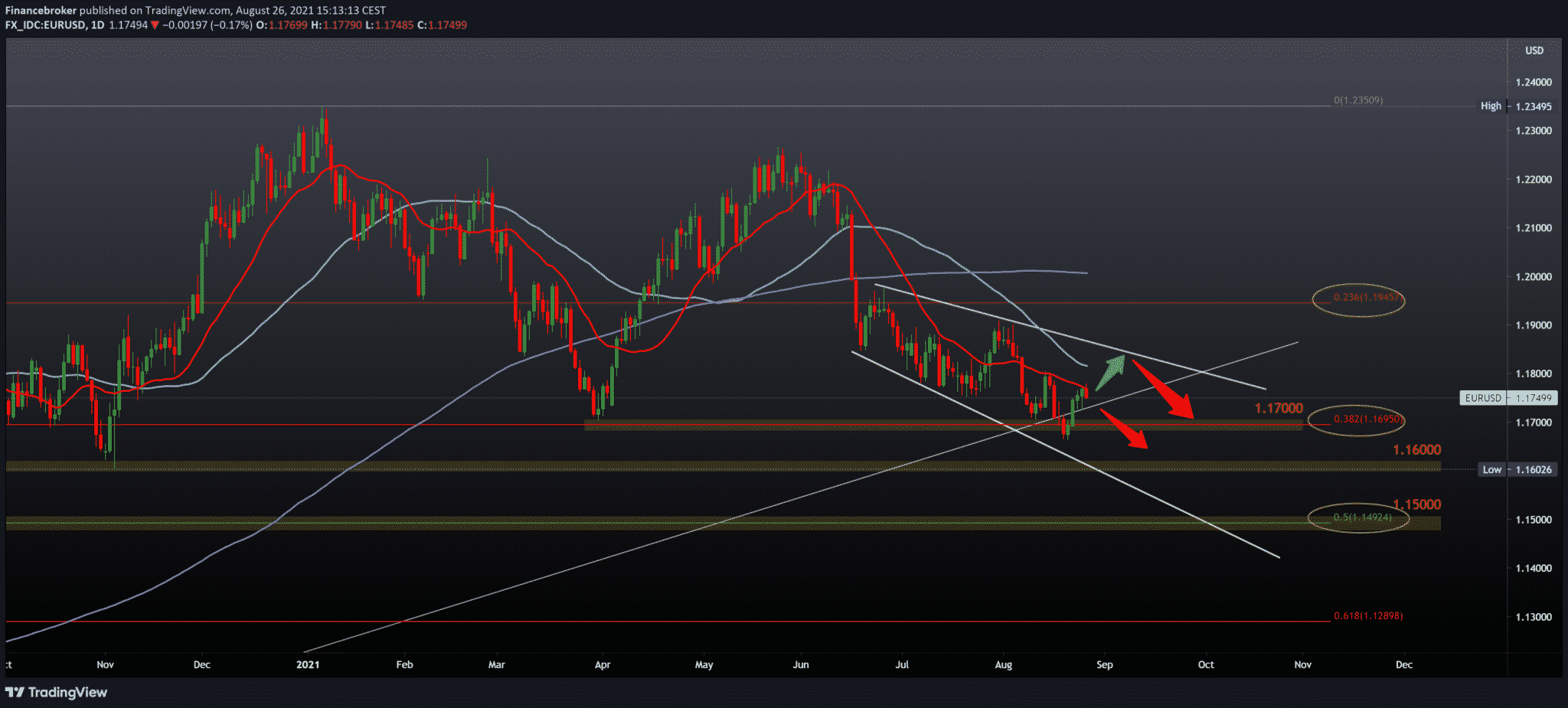

EURUSD, GBPUSD, and US Gross Domestic Product

Looking at the chart on the daily time frame, we see that EURUSD encounters resistance in the form of a 20-day moving average at 1.17700, and to continue on the bullish side, we need a break above this resistance. If the pair succeeds, we can climb to a 50-day moving average of 1.18000. We still have support with the bottom trend line and 38.2% Fibonacci level at 1.16950. The movement is still in the falling channel, and in order to be able to move in the bullish scenario, we need a break above the upper line of resistance. For the bearish scenario, we need further negative consolidation and pressure from the 20-day moving average, which can again direct us towards the 38.2% Fibonacci level.

