EURUSD and GBPUSD: The Euro Continued Its Recovery

- During the Asian trading session, the euro continued its recovery.

- During the Asian trading session, the pound continued to rise against the dollar.

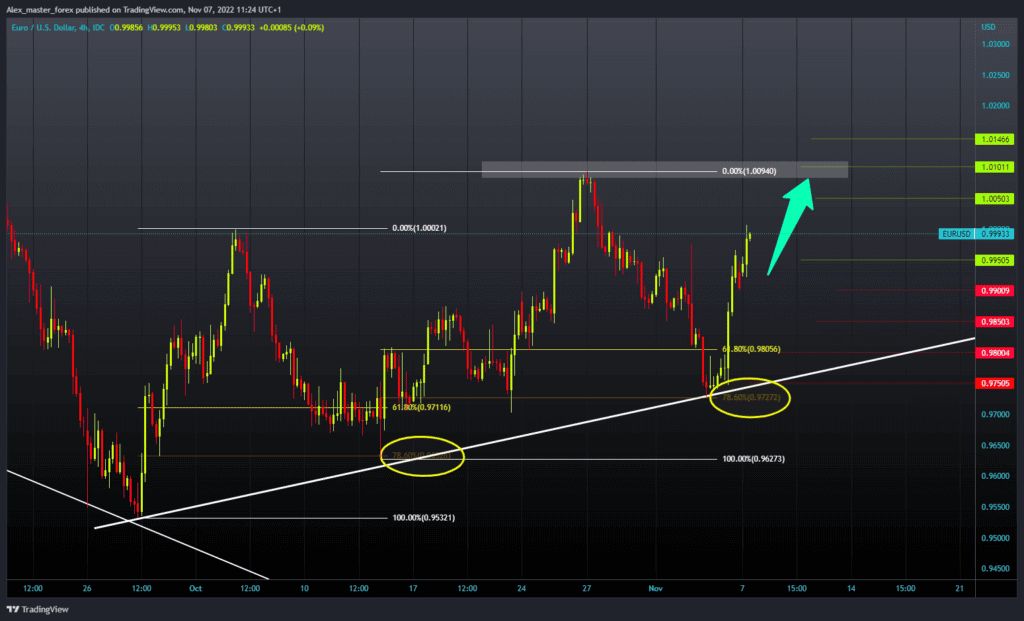

EURUSD chart analysis

During the Asian trading session, the euro continued its recovery. Now we retest the 1.00000 level. The dollar continued to weaken before the US congressional elections so that we could expect further growth of the euro to a higher level. For a bullish option, we need a continuation of positive consolidation.

Then we could expect the euro to rise to the previous high at the 1.00940 level. Then we need to stay up there and try to move above. Potential higher targets are 1.01000 and 1.01500 levels. For the bearish option, we need negative consolidation and pullback to the 0.99500 support zone. Increased pressure at that level could cause the euro to slide below. Potential lower targets are 0.99000 and 0.98500 levels.

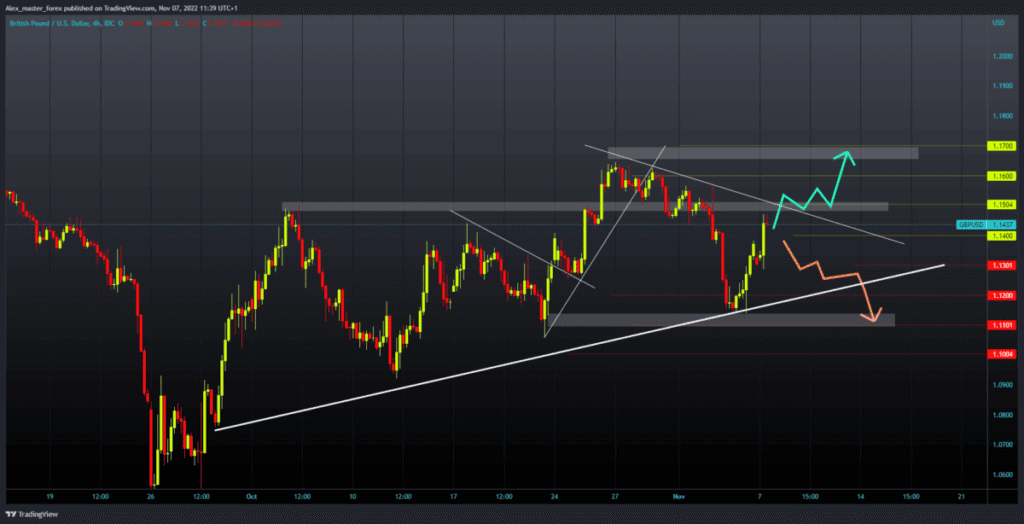

GBPUSD chart analysis

During the Asian trading session, the pound continued to rise against the dollar. The bullish trend started at the end of last week and continued at the beginning of this week. Since the start of trading last night, the pound is up 0.70% against the dollar. To continue the bullish option, we need further positive consolidation and a move to the 1.15000 level.

Then we need to see a break above, and after that, try to hold above. Potential higher targets are 1.16000 and 1.17000 levels. For a bearish option, we need a negative consolidation and a return below the 1.14000 level. In the following, we could expect further withdrawal of the pound, and the potential lower targets are 1.13000 and 1.12000, as well as last week’s low at the 1.11500 level.

Market overview

UK house prices fell by 0.4% compared to September, when prices fell by 0.1%. This was the second consecutive decline since February 2021. Annual home price growth eased to 8.3 percent in October from 9.8 percent in the previous period.

ECB representative Villeroy stated that it should only stop raising interest rates once it sees a halt and a clear slowdown in core inflation. Inflation could peak in the first half of 2023, and it could take two to three years to return to the desired target.