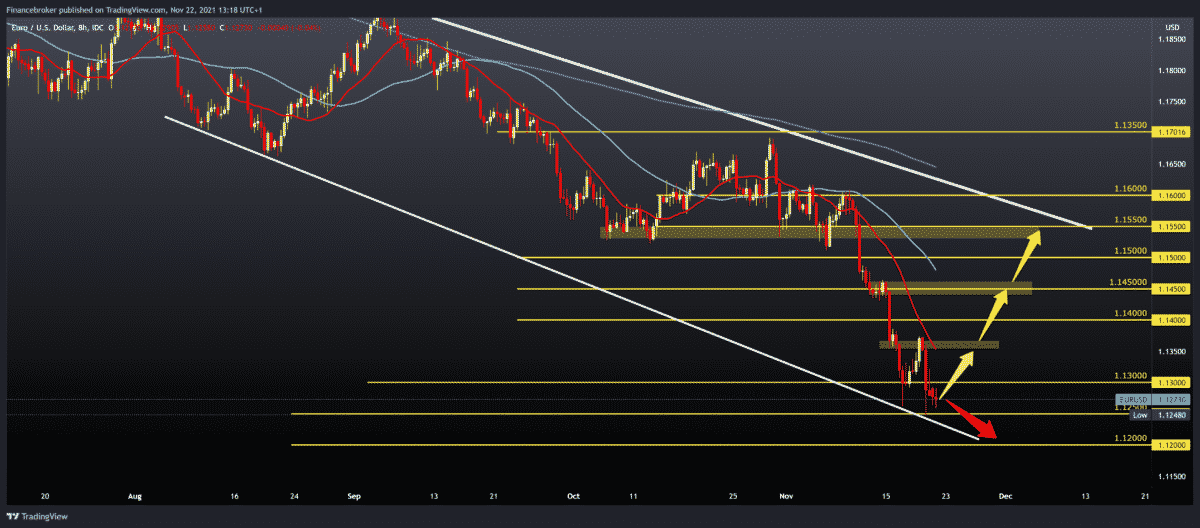

EURUSD, GBPUSD continuation on bearish side

The EURUSD pair is still under bearish pressure because we are at this year’s low, and now there is a chance that we will go even lower. Our current support is 1.12500, but we can expect a further decline to 1.12000 if we do not get support. The increase in the number of new coronavirus infections in Europe negatively impacts the euro.

Bullish scenario:

- We need positive consolidation and growth above 1.13000 to move from this year’s lower low.

- Our first upper resistance is at 1.13500, and with the break above, we get support in the MA20 moving average.

- The next resistance is 1.14000, then 1.14500 instead of the previous consolidation.

Bearish scenario:

- We need a negative consolidation that would again jeopardize the low at 1.12480.

- Break below the descent us to 1.12000 new minimum this year.

- A further drop in the price brings us to the EURUSD period of June 2020.

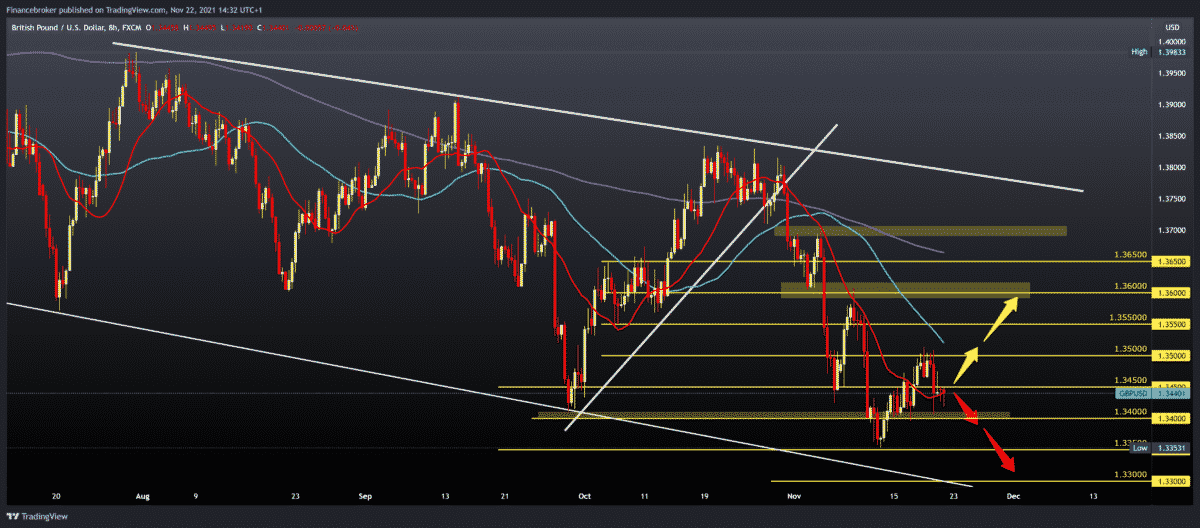

GBPUSD chart analysis

Pair GBPUSD continues to consolidate at 1,345,500, and now we need to pay attention to whether the support will last or we will see a break below. The current situation is calm, but we will probably see a bigger impulse in some direction soon.

Bullish scenario:

- We need new positive consolidation and growth above 1,34500; then we get support in the MA20 moving average.

- Further movement brings us to 1.35000 of the previous high and MA50 moving average.

- Next, resistance is at 1.36000, then November high at 1.37000.

Bearish scenario:

- We need a negative consolidation below 1.34000.

- A further drop in the GBPUSD pair brings us to the November lower low to 1.33500.

- Additional strengthening of the dollar and great pressure on the pound will probably influence the further continuation of the bearish scenario.

Market news

Germany’s economic recovery is likely to slow this autumn, as supply chain problems continue to affect industrial production, the Bundesbank said in its monthly report.

The central bank noted that the risks of an intensified pandemic would exist throughout the winter half of the year.

The bank said that the macroeconomic effects are likely to be less serious than in previous pandemic waves.

The Bundesbank expects that inflation will rise to slightly less than 6% in November. Still, it will noticeably fall in January when the statistical special effects, especially the effect of the VAT base, expire.

“But that inflation will be above 3 percent for a long time to come,” the bank added.

On Monday, as expected, China kept the reference interest rates on loans for the 19th consecutive month.

The primary interest rate on a one-year loan remained unchanged at 3.85 percent, and the five-year LPR at 4.65 percent.

The primary interest rates on one-year and five-year loans were last reduced in April 2020. The first-year interest rate on one-year loans was reduced by 20 basis points and ten on five-year loans in April 2020.

The basic interest rate on the loan is fixed monthly based on the submissions of 18 banks, although Beijing influences determining the rate. This credit rate replaced the standard reference interest rate of the central bank in August 2019.

According to Punchball, the Biden administration will announce whether or not to re-nominate current Fed President Jerome Powell for a second term, Lael Brainard, citing several sources who know about the move.

According to most political betting sites, Powell is still a big favorite to secure a nomination. The market implies that the chances of a renowned Fed president are currently just over two-thirds of Fed members.

-

Support

-

Platform

-

Spread

-

Trading Instrument