EURUSD, AUDUSD and NZDUSD Potential for Recovery

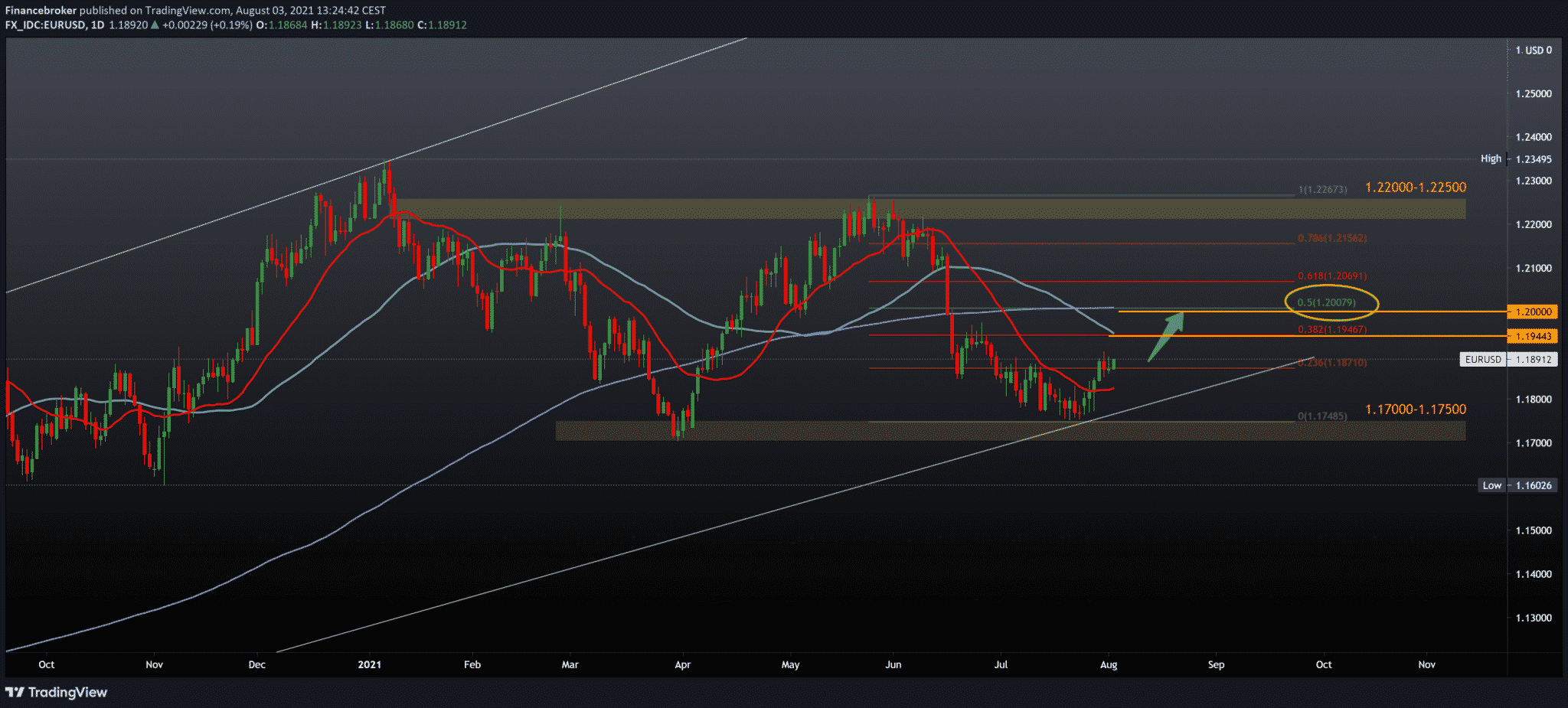

EURUSD, the pair is still slowly recovering today. It is climbing to 1.18880, making a smaller break above 23.6% Fibonacci levels at 1.18710. Further, we can expect the pair to climb to 1.19500 at a 38.2% Fibonacci level. There is a 50-day moving average waiting for us; if a couple manages to overcome that obstacle, then we can see the pair at a 200-day moving average at 50.0% Fibonacci level. The break above is just added support for the continuation of the bullish trend. If we expect a bearish scenario, we look for resistance at MA50 and 38.2% Fibonacci level. And then a pull to the bottom support line again to 23.6%.

