EURUSD and NZDUSD Daily Views on the Bullish Side

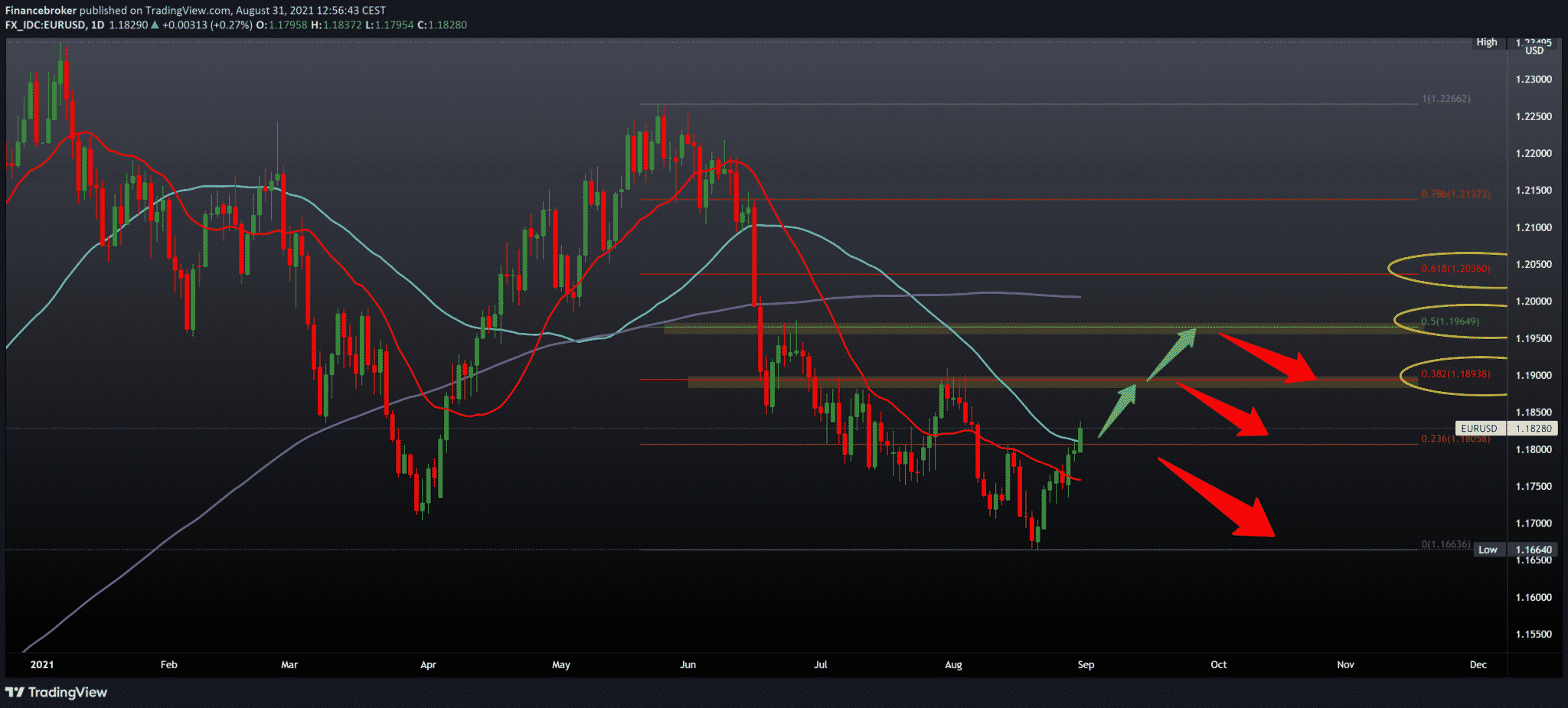

Looking at the chart on the daily time frame, we see that EURUSD has found support at 1.16640, and after that, we have the current bullish trend. The first hurdle in the form of a 20-day moving average and the second hurdle in the 50-day moving average were overcome with additional support at 23.6% Fibonacci level at 1.18050. For further continuation, we need a break from the previous high to 1.19000. This coincides with the 38.2% Fibonacci level where we can expect the next resistance or consolidation.

Our next upper resistance is 50.0% Fibonacci level at 1.19650, the place of the previous high from the end of June. We need a negative consolidation and withdrawal below the 23.6% level for the bearish scenario. This will be a sign for us to continue this bearish pullback. Then we need to pay attention to how the EURUSD pair behaved at the previous low and the zone around 1.17000.

