EURUSD and GBPUSD: The EURUSD At The 1.01000 Level

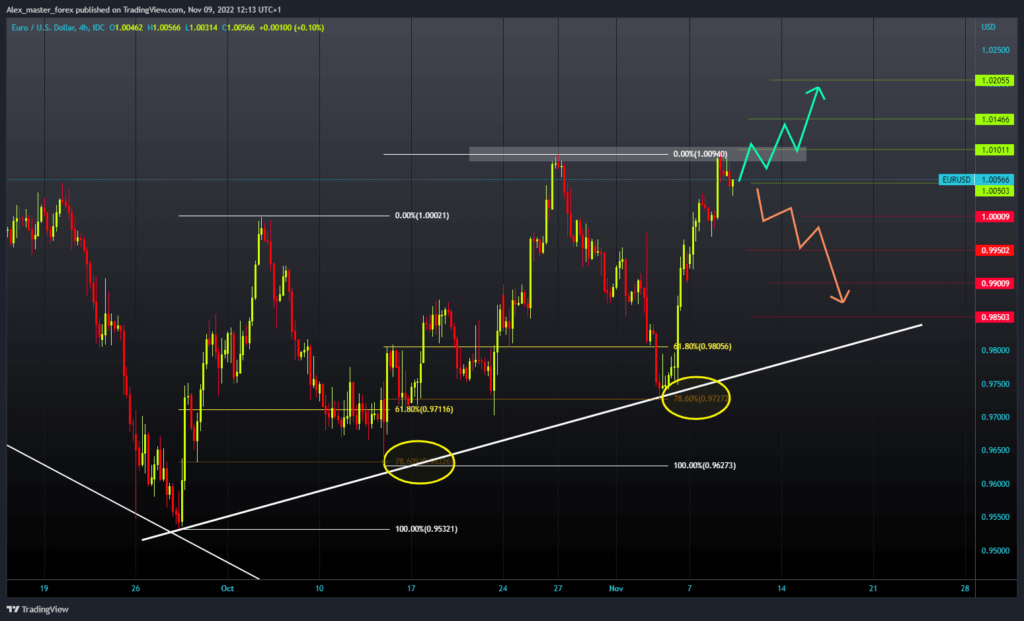

- Before the start of yesterday’s American elections, the EURUSD pair formed a new November high at the 1.01000 level.

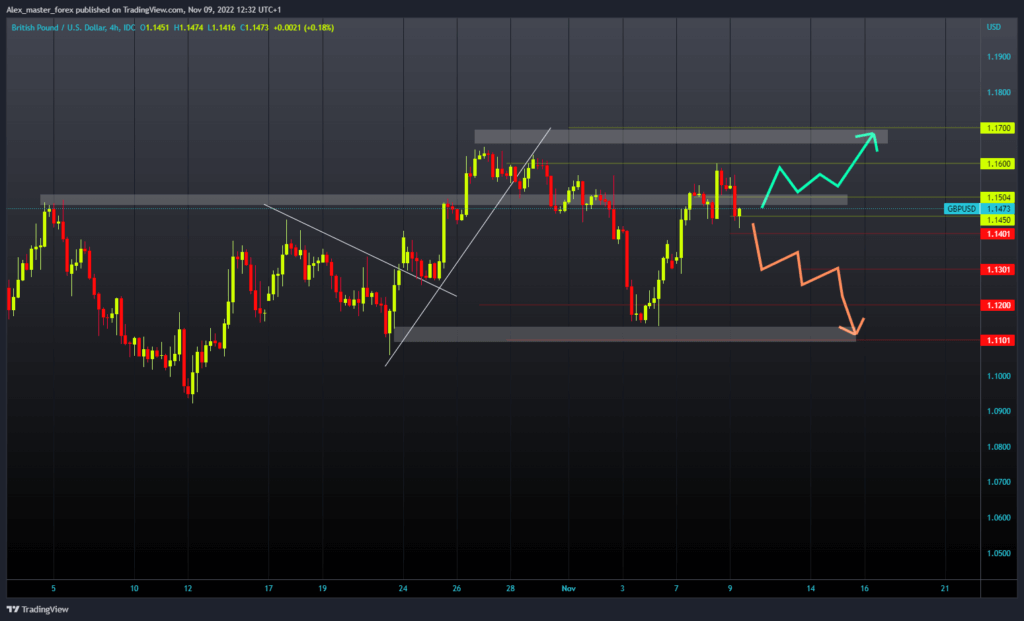

- Yesterday’s growth of the pound was stopped at the 1.16000 level

EURUSD Chart Analysis

Before the start of yesterday’s American elections, the EURUSD pair formed a new November high at the 1.01000 level. Since then, we have been in a short pullback to the 1.00500 level. We are currently finding support at that level, but we cannot rule out that we will not see a further pullback.

For a bullish option, we need a positive consolidation and a return to the 1.01000 leva resistance. Then we need a break above and try to hold there. With a new bullish impulse, we could see a continued euro recovery. Potential higher targets are 1.01500 and 1.02000 levels. For a bearish option, we need a negative consolidation and a drop to the next support at the 1.00000 level. A fall in the euro below could mean a bigger pullback on the chart. Potential lower targets are 0.99500 and 0.99000 levels.

GBPUSD Chart Analysis

Yesterday’s growth of the pound was stopped at the 1.16000 level. After that, we see a pullback to 1.15000, and during the Asian session, the pound fell further to 1.14150 levels. For now, we have support at that level, and we see a minor recovery of the pound to the 1.14660 level. For a bullish option, we need a positive consolidation and a return above the 1.15000 level.

Then it would be good for the pound to break above and try to hold there. With the next bullish impulse, we could break the 1.16000 level and try to continue the bullish recovery. Potential higher targets are 1.16500 and 1.17000 levels. For a bearish option, we need negative consolidation and a drop to the 1.14000 support level. A break below would mean a further fall of the pound. Potential lower targets are 1.13000 and 1.12000 levels.