EURUSD, AUDUSD, GBPUSD continued recovery this week

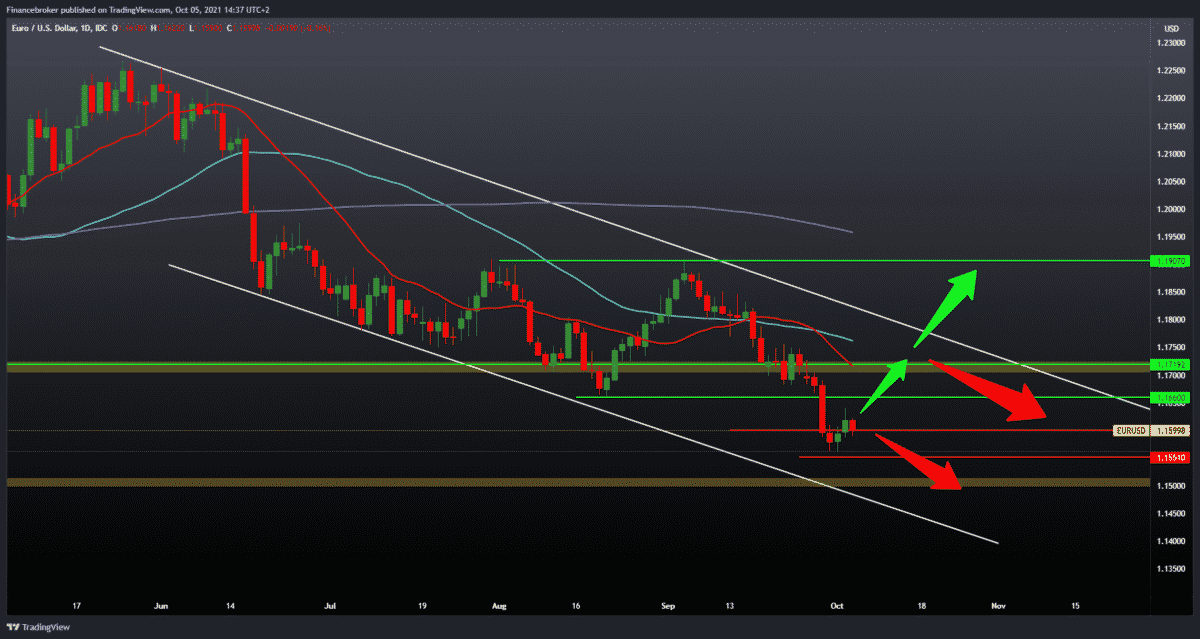

Looking at the EURUSD chart on the daily time frame, we see that after yesterday’s bullish impulse, the pair is now a real pullback to the bearish side. The dollar consolidated and continued to strengthen, which affected the withdrawal of this pair. We have to pay attention again to whether we will see a break below the previous low or we will see a consolidation that will put us back on the bullish track. If that happens above, we will have higher resistances in the form of moving averages, and the broader picture is that we are in a falling channel, and as long as we are in this channel, we will continue to be in a bearish trend.

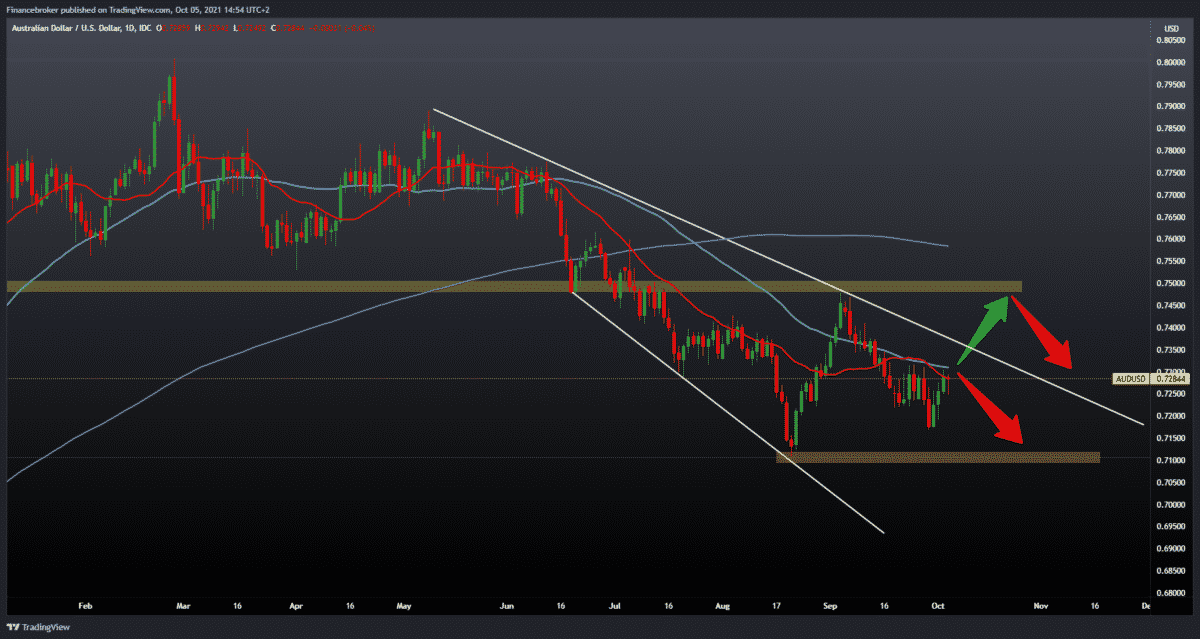

AUDUSD chart analysis

Looking at the AUDUSD chart on the daily time frame, we see that the pair has been in a bullish trend in the last three days after falling to 0.71500. After that, AUDUSD climbed to the current 0.72850. We are currently testing 20-day and 50-day moving averages, and if we cross this hurdle, our next resistance is in the upper drop line. Only if we make a break above this line can we reach the 0.75000 area again. For the bearish scenario, we need the continuation of bearish consolidation within this channel, which will direct us again to the previous low in the zone 0.71000-0.71500.

