EURUSD, GBPUSD, AUDUSD and economic events for this week

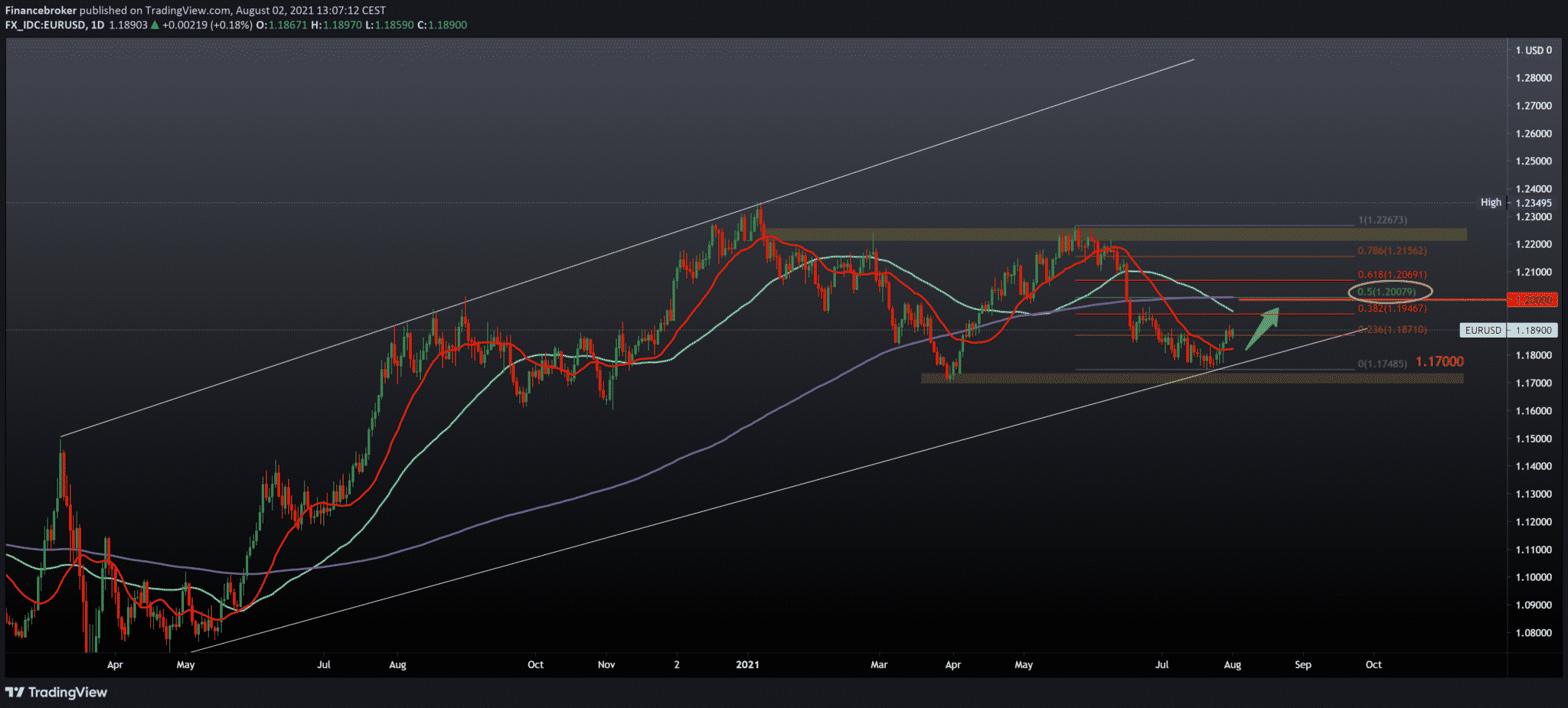

Following the EURUSD on the daily time frame, we see that the pair is moving in a large growing channel. We find support on the lower edge of the canal in the zone 1.17000-1.18000. We are currently climbing to 1.18800 with the support of the MA20 moving average. Based on this situation on the chart, we can expect the further recovery of the euro and growth in value to the psychological level of 1.20000, which coincides with the 200-day moving average. With the Fibonacci level setting, we are currently still testing 23.6% Fibonacci level at 1.18710. If we look at the 38.2% Fibonacci level, we see that we have resistance at 1.19470. a place of overlap with a 50-day moving average. For the bearish scenario, we need a drop below 1.17000 to think about it and look for the next potential support zones.

