EURUSD, GBPUSD, AUDUSD Forecast for Oct 22, 2021

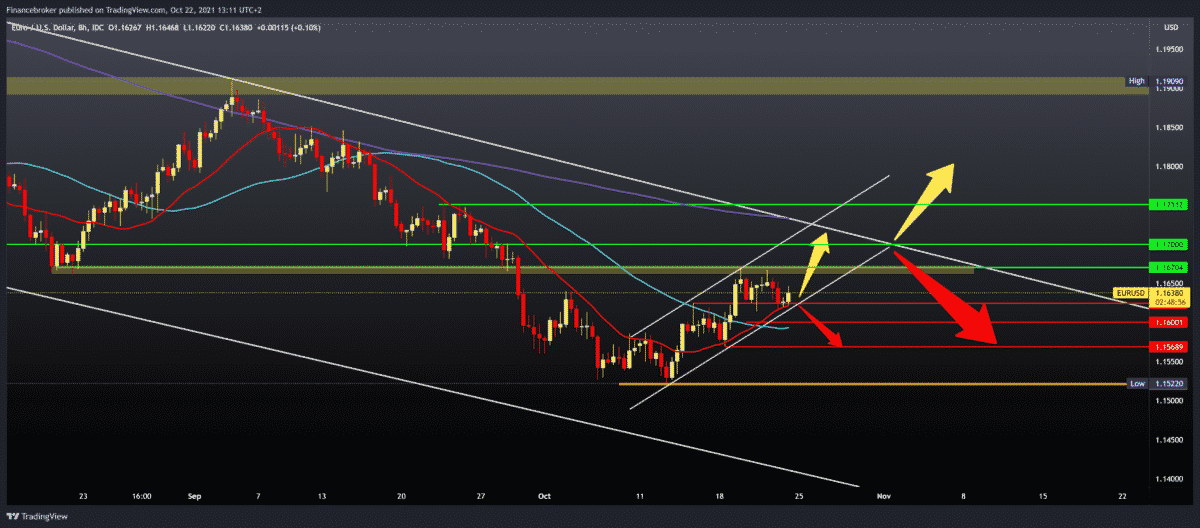

EURUSD has been advancing since this morning during the European session, from support at 1.16250 to the current 1.16400. Pair runs in a growing channel from October 12 to today. Now we are again approaching the previous resistance at 1.16700.

Bullish scenario:

- EURUSD found support in the MA20 and MA50 moving averages.

- He also found immediate support on the bottom line of the growing channel.

- Our first resistance is 1.16700 Octobers high; then the next resistance is 1.17000 lower low from September.

- Stronger resistance awaits us in the upper trend line with the MA200 moving average in the zone 1.17000-1.17500.

Bearish scenario:

- We need a negative consolidation to move to the bearish side, and EURUSD should break below the bottom channel line.

- The first support below is at 1.16000 with the MA50 moving average. Then next at 1.15690, and below on last week’s low at 1.15220.

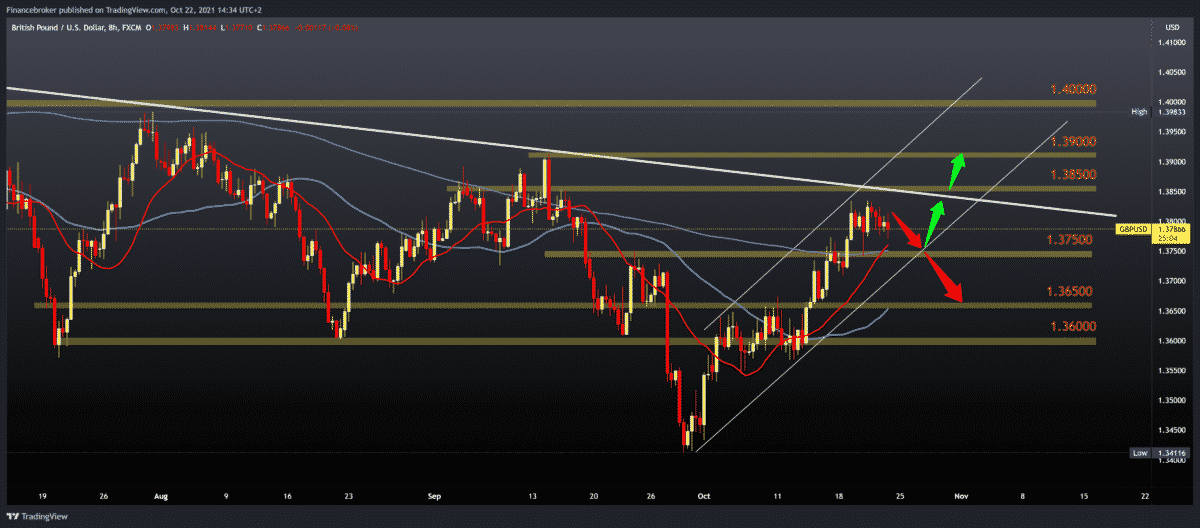

GBPUSD chart analysis

GBPUSD encountered resistance yesterday in the upper trend line zone, 1.38300-1.38500. Today the pair is making a pull below 1.38000, seeking support at lower levels on the chart. Market volatility slowed on Friday, and we expect larger shifts next week.