NZDUSD Chart Analysis

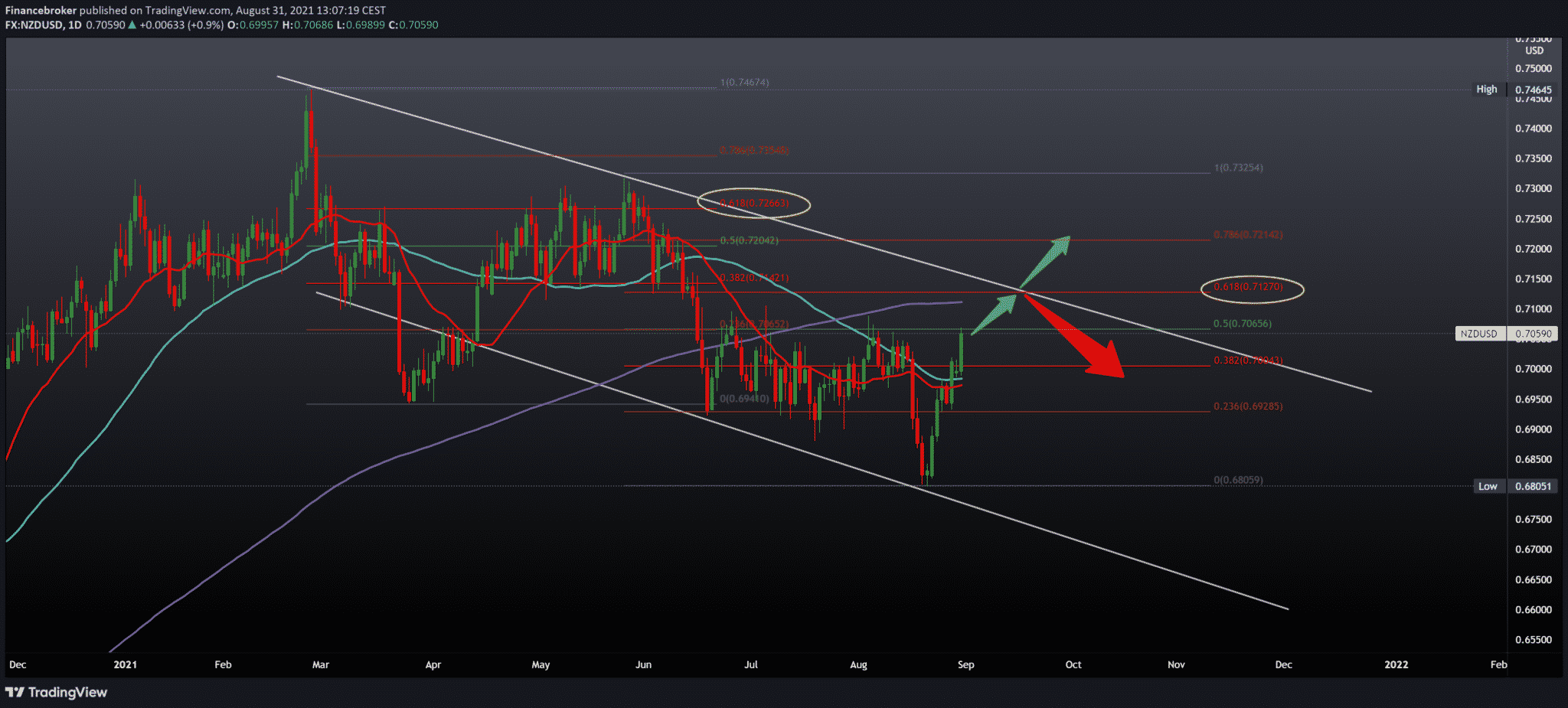

Looking at the graph on the daily time frame, we see that not after falling to 0.68000, the pair bounced from the lower support line to the upper resistance line. We received current support in the 20-day and 50-day moving averages, as well as in the 38.2% Fibonacci level at 0.70050. Our target within this channel is at 61.8% Fibonacci level at 0.71270. This coincides with the 200-day moving average.

On the upper line, we can expect resistance that can again NZDUSD direct towards the lower targets on the graph. The break above will only amplify the current bullish signals on the chart. Furthermore, it will direct our attention to the next 78.6% Fibonacci level at 0.72140.

Market Overview

Inflation in the eurozone climbed more than expected to a nearly ten-year high in August; fast Eurostat data showed yesterday.

Inflation climbed to 3 percent in August from 2.2 percent in July. That was the highest since November 2011. Moreover, it also exceeded the European Central Bank’s target of 2 percent and the economists’ forecast of 2.7 percent.

Core inflation, which excludes energy, food, alcohol, and tobacco, rose to 1.6 percent from 0.7 percent in July. The rate showed a predicted 1.5 percent rise.

The rise in inflation is primarily due to temporary forces that should disappear next year, leaving core and core inflation well below 2 percent by the end of 2022, said Jack Allen-Reynolds, an economist at Capital Economics.

The economist said that the interest rate would fall to around 2% in January. It would then be reduced to around 1% throughout the year until the end of 2022.

Despite the jump in core inflation and further growth in headline inflation, this will not replace the ECB’s bullish stance ahead of next week’s September meeting, ING economist Bert Colijn said.

Conclusion

China’s service sector shrank in August amid a resurgence of the virus, the results of an official survey by the National Bureau of Statistics showed on Tuesday.

The official index of non-productive procurement managers, which measures services and construction performance, fell to 47.5 in August from 53.3 a month ago. A reading below 50 indicates a decrease in the sector.

At the same time, the factory PMI entered at 50.1, up from 50.4 in the previous month. The expected reading was 50.2.

The conclusion is that even looking through the instability caused by the recent rise of the virus in China. It seems that the economy will return to the country after a period of production above the trend, economists added.

-

Support

-

Platform

-

Spread

-

Trading Instrument