EURUSD, GBPUSD, NZDUSD Forecast: Daily Indications of Recovery

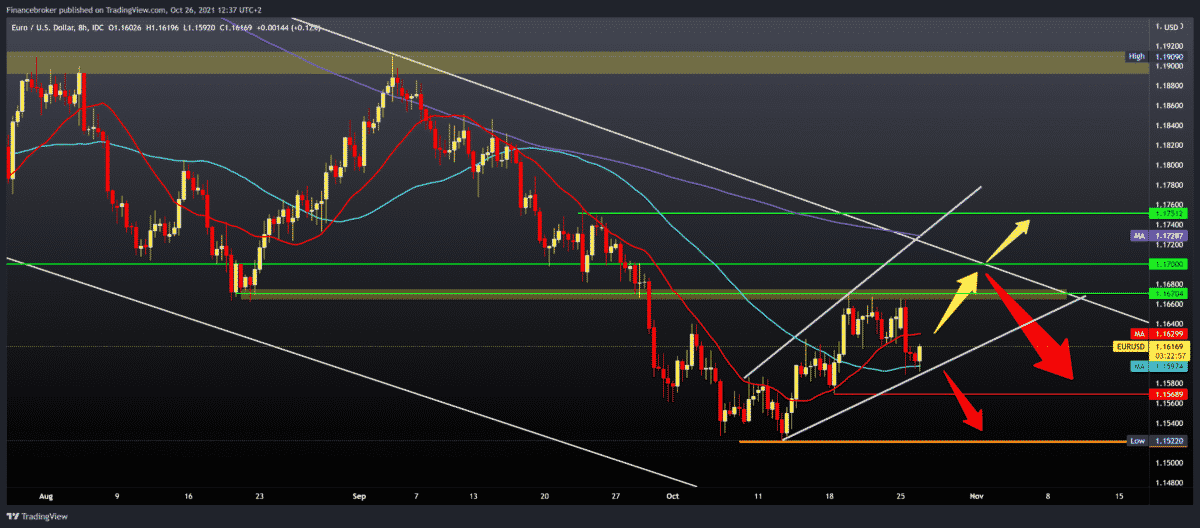

EURUSD was under a huge of pressure yesterday, dropping from 1.16700 to 1.15800. Today during the European session, we see the current recovery of the euro at 1.16150 with the support of the MA50 moving average.

Bullish scenario:

- EURUSD made higher low support at 1.15880.

- We now need further positive consolidation to break above the MA20 moving average.

- Our main obstacle is the zone at 1.16700 to be able to make a new higher high.

- Next up, our resistance is at 1.17000 along with the top trend line.

Bearish scenario:

- First, we need a pull below the bottom trend line and the MA50 moving average.

- Our next potential support is at 1.15690, and below us is the October low at 1.15220.

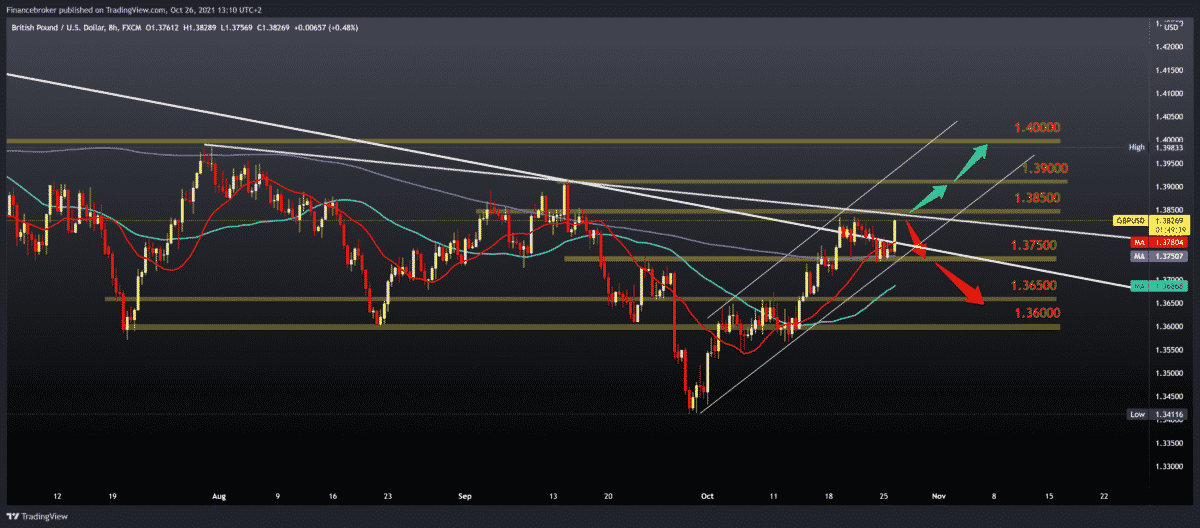

GBPUSD chart analysis

Pair GBPUSD found support yesterday at 1.37500 with the MA200 moving average. Today we have strong bullish momentum and growth to 1.38270, and we are again entering an essential zone that can determine the future movement of this pair.