Bullish scenario:

- GBPUSD needs to make a new positive consolidation first to be able to test the upper trend line.

- Then we need a break above this resistance, after which the target is the previous high from September at 1.39100.

- Moving averages are on the bullish side for now, and we are still moving in a growing channel.

Bearish scenario:

- The GBPUSD pair should continue negative consolidation below MA20 and MA200 in the 1.37500 zones.

- Our next support is at 1.37000, then 1.36500 with an MA50 moving average.

- The further continuation of the GBPUSD decline leads us to the previous October consolidation around 1.36000.

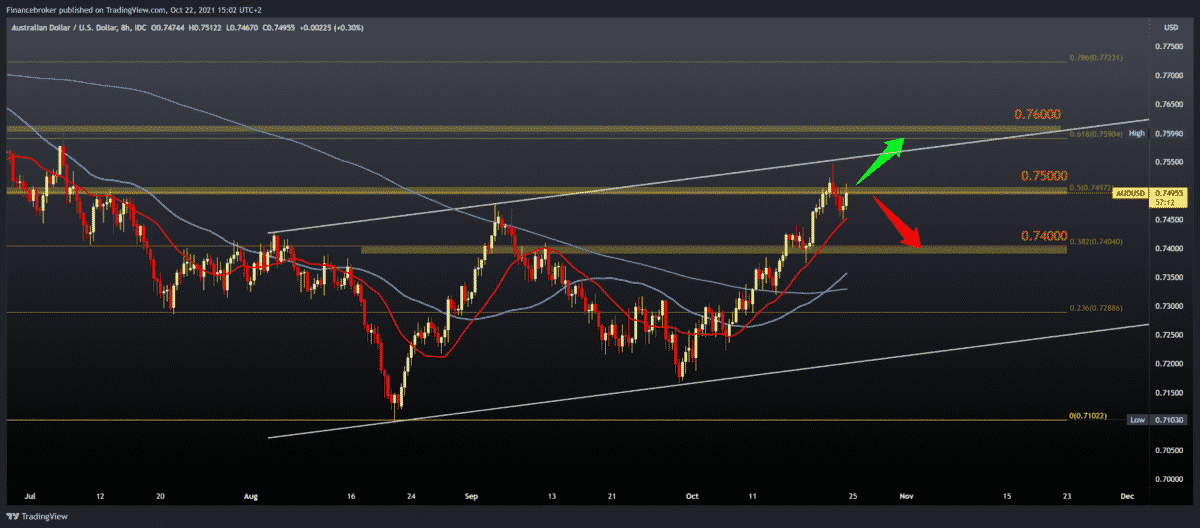

AUDUSD chart analysis

AUDUSD managed to make a new four-month high at 0.75500 yesterday, and after that, we have a smaller pullback to 0.74500. Today the pair is stable at around 0.75000. Since August, we have been in a growing channel and are currently consolidating around the upper line.

Bullish scenario:

- During October, the pair had good support in the MA20 moving average and more robust support last week in the MA200 moving average at 0.73500.

- We are currently testing 50.0% Fibonacci level at 0.75000, and we need a break above this level.

- Our next target is 61.8% Fibonacci level at 1.75900, and we have to break above the channel’s top line.

Bearish scenario:

- We need a bearish consolidation and break below the MA20 moving average.

- Pair then descends to the first lower support at 38.2% Fibonacci level at 0.74000; middle support is at 0.74300.

- The MA50 and MA200 moving averages are in the 0.73250-0.73500 zone.

- Our maximum bearish target is the lower line from this growing channel.

Market overview

Retail sales in the UK dropped unexpectedly in September, data released by the National Statistics Office showed on Friday. Retail sales fell 0.2 percent month-on-month in September, after easing 0.6 percent in August. Sales were forecast to rise 0.5 percent.

Germany’s private sector growth fell to an eight-month low in October, and the results showed on Friday. The title composite production index fell more than expected to 52.0 in October from 55.5 in the previous month.

The expected level was 54.0. The index has been falling every month since reaching a record high in July. A reading above 50.0 indicates an increase in the sector, which is positive.

German PMI data in October indicate that economic activity began to grow at the beginning of the fourth quarter, said Phil Smith, assistant director at IHS Markit. The manufacturing procurement manager index fell to a nine-month low of 58.2 from 58.4 in September.

The French private sector has grown at the slowest pace in the past six months, the results of the latest IHS Markit survey showed on Friday. Growth was driven solely by the service sector as production fell at the fastest pace since May 2020.

The composite production index fell to 54.7 in October, as economists expected, from 55.3 in September. French PMI in production fell more than expected to 53.5 from 55.0 in the previous month, and the forecast was 54.0.

-

Support

-

Platform

-

Spread

-

Trading Instrument