EURUSD and GBPUSD: The Euro Retreated Against the Dollar

- At the beginning of the week, the euro continued to fall and retreated against the dollar.

- During the Asian trading session, the pound is in a minor retreat from the 1.16000 level.

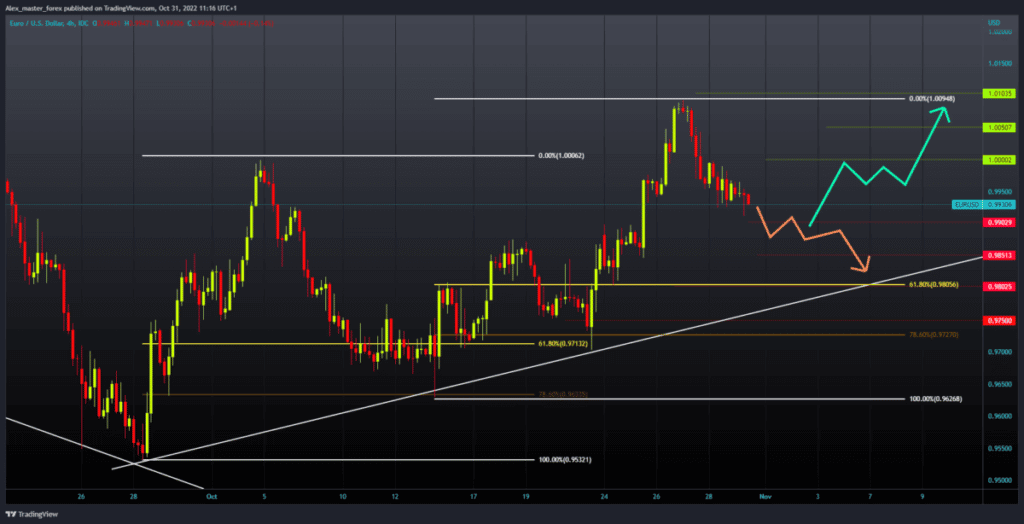

EURUSD chart analysis

At the beginning of the week, the euro continues to fall and retreat against the dollar. The pressure on the European currency continues, and this week we could see a further fall of the euro from last week’s high to the 1.01000 level. For a bearish option, we need a negative consolidation and a continuation of the decline to the 0.99000 level. Failure to hold there would lead to a breakout below.

This would lead to a further decline in the European currency. Potential lower targets are 0.98500 and 0.98000 levels. We need a new positive consolidation and support at the 0.99500 level for a bullish option. If we manage to climb above, then we would have a chance for the euro to move from this level and start a recovery. Potential higher targets are 1.00000 and 1.00500 levels.

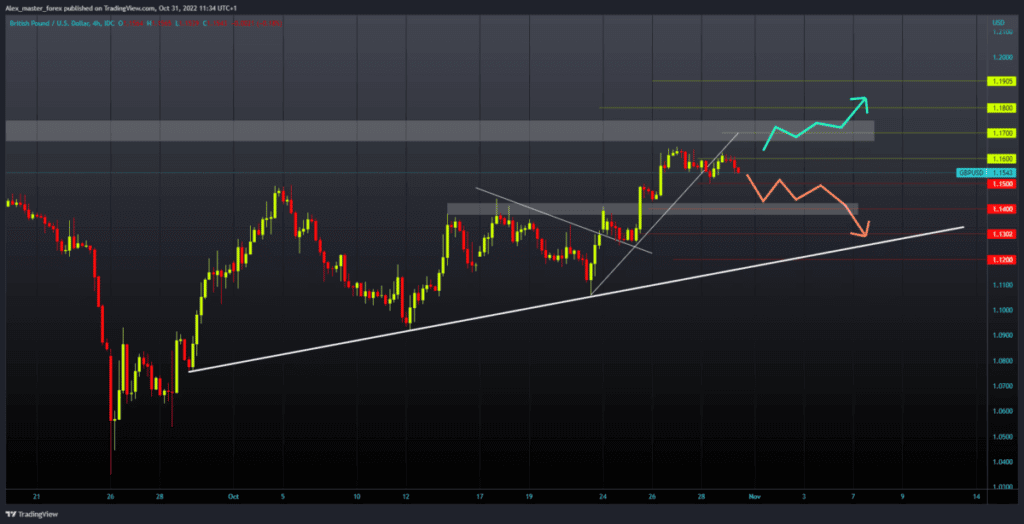

GBPUSD chart analysis

During the Asian trading session, the pound is in a minor retreat from the 1.16000 level. Currently, the pound is now at the 1.15500 level, and if this pullback continues, our target is the 1.15000 psychological level. We need a negative consolidation and a break below the 1.15000 level for a bearish option. In the continuation, the pair GBPUSD could start a further decline. Potential lower targets are 1.14000 and 1.13000 levels.

Additional support at the 1.13000 level is in the lower trend line. We need a positive consolidation and a return above the 1.16000 level for a bullish option. If we were to succeed in that, we would have to hold above and wait for a new bullish impulse that will continue the recovery. Potential higher targets are 1.17000 and 1.18000 levels.