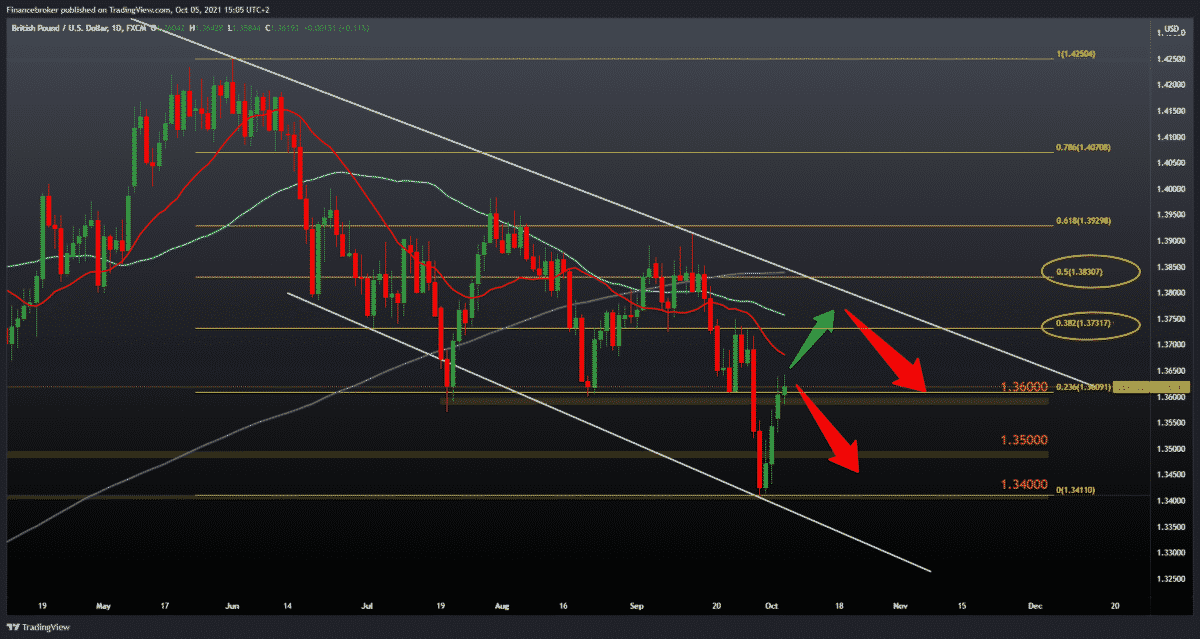

GBPUSD chart analysis

Looking at the GBPUSD chart on the daily time frame, we see that the pair has been in a bullish trend for the last four days. With the Fibonacci level setting, we are currently testing the 23.6% level at 1.36000. To continue on the bullish side, we need the continuation of this bullish impulse up to the next resistance at 38.2% Fibonacci level at 1.37300. Additional resistance above awaits us in moving averages of 20 days and 50 days. The broader picture tells us that as long as we are down this channel, we can expect the bearish trend to continue, and for a longer-term bullish trend, we need a break above the upper resistance line.

Market overview

Private sector growth in the eurozone has moderated for the second month in a row as a lack of imports has hampered both production and production, final data from IHS Markit showed on Tuesday.

The final composite production index fell to 56.2 in September from 59.0 in August. The prognosis was 56.1. Nevertheless, a reading above 50.0 indicates an expansion.

“Although for now, the overall rate of expansion by historical standards is relatively solid, the economy is entering a slower growth trajectory in the last quarter of the year,” said Chris Williamson, a chief business economist at IHS Markit.

Growth rates were significantly slower than in August in both the manufacturing and service sectors. The procurement manager index fell to 56.4 from 59.0 in the previous month, and the reading was slightly above the 56.3 forecasts.

The research showed that there were milder rates of expansion and new orders and employment, while business expectations from the company were the least optimistic since February.

In terms of prices, research has shown that import prices have risen at the fastest common rate so far, and export prices grew at a rate that was surpassed only in June and July.

The Central Bank of Australia left its monetary policy unchanged, as expected, and promised to keep its interest rate at a historically low level until 2024.

The Australian Reserve Bank’s policy committee has decided to leave its interest rate same level at a low of 0.10 percent. The bank reiterated that it would not raise the cash rate until real inflation was maintained within the target area of 2 to 3 percent. The basic scenario for the economy is that this condition will not be implemented before 2024.

Although the bank has held on to its weapons predicting that rates will not rise until 2024, high inflation will spur rate increases in 2023, said Marcel Thieliant, an economist at Capital Economics.

The board assessed that there is uncertainty regarding the time and pace of recovery and that it will probably be slower than earlier in the year.

The bank forecast economic recovery again in the December quarter and is expected to return to its before-delta path in the second half of 2022 year.

The car market in Great Britain recorded the weakest September since 1998. Car sales fell sharply by 34.4 percent in September compared to last year, when the restrictions of the pandemic significantly reduced economic activity.

Regardless, September was the best month ever to pick up new battery-powered electric vehicles or BEVs. BEV registration rose 49.4 percent year on year.

-

Support

-

Platform

-

Spread

-

Trading Instrument