Bullish scenario:

- We have good current support at 1.37500.

- The pair made a break above the upper trend line.

- We are testing the previous resistance zone and expect a break for the new October high.

- We need a break above 1,38500 to continue the bullish trend.

- Our next upper resistance is 1.39000 September high, and then the zone around 1.40000 High from July.

Bearish scenario:

- We need to pull the pair below 1.37500.

- To continue, we need a break below the bottom channel line, support on the MA50 in the zone around 1.37000.

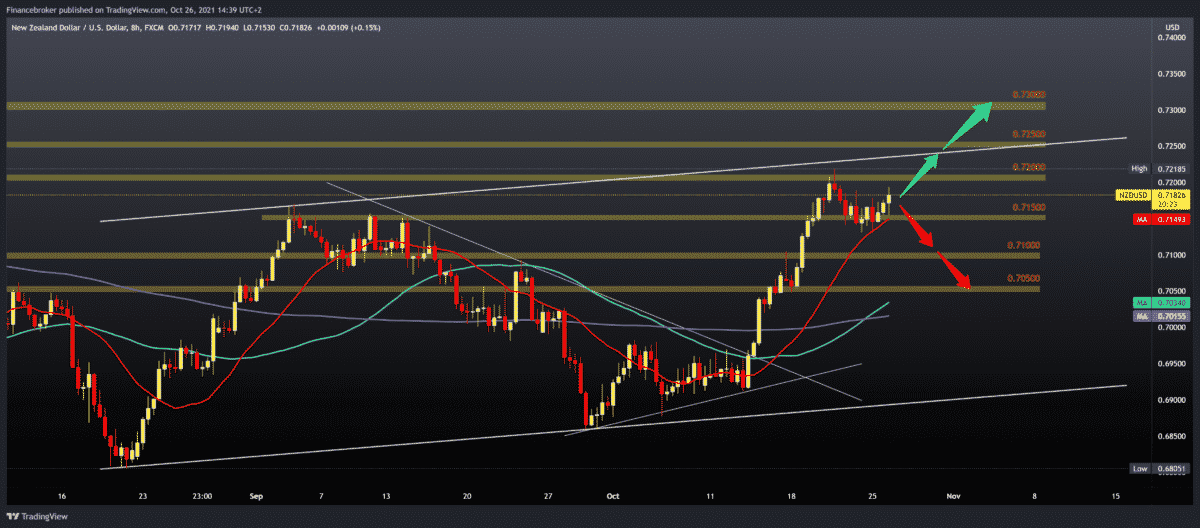

NZDUSD chart analysis

Pair NZDUSD has been moving in a growing channel since the beginning of September, and on October 20, the pair made a two-month high at 0.72185. After that, we had a drop to 0.71250. We are back in the bullish zone again by finding support at that level with the MA20 moving average.

Bullish scenario:

- NZDUSD must remain above 0.71500, and we need a break above the previous high at 0.72185.

- Our next resistance is the top line of the channel, and the break above us leads to 0.72500.

Bearish scenario:

- The NZDUSD must make a retreat below the MA20 moving average and a zone around 0.71500.

- The first lower support below is at 0.71000, then the next in the zone MA50 and MA200 moving averages 0.70000-0.70500.

Market overview

At an emergency ministerial meeting on Tuesday, European Union countries disagreed on a bloc-wide response to rising energy prices. Some countries called for regulatory revision, and others strongly opposed it.

Gas prices in Europe reached record highs this fall and remain high, prompting most EU countries to respond with urgent measures such as price caps and subsidies to reduce energy bills.

However, the countries are struggling to agree on a long-term plan to mitigate changes in fossil fuel prices, which Spain, France, the Czech Republic, and Greece say to justify a major change in the way EU energy markets operate.

“There was no agreed position on whether or not intervention measures should be adopted at EU level and implemented in all member states,” said Slovenian Infrastructure Minister Jernej Vrtovec, whose country holds the EU presidency after the meeting.

Sellers in the UK expect sales in November to be above seasonal norms. The retail balance rose to 30 percent in October from 11 percent in September, and the net 35 percent predicts that sales will continue to grow next month.

Net 48 percent of retailers reported an increase in orders in October compared to 20 percent in September. However, a net 41 percent expect orders to decline slightly next month.

However, this increase may partly reflect a comparison with October 2020, when sales and orders declined due to the growth in Covid-19 cases and tightening societal constraints.

The economic recovery of Great Britain has been quite uneven lately, and it seems that the same applies to the retail sector, “said Ben Jones, the chief economist of the CBI. In recent months, the sales effect has jumped while stock shortages continue, and they are pulling in the opposite direction.

-

Support

-

Platform

-

Spread

-

Trading Instrument