The AUDUSD Pair Chart Analysis

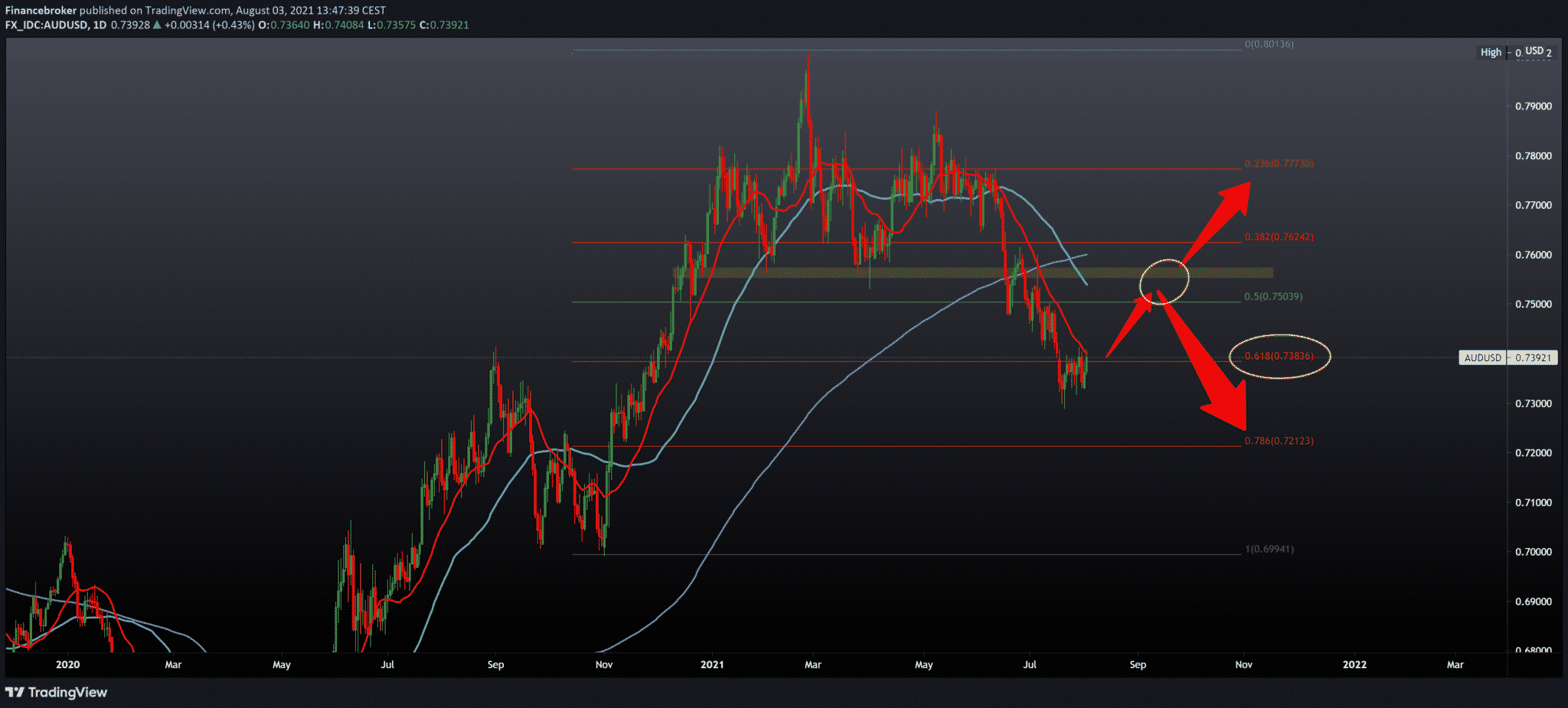

Looking at the AUDUSD pair on the daily time frame, we see that we found support at 61.8% Fibonacci level at 0.73840. We now have the potential to see a smaller pullback to the 0.75000-0.75500 zone. The Australian dollar gained strength after this morning’s report by the Reserve Bank of Australia. The interest rate continued at the same level at 0.10% and stopped the fall of the Australian dollar. Our first next target is 0.75000 at a 50.0% Fibonacci level. Moreover, for support, we need a break above the 20-day moving average. Our 50-day moving average coincides with 50.0% Fibonacci level, and the 200-day moving average coincides with 38.2% Fibonacci level at 0.76200.

We can look at the previous candlesticks as the Head & Sholders pattern, and the target of this pullback is our neckline. For the bearish scenario, we will watch when the pair climbs into the 0.76000 neckline zone or if something drastic does not happen and the pair continues to fall from this level.

