EURUSD, GBPUSD daily chart overview

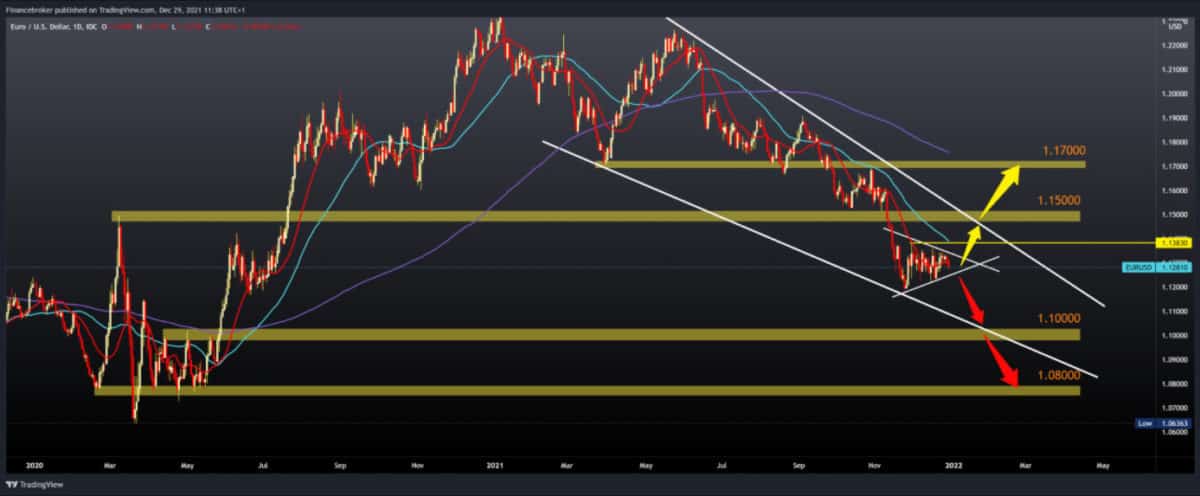

EURUSD chart analysis

During Asian trade, the euro weakened against the dollar. Yesterday, France reported that the largest daily increase in the number of newly infected since the beginning of the pandemic was recorded, over 180,000 new cases. Italy also broke the record, so the euro came under great pressure again. The Bundesbank recently announced that the German economy could slow down in the last quarter of this year. The number of newly infected with covid-19 introduces new restrictions and keeps the population at home. The euro is currently on 1.12800 dollars, which is a weakening of the common European currency by 0.27% since the beginning of trading tonight.

Bullish scenario:

- We need a new positive consolidation and a break above the top line of the triangle.

- With the support of the MA20 moving average, we can expect further growth to 1.13800 previous high and MA50 moving average.

- Crossing above takes us to the next resistance zone at 1.150000.

- Additional resistance at this level is the upper trend line formed by the May maximum.

Bearish scenario:

- We need to continue this negative consolidation, and EURSUD falls below the support bottom line.

- We then test the previous November minimum at 1.11850.

- A fall below this potential support will form a new minimum on the chart, and the potential target is 1.10000 as the next larger support zone.

GBPUSD chart analysis

During the Asian session, the British pound weakened against the US dollar. The UK reported 130,000 new infections yesterday. Post-Brexit tensions over fishing with the EU have received a positive outcome for 2022. Still, the status of Northern Ireland remains a stumbling block for relations between European countries and the UK. Currently, the pound is changing for 1.3422 dollars, which is a weakening of the British currency by 0.04% since the beginning of trading tonight.

Bullish scenario:

- We need better positive consolidation above 38.2% Fibonacci levels, and with support in the MA50 moving average, we can expect a further recovery of GBPUSD.

- Our next target is a 50.0% Fibonacci level in the zone around 1.35000.

- At 61.8% Fibonacci level, we find the upper trend line, which can be an obstacle for us to continue bullish.

- A break above the resistance line can climb us to 1.37000 and 78.6% Fibonacci levels. At this level, additional pressure can create the MA200 moving average.

Bearish scenario:

- We need continued negative consolidation and a price drop below the 38.2% level and the MA50 moving average.

- The first next support awaits us at 23.6% Fibonacci level at 1.33150, and additional support at that level is the MA20 moving average.

- Increased bearish pressure could push the price to the previous support zone around 1.32000.

- A fall below would form a new lower low, which would bring us closer to the psychological zone at 1.30000.

Market overview

Spanish news

Retail sales in Spain grew at the fastest pace in November in the last six months after falling in the previous month, preliminary data from the INA statistical office showed on Tuesday. Retail sales rose 4.9 percent year on year after falling 0.7 percent in October. The increase was the largest since May when retail sales rose by almost 20 percent.

European news

France on Tuesday reported a record 179,807 new confirmed coronavirus cases in 24 hours, one of the largest one-day figures in the world since the pandemic began.

The United States reported more than 505,000 new cases of COVID-19 on Monday. This is the largest number of new daily infections in Europe, according to data from Covidtracker.fr. Since the pandemic’s beginning, the United States and India alone have reported an average of more than 200,000 new cases a day.

Britain reported a record 129,471 new COVID-19 cases on Tuesday, but figures do not include figures for Scotland and Northern Ireland due to differences in reporting practices during the Christmas holidays.

-

Support

-

Platform

-

Spread

-

Trading Instrument