EURUSD, GBPUSD, NZDUSD Pairs Forecast for Oct 21, 2021

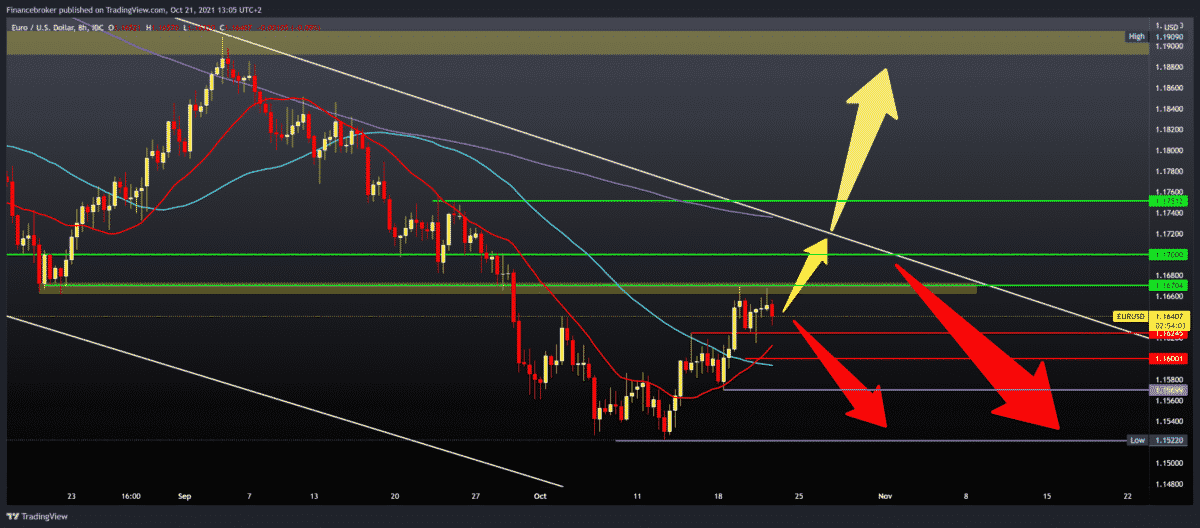

EURUSD fails to break above the current resistance zone at 1.16700. Pair is facing resistance for now, and we are heading to the bearish side again.

Bearish scenario:

- To continue, EURUSD needs to make a break below 1.16250 and MA20 moving average.

- A further decline in EURUSD brings us down to 1.16000, and we are looking for support in the MA50 moving average.

- The next resistance is at 1.15700 and then at 1.15220 October minimum.

Bullish scenario:

- EURUSD must make a positive consolidation.

- The pair needed a break above 1.16700 and potentially testing 1.17000 levels.

- Our next upper resistance is 1.17500 on the MA200 moving average and resistance in the downward trend line.

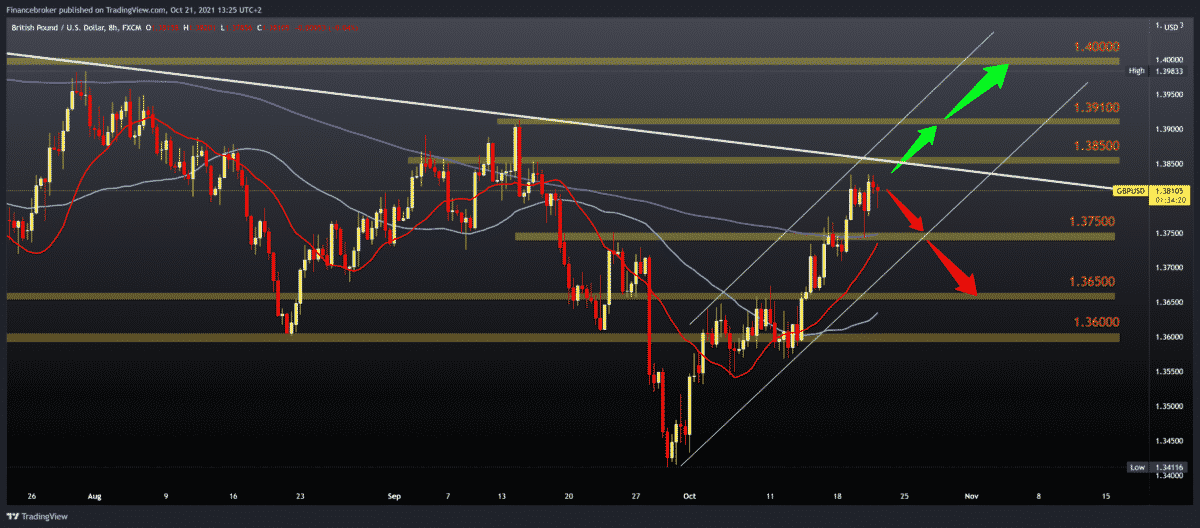

GBPUSD chart analysis

GBPUSD encountered resistance at 1.38000, after which we have a withdrawal during this European session at 1.37800. The current value of the pair is 1.38000.

