EURUSD and GBPUSD: The Decline Of The European Currency

- The decline of the European currency stopped at the 0.975000 level this morning.

- During the Asian trading session, the pound was held around the 1.12000 level.

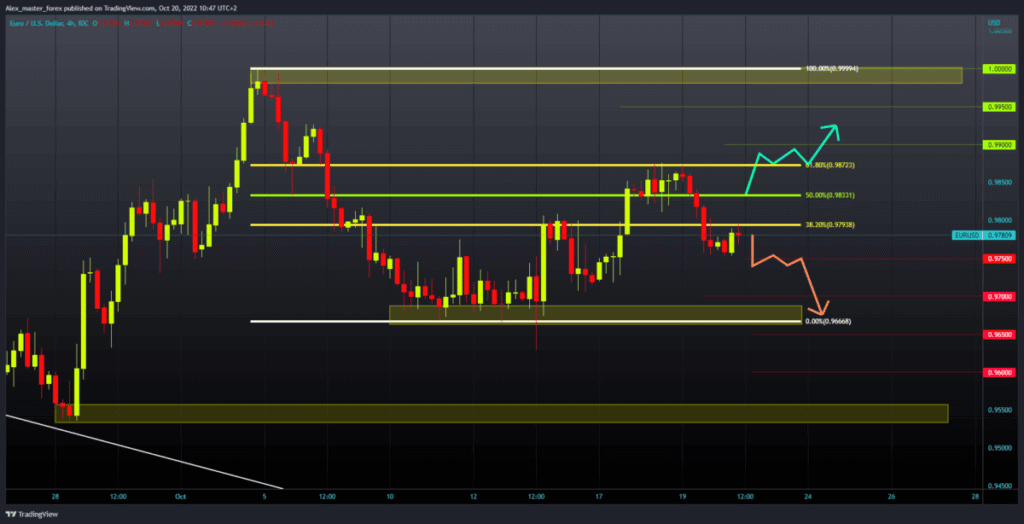

EURUSD chart analysis

The decline of the European currency stopped at the 0.975000 level this morning. Since then, we have had a recovery of the euro, which managed to move up to the 0.97880 level. Now the 0.98000 level is important for us because we need a break above it to continue the recovery. If we succeed in that, the pair should move up to the 0.98730 level.

Potential higher targets are the 0.9900 and 0.99500 levels if the euro manages to climb above the 0.98730 resistance level. For a bearish option, we need a negative consolidation and a drop below this morning’s support at the 0.97500 level. After that, the euro would go down to the next zone at the 0.97000 level. Potential lower targets are 0.96500 and 0.96000 levels.

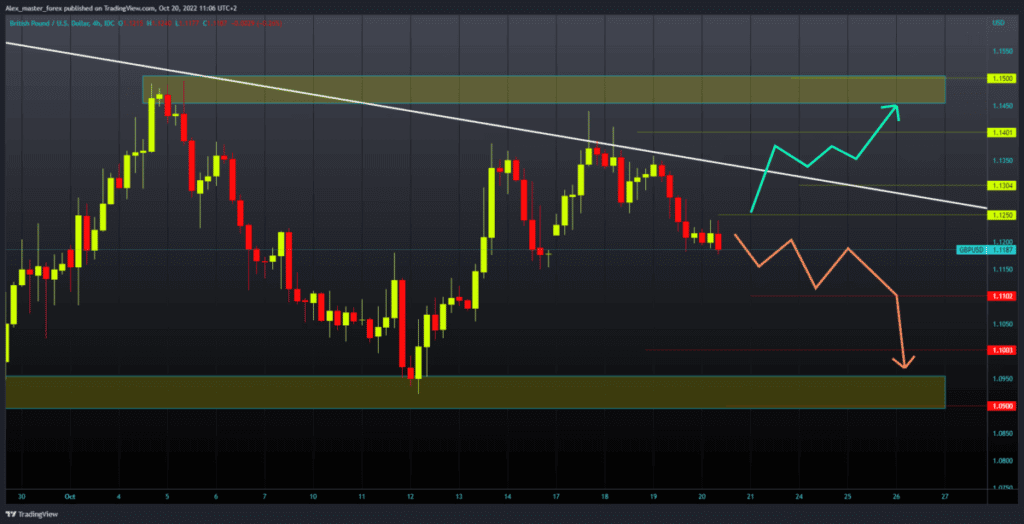

GBPUSD chart analysis

During the Asian trading session, the pound was held around the 1.12000 level. Yesterday’s inflation data of 10.1% showed that inflation is at a 40-year high and that the British economy is not on the right track. There are increasing chances that the pound will continue to slide and record new minimums.

We need a negative consolidation and a further pullback below the 1.12000 level to continue the bearish option. Potential lower targets are 1.11000, 1.10000, and 1.09000, last week’s low. For a bullish option, we need a positive consolidation and a move toward the 1.12500 level. Afterward, we must try to hold on there and continue towards the 1.13000 level. Additional resistance in this zone is in the upper trend line. Potential higher targets are 1.14000 and 1.15000 levels.

Market overview

Inflation in the Eurozone rose to a record high level. Harmonized inflation rose to 9.9% in September, slightly below the estimate of 10.0%. In the previous month, the inflation rate was 9.1%. Among the four components of inflation, energy prices recorded the highest annual growth of over 40%.