The GBPUSD pair chart analysis

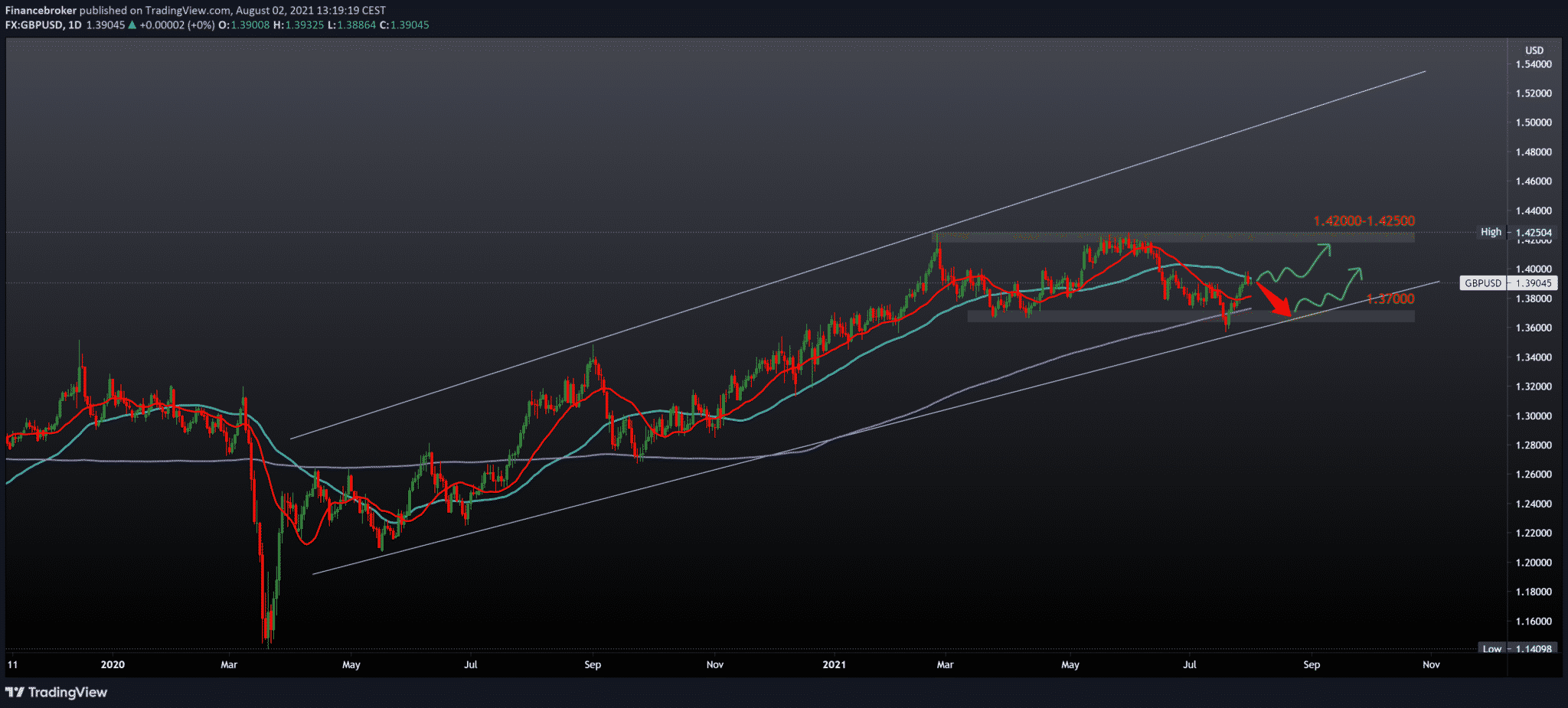

On Friday, the pound retreated from 1.40000, failing to stay at that level and above the 50-day moving average, while MA20 and MA200 are on the bullish side. In contrast, the pair’s value was withdrawn to lower levels by testing the bottom line of support and the required support in the MA200 in the zone 1.37000-1.38000, and then with positive consolidation, the continuation of the longer-term bullish trend. The dollar has been volatile for the past week, and we can expect the pound to exploit and manage to climb above 1.4000, and if that happens, then we can expect to revisit the pre-zone resistance zone at 1.42000-1.42500.