Bearish scenario:

- GBPUSD must make a negative consolidation and move towards the previous low.

- Our first support is at 1.37500 with the support of MA200 and MA20 moving averages.

- The next lower support is at 1.36500 with the support of the MA50 moving average.

Bullish scenario:

- GBPUSD is still in the October growing channel, and as long as we are in this channel, we are in a bullish trend.

- All moving averages are from the lower bullish side, directing the pair upwards.

- The first potential resistance is the zone around 1.38500 with the resistance of the upper trend line.

- If GBPUSD makes a break above, the next resistance is at 1.39000 high from September, before the psychological level at 1.40000.

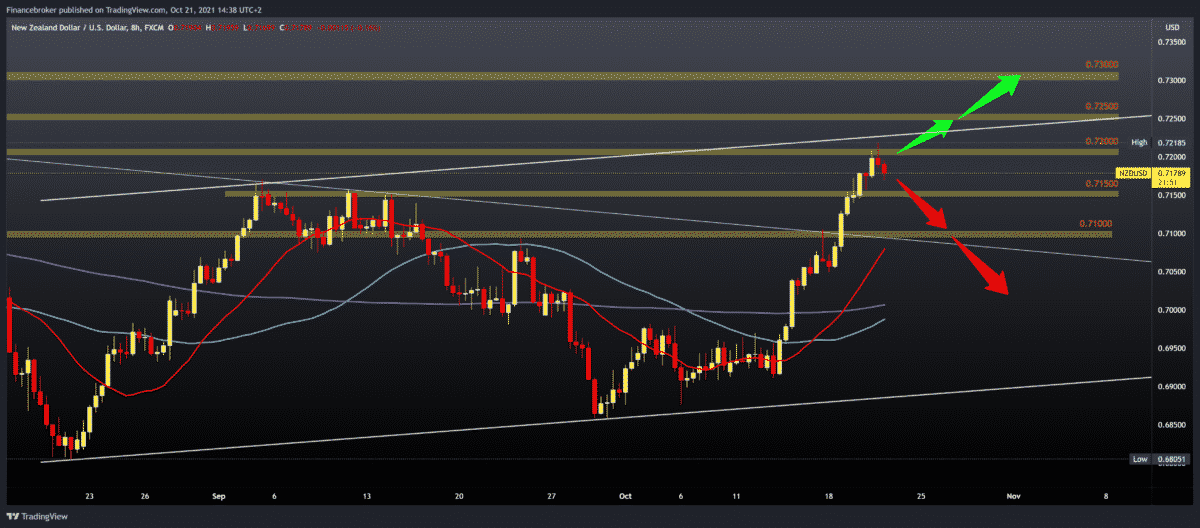

NZDUSD chart analysis

NZDUSD made a new October high at 0.72185 during the Asian session. During the European session, the pair withdrew to the current 0.71750. The broad picture tells us that we are in a growing channel and that the couple has touched the top line. Now we can expect some consolidation or pullback.

Bearish scenario:

- NZDUSD should first make a break below the 0.71500 support zone.

- Further negative consolidation brings us down to 0.71000 next support zone. Additional support is the MA20 moving average at this level.

- MA50 and MA200 are in our psychological left zone at 0.70000.

Bullish scenario:

- We need positive consolidation at the level of 0.71500, which will direct us to the bullish side.

- NZDUSD must make a break above last night’s high at 0.72185 and above the top channel line.

- The next resistance is at 0.72500, then 0.73000.

Market overview

The UK budget deficit is decreased in September from a year earlier due to higher tax revenues; data released Thursday by the National Bureau of Statistics showed.

In September, net public sector borrowing was at GBP 21.8billionr, the second-largest record borrowing, GBP 7.0 billion less than in September 2020.

The ONS said the additional funds needed by the government’s coronavirus support programs, combined with reduced cash incomes and falling GDP, have pushed the public sector’s net debt to its current level.

Paul Dales, an economist at Capital Economics, said: “Although the budget deficit recorded the second-largest borrowing in September, and the net public sector debt ratio the highest since 1963, public finances are improving faster than expected.”

The New Zealand Reserve Bank said that spending on New Zealand credit cards fell for the second month in a row in September.

Credit card spending fell 3.3 percent a month in September, after falling 15.8 percent in August.

On an annual basis, spending on credit cards fell to 12.9 percent in September, after falling 6.9 percent in the previous month.

-

Support

-

Platform

-

Spread

-

Trading Instrument