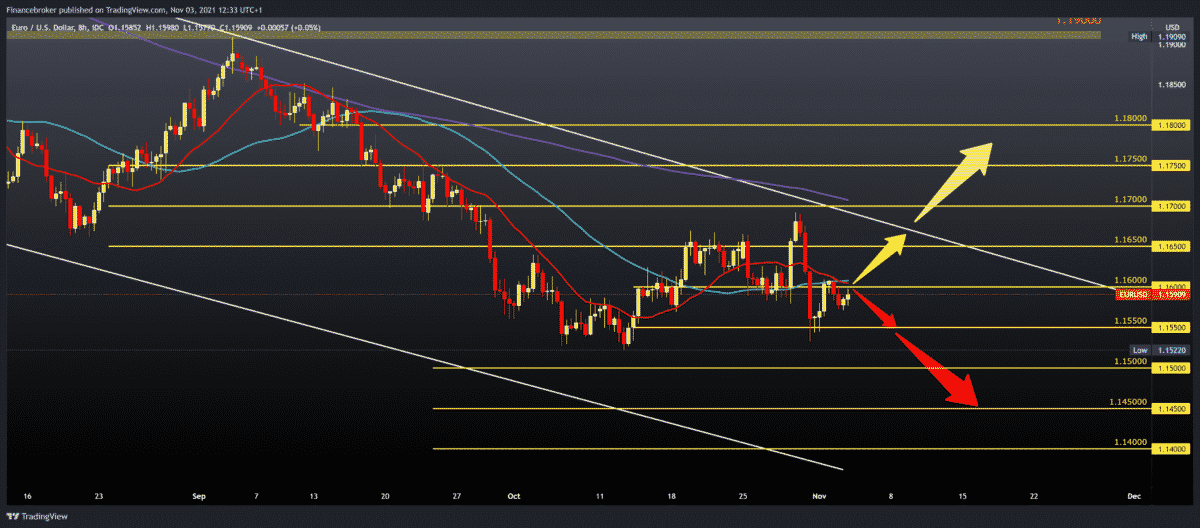

EURUSD, GBPUSD Forecast for November 3, 2021

Pair EURUSD is still under bearish pressure as it failed to make a break above 1.16000 yesterday. Air is still in negative consolidation below the MA20 and MA50 starting average.

Bullish scenario:

- EURUSD must make a break above 1.16000 and above the MA20 and MA50 moving average.

- Then we can expect further growth to the resistance zone at 1.16700. our next resistance is the October previous high at 1.16950

- The additional pressure we have in the falling trend line and the MA200 around 1.17000-1.17200.

Bearish scenario:

- Pair needs to continue this negative consolidation to get closer and test the previous low at 1.15330. We are also very close to the October lower low at 1.15220.

- A further decline in EURUSD brings us down to the 1.15000 psychological support zone, then the next to 1.14500, then 1.14000.

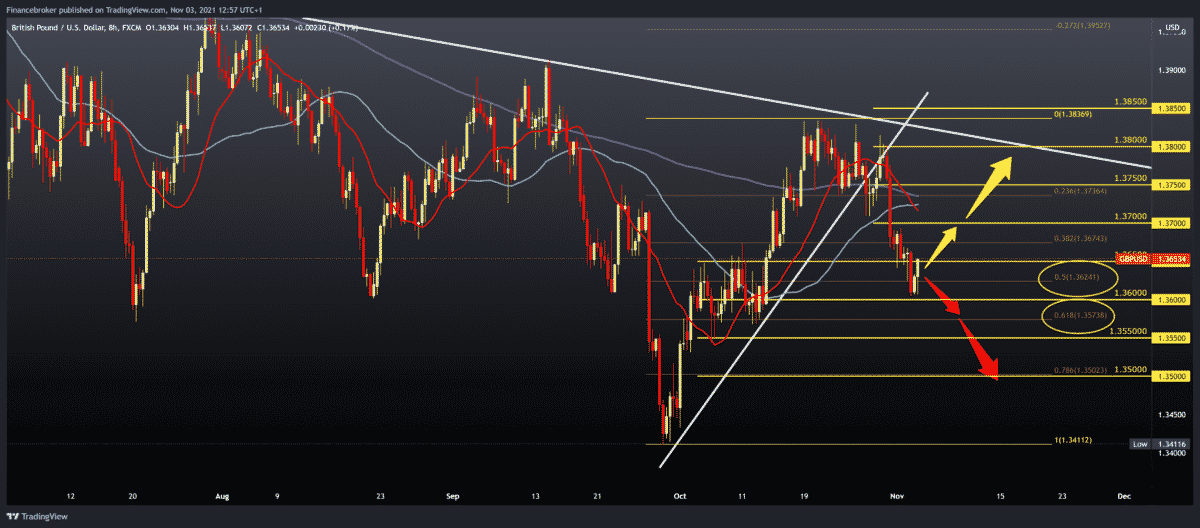

GBPUSD chart analysis

During the Asian session, the GBPUSD pair found current support at 1.36000, and now in the European session, it has recorded a slight increase to 1.36300. If this continues, we can expect the pair to climb to the 1,36500 previous support zone.

Bullish scenario:

- GBPUSD must make a breakthrough above 1.36000 and endanger the 1.37000 resistance zone.

- The MA20, MA50, and MA200 moving averages await us above as additional resistance to 1.37300-1.37400.

- We also find a 23.6% Fibonacci level which can increase bearish pressure.

- A break above this resistance climbs us to the upper trend line in the zone around 1.38000.

Bearish scenario:

- We need continued negative consolidation, retreating below 1.36000 and testing 61.8% Fibonacci levels at 1.35740.

- Further lowering GBPUSD on the chart, it seeks support at 1.35500, then at 1.35000, the October lower low at 1.34300.

Market overview

The UK service sector registered a growth spur in October driven by new solid business amid economic reopening and loose international travel restrictions, the final results of the IHS Markit survey showed on Wednesday.

The title Index of Purchasing Managers Chartered Institute of Procurement & Supply Services rose to 59.1 in October from 55.4 in September. The prognosis was 58.0.

New orders grew at the highest rate in the last four months of October, and new jobs from abroad increased the fastest so far since June 2018.

Employment rose by the second-fastest step since June 2014. Service providers commented on the extremely high demand in the hospitality, leisure, and transport sectors.

Cost inflation accelerated with the most robust jump in 25 years. The inflation rate of exit fees reached a new record level in October.

“The likely rise in interest rates this week could cool heads off the overblown British economy. It will also result in additional pressure on some household budgets, threatening to disrupt this flow of happiness early next year,” said Duncan Brock, the group’s director at CIPS.

Unemployment Rates

The unemployment rate in Italy fell slightly in September, data from the statistical institute ISTAT showed on Wednesday.

The unemployment rate dropped to 9.2 percent in September from 9.3 percent in August, which was in line with economists’ expectations. In fact, the unemployment rate was 10.1 percent, same month last year.

The Chinese service sector recorded strong growth in October, boosted by business activities and new business, data released by IHS Markit on Wednesday showed.

The Caixin Services Purchasing Managers Index rose to 53.8 in October from 53.4 in September. The growth rate was the fastest since July, and a reading above 50.0 indicates favorable growth in the sector.

Driven by improved market conditions and increased customer demand, new orders recorded the largest growth in three months. Export orders also returned to growth in October. Employment in service companies rose for the second month in a row, although the job creation rate as a whole remained mild.

The survey found that average input price inflation rose in three months. Commission members attribute the latest cost increase to higher staff and raw material costs.

-

Support

-

Platform

-

Spread

-

Trading Instrument