coalition options on the table. Negotiations on coalitions are expected to take weeks and perhaps months. The continuing uncertainty explains why there has been a limited reaction from the euro to the initial election results.

“The close results of the parties further strengthen the need for political parties to make a compromise for the formation of the next government.”

This most likely favors only a modest shift in policy direction in Germany. Thus, leading to a limited impact on the euro’s performance.

According to data published by the European Central Bank on Monday, Eurozone money growth accelerated in August, while loans to the private sector slowed further.

The broad money supply of M3 grew by 7.9 percent on an annual level in August. This followed the 7.6 percent in July. The M3 is projected to advance 7.8 percent.

Similarly, growth in M1 narrowly increased to 11.1 percent from 11 percent a month ago.

Regarding the lending dynamics, the data showed that lending to the private sector achieved annual growth of 3.1 percent, slower than the growth of 3.4 percent in July.

Private sector-adjusted loans also grew more slowly than 2.9 percent, after rising 3 percent in July.

A Wrap

The global recovery has dropped momentum and is facing three key winds. They include the expansion of the Delta variant, persistent bottlenecks in the supply chain, and the weakening of government support. But despite the winds, economists at ABN Amro expect growth to remain above the trend, with services recovering a long way to go. “We continue to expect growth above the trend to continue until 2022. After the current soft patch, we expect next year’s recovery to regain momentum.”

Consumption of goods is a healthy correction. The recovery of services has a long distance to go before consumption returns to the pre-pandemic trend. The passage of the Delta wave is likely to give the service sector – which makes up the majority of private consumption – a new impetus.

Greater government investment will help. Especially with Biden’s plans for infrastructure spending in the United States starting to be activated and the Eurozone Recovery Fund starting to pay out to member states. Although supply deficiency has proven to be more persistent than expected, they are likely to narrow somewhat by 2022. That should bring a new backlog to recovery, given the likely significant backlog of investment demand. Labor market normalization should also help recover. By the end of the year, many economies should be back close to pre-employment levels before the pandemic.

-

Support

-

Platform

-

Spread

-

Trading Instrument