EURUSD, GBPUSD, Interest Rate Report for GBP

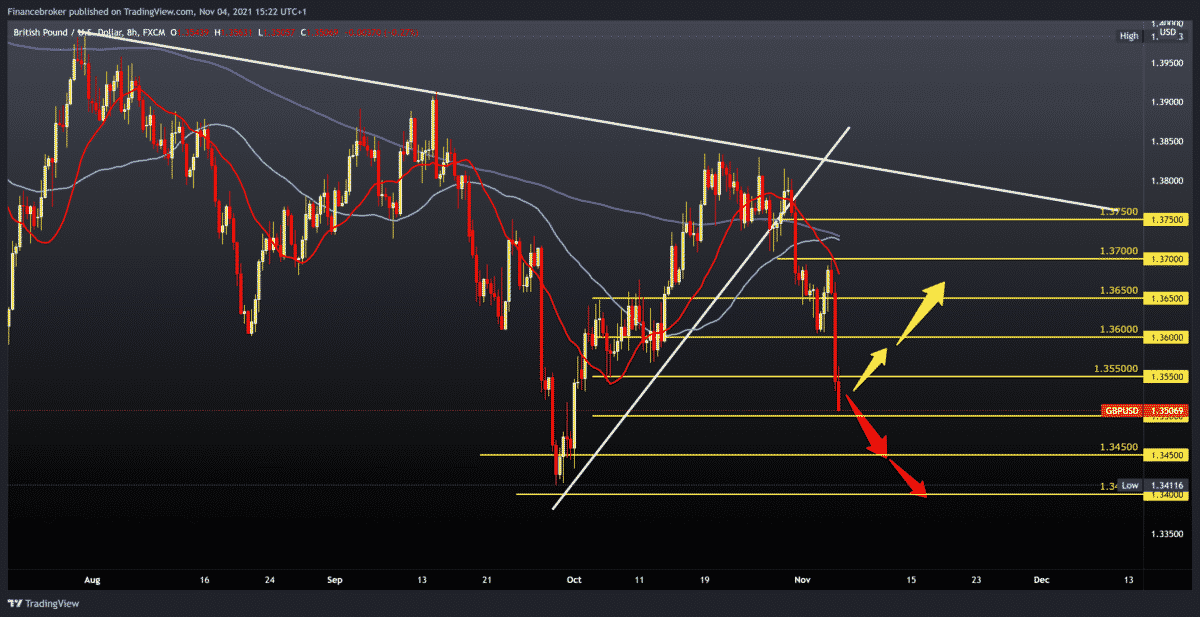

After yesterday’s attempt by EURUSD to make a break above 1.16000 following the Fed’s news on interest rates, we see the pair move to the bearish side again during the Asian session. Making a pullback below 1.15500, and now the October support zone at 1.15220 is again threatened.

Bullish scenario:

- We need a new positive consolidation above 1.16000 and moving averages of MA20 and MA50.

- The break above us climbs to the resistance of 1.16700, then to 1.17000 on the upper trend line and the MA200 moving average.

Bearish scenario:

- We need a break below the previous lower low at 1.15220.

- We have moving averages on the bearish side, which increases the pressure on the pair.

- Our next lower supports are 1.15000, then 1.14500, then 1.14000.

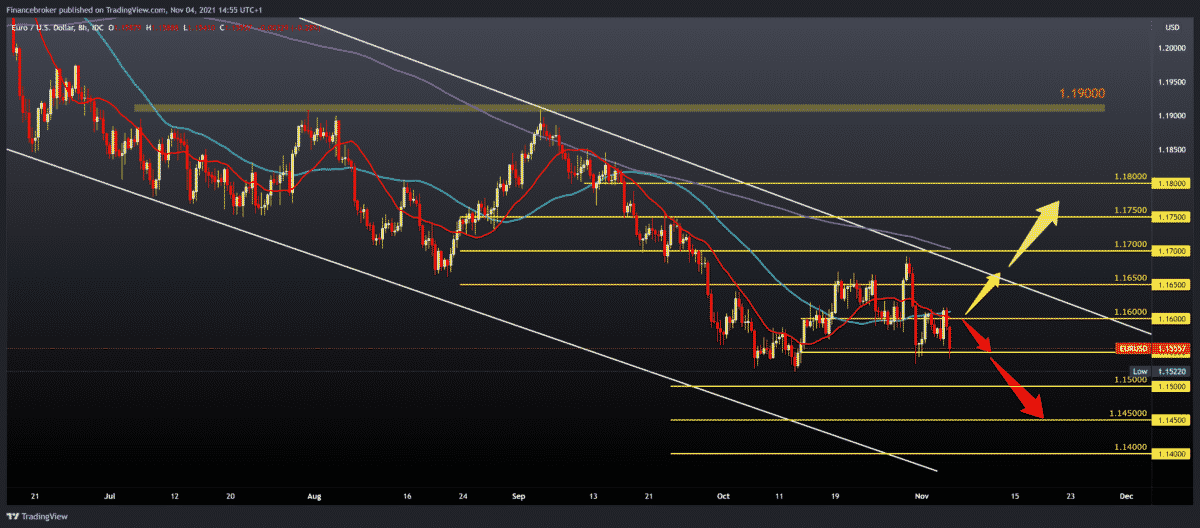

GBPUSD chart analysis

The pound capitulated against the dollar today. The day the pair started at 1.37000, during the Asian session, the pair began to weaken and retreat to 1.36500. In the European session, the pair fell by 110 pips from 1,36500 to 1,35400. Now in the US session, the agony for the pound continues, and GBPUSD continues to fall to the current 1,35190.

Bearish scenario:

- We are looking for the first support at 1.35000 psychological support. If it does not last, we go further to 1.34500.

- The current fundamental level is at the previous October low at 1.34116.

Bullish scenario:

- We need a new positive consolidation that will find support and move to the bullish side again.

- Now our first upper resistance is at 1.36000, then 1.36500, then the previous high at 1.37000.

- We have plenty of room to reach moving averages in search of their support.

Market overview

Bank of England policymakers have decided to keep a low-interest record rate and quantitative easing in split votes and have hinted at an increase in the rate in the coming months as inflation remains stubbornly above the target.

Seven members of the MPC voted to keep the key interest rate unchanged at 0.10 percent. At the same time, Dave Ramsden and Michael Saunders demanded an increase in the rate by 0.15 percent, the bank said in a statement on Thursday.

Ramsden and Saunders said the economic outlook justifies tightening monetary policy stance at the meeting.

Markets expected a rate increase of 15 basis points at the meeting after Governor Andrew Bailey recently commented that the bank will have to act on inflation.

Disagreeing members said that the decision to tighten policy at this meeting would reduce the risk of medium-term inflation expectations rising. This could ultimately require a subsequent sharp tightening of policy and thus greater adjustment for growth and employment.

The MOC estimated that it would be necessary to increase the bank’s rate in the coming months for CPI inflation to return to a sustainable target of 2%.

-

Support

-

Platform

-

Spread

-

Trading Instrument