AUDUSD pair Chart analysis

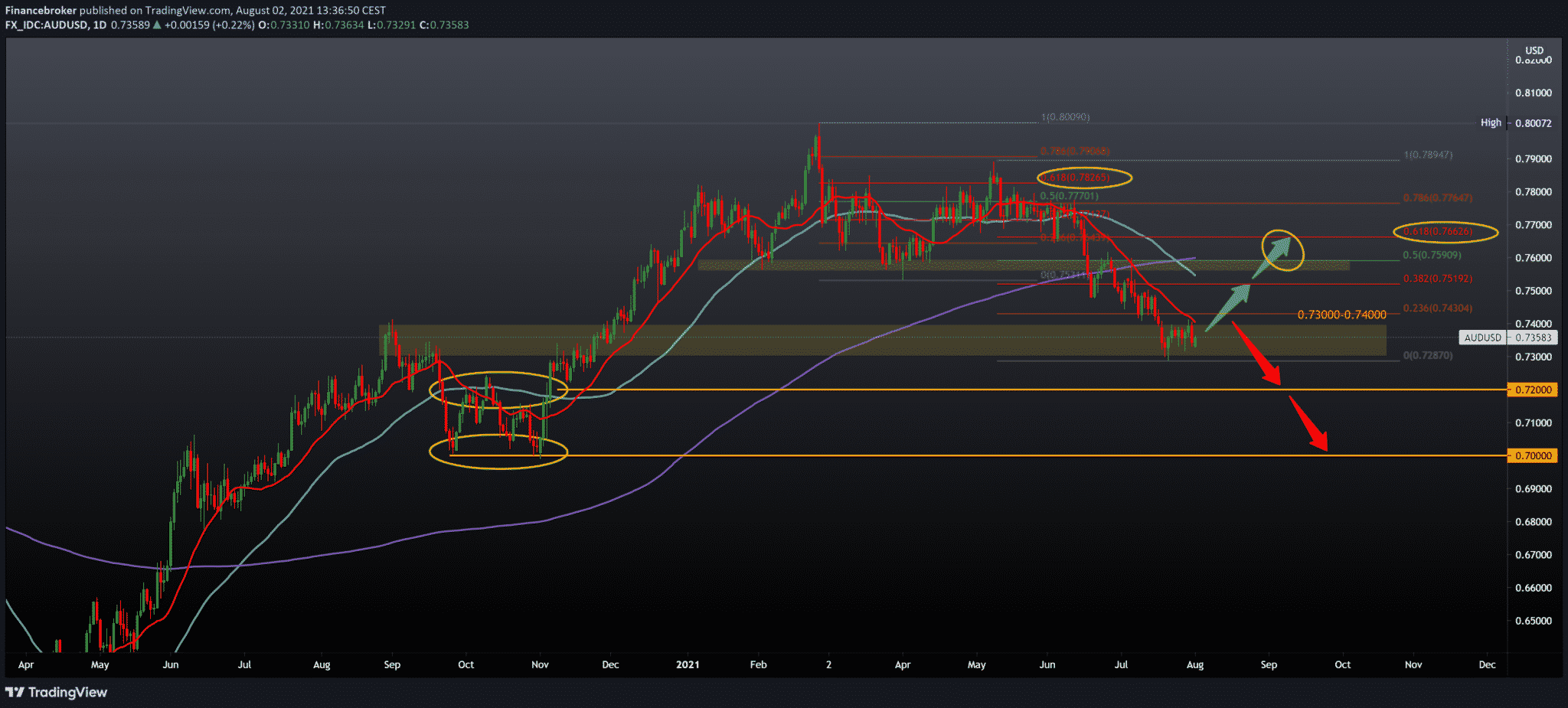

AUDUSD fell from 0.74000 to 0.73000 during those 24 hours on Friday. While today, the situation is totally different where this pair records gains + 50% compared to the losses from the previous Friday, climbing to 0.73500.

Although the overall picture is very bearish and much of Australia is Lockdown due to an increase in new infections with the new Delta strain of Coronavirus, we can expect a smaller pullback upwards in favor of the Australian dollar as the dollar is under high pressure ,after the latest economic data during the previous week and the bearish feeling in Jerome Powell’s statements during the FOMC meeting last Wednesday.

Based on this, we expect the pair to first rise above MA20 and stabilize in the zone around 23.6% Fibonacci level at 0.74300, then looking towards MA50 approaching 38.2% Fibonacci level at 0.75190. Our ultimate medium-term goal is MA200 in the 50.0-61.6% Fibonacci level zone. The opposite is the following, the continued weakening of the Australian dollar against the US dollar and the fall below the previous low to 0.72800 from July 21, and the inability of AUD to cope with the pressure of the Corona pandemic. Then we look for potential support at 0.72000, the previous places to keep the price on the chart.

Overview of the Economic Calendar

Looking at the economic calendar for this week, we see that there is a lot of important economic data, which will definitely affect the market’s volatility. Monday is full of news on production trends for July;

On Tuesday morning, we will receive a report from the Reserve Bank of Australia (RBA) on the interest rate, as well as statements by officials on the next moves of the RBA regarding the purchase of government bonds, coronavirus.

On Wednesday we will see the news NZD- Employment Change, AUD- Retail sales, as well as very important news for GBP, USD, and the report on oil stocks.

Thursday is GBP day where we are waiting for the BOE report on interest rates. And, for the end on Friday before the start of the American session, data on Nonfarm Payrolls, a report on unemployment in the US; as well as Canadian Ivey PMI and Employment Change.

-

Support

-

Platform

-

Spread

-

Trading Instrument