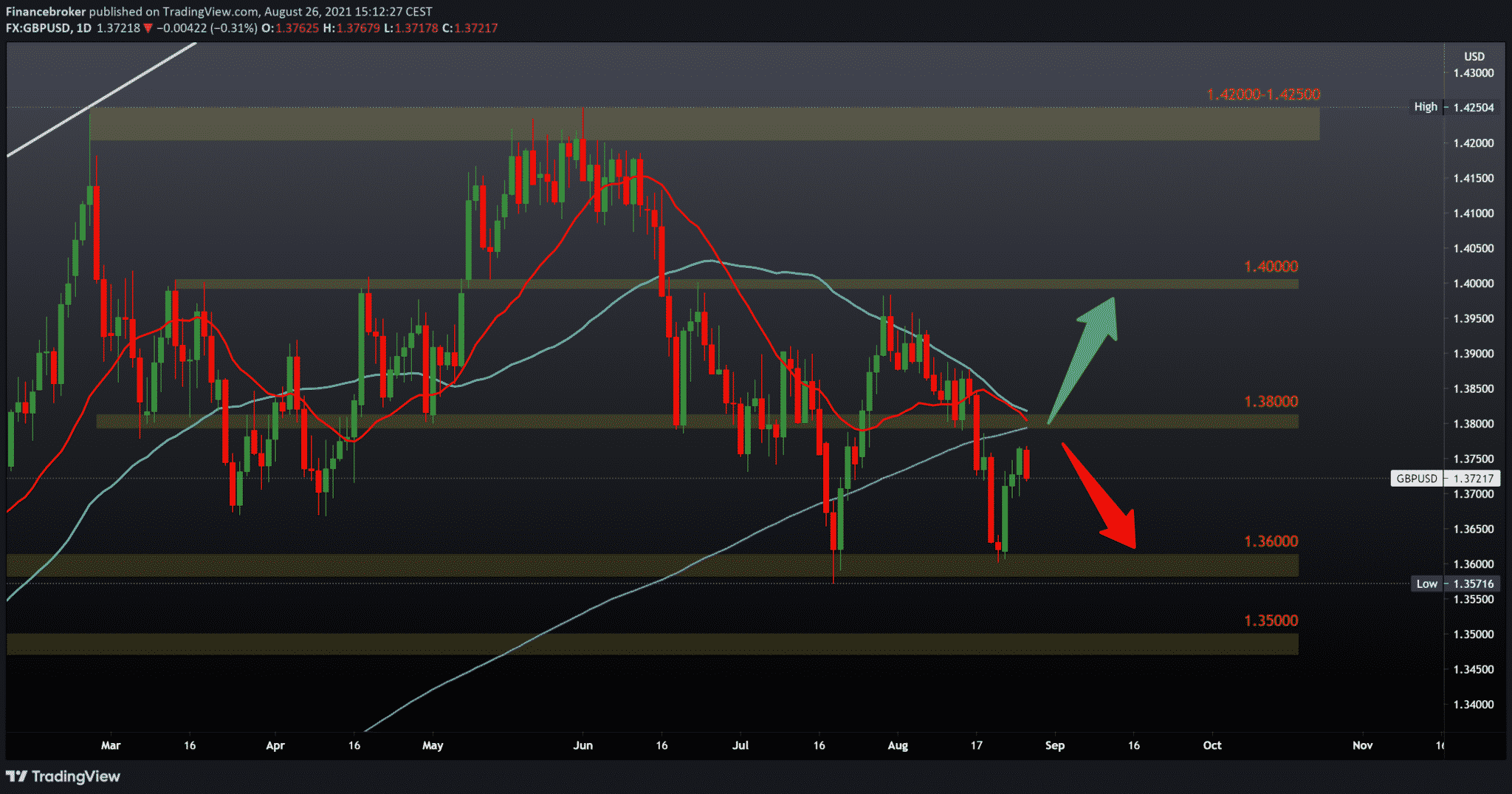

GBPUSD Chart Analysis

Looking at the chart on the daily time frame, we see that the Pound is in a pullback against the dollar. We can say that the pair has encountered resistance in moving averages so far in the zone around 1.38000. In fact, we are currently at 1.37200. Based on the current situation, we can conclude that the pair will probably continue to consolidate in zone 1.36000-1.38000. We can expect the bullish trend to continue if the Pound strengthens and breaks above moving averages with appropriate bullish consolidation.

Market Overview

Consumer confidence in Germany will weaken sharply in September. This is mainly due to deteriorating economic expectations and a propensity to buy, as well as a propensity to save; survey data showed on Thursday.

The forward-looking consumer confidence indicator fell to -1.2 from a revised -0.4 in August, the GfK market research group said. Economists expected the index to fall to -0.7.

The indicator of economic expectations fell for the second month in a row but remained at a high level. The reading dropped to 40.8 from 54.6.

The propensity to buy index fell to 10.3 from 14.8 in the previous month. Carefree shopping is still not a reality in light of the mandatory use of masks and distance rules, as well as stronger price growth, GfK said.

The income expectation index rose to 30.5 from 29.0 in the previous month, thanks to stable employment figures and the associated low fear of unemployment.

Fears that the restrictions could even be tightened now are obviously depressing the feelings of consumers, Burkle added.

Rising inflationary pressures are also lowering consumer sentiment.

“Although these are primarily one-off effects stemming from VAT cuts in the second half of 2020, given the current low-interest-rate phase, households perceive inflation rates as an even greater threat to their purchasing power,” Burkle said.

Unemployment Benefits Increased in the US

According to a report released by the Department of Labor on Thursday, the first reports of US unemployment benefits increased slightly more in the week ending Aug. 21.

The report states that the initial demands for the unemployed increased to 353,000. This is an increase of 4,000 compared to the revised level from the previous week of 349,000.

Economists expected job claims to rise to 350,000 from the 348,000 originally reported for the previous week.

Meanwhile, the Labor Ministry said the less volatile four-week moving average fell to 366,500, down 11,500 from last week’s revised average of 378,000.

In an interview with Fox Business today, Fed President in Kansas City Esther George said that good progress has been made in the economy, but also warned in the following statements:

“Inflation is coming strongly, suggesting the possibility of withdrawing from the agenda of reducing property purchases.”

“Communication at the September meeting will reflect discussions on potential reductions.”

“Less precision as to when the cuts will apply, and the outlook suggests the Fed may begin adjusting this year.”

-

Support

-

Platform

-

Spread

-

Trading Instrument