The NZDUSD Pair Chart Analysis

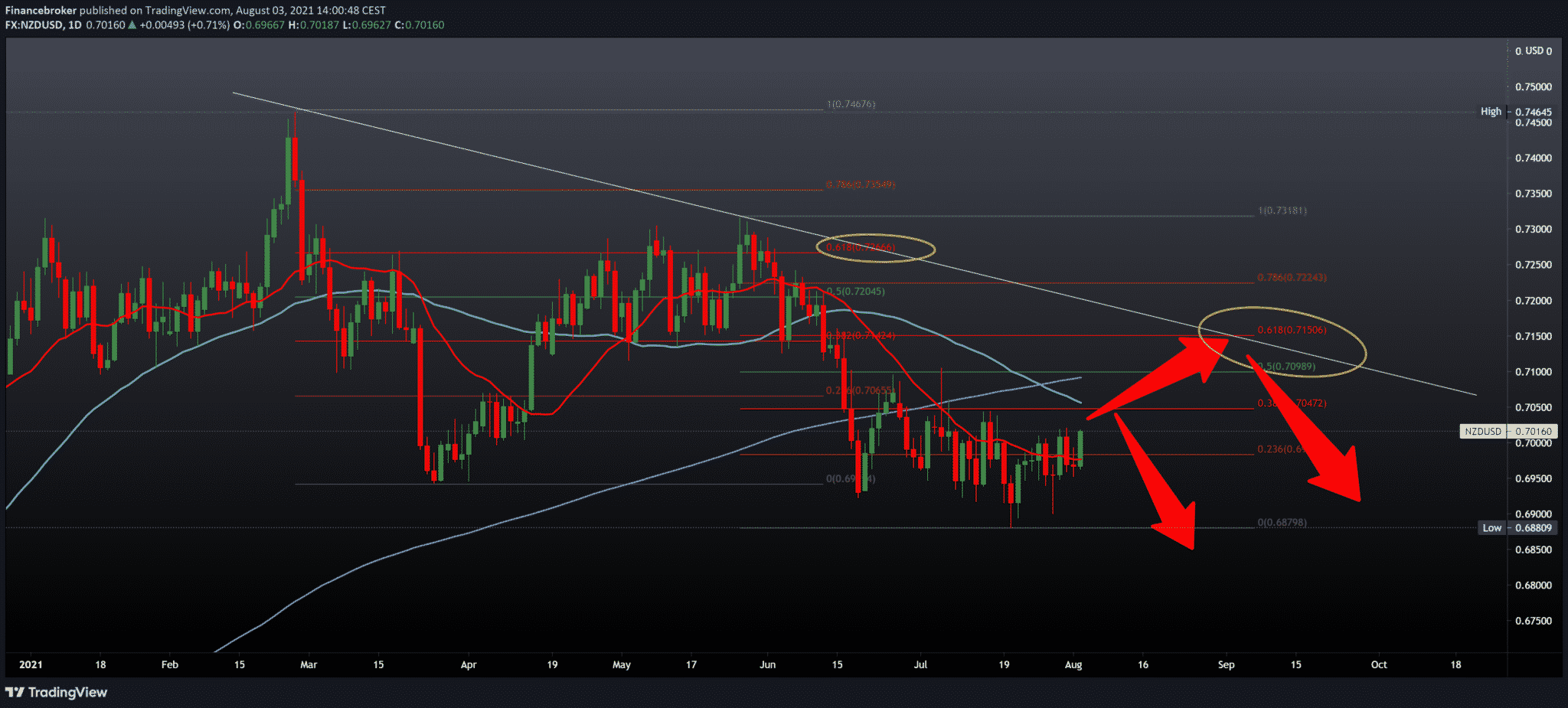

Looking at the NZDUSD on the daily time frame, we see that the pair has found support in the 0.69000-0.69500 zone and is now testing a 0.70000 psychological level for investors. In this chart, we can use Fibonacci retracement levels. In the first Fibonacci level setting, we see that the pullback is completed at 61.8% Fibonacci level.

After that, we can draw a certain line connecting the previous highs; we can call that line the trend or resistance line. By setting the second Fibonacci retracement level from the previous high to 0.73180 and the previous low to 0.68800, we see that here 61.8% level coincides with the upper resistance line.

Based on this setting, we can expect the NZDUSD pair to climb to 0.71500. Where the first next resistance awaits us, coinciding with the 200-day moving average movement. We expect lower resistance at 0.382 Fibonacci level because it intersects with the 50-day moving average.

An Overview of the Market

The Central Bank of Australia left the key interest rate unchanged. It also left the target of government bond yields on Tuesday unchanged, which was expected.

The Australian Reserve Bank’s policy committee, headed by Governor Philip Love, has decided to leave its cash rate unchanged at a record low of 0.10 percent.

The board also decided to continue buying government securities at a rate of $ 5 billion a week until early September. It then continued to $ 4 billion a week at least until mid-November.

The bank repeated that it would not raise the cash rate. That is until real inflation is maintained within the target area of 2 to 3 percent. The central scenario is that this condition will not be met before 2024.

There were widespread expectations that the RBA would postpone reducing the purchase of its bonds this month in response to the quarantine in Sydney.

Love noted that Australia’s economic recovery is stronger than previously expected. However, recent virus outbreaks are interrupting the recovery, and GDP is expected to fall in September.

-

Support

-

Platform

-

Spread

-

Trading Instrument