EURUSD and GBPUSD: Struggle Is Real

- During the Asian session, the euro struggled to stay above the 0.95500 level.

- And today, the pound continues to slide to the bearish side.

- The Bank of England announced this morning that it will buy enough long-term government bonds as needed between today and October 14 to stabilize financial markets.

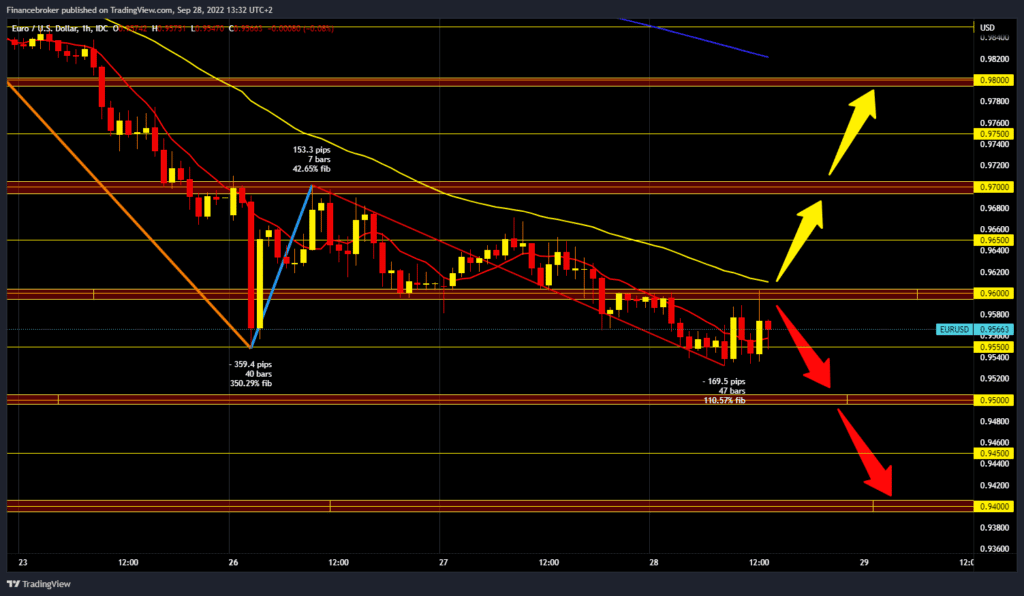

EURUSD chart analysis

During the Asian session, the euro struggled to stay above the 0.95500 level. Then, the euro jumped to the 0.96000 level in the previous hour but immediately retreated to its initial position. Bearish pressure is still very present, and we could see a further decline in the euro. We need a negative consolidation and a drop below the 0.95500 support level to continue the bearish option. The following important level is 0.95000. We need a positive consolidation and growth above the 0.96000 level for a bullish option. Additional resistance at that level is in the MA50 moving average. A break of the euro above would be of great benefit to us because the pair would form a better bottom from which the recovery could continue. Potential higher targets are 0.96500 and 0.97000 levels.

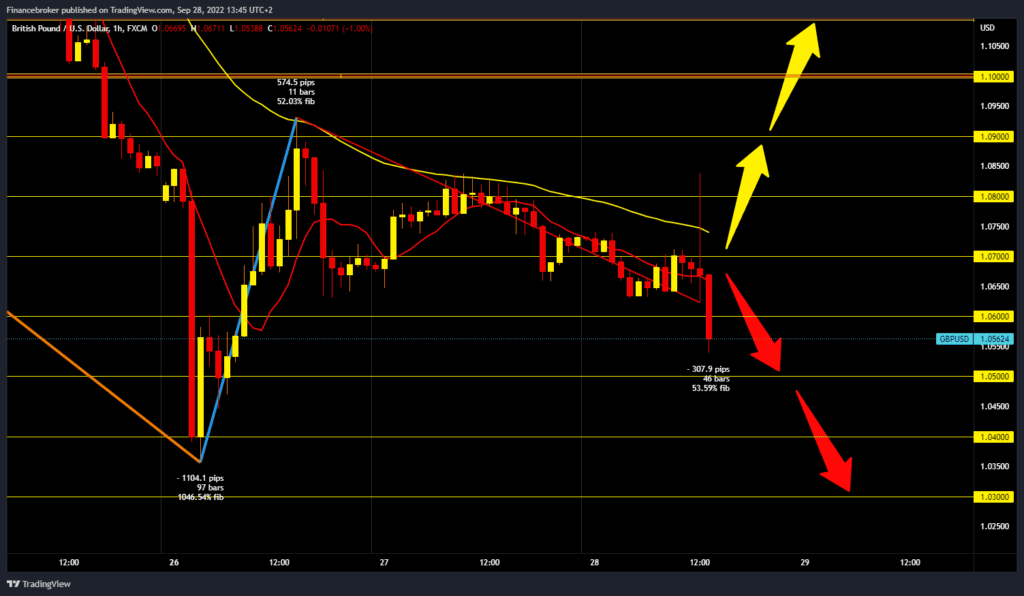

GBPUSD chart analysis

And today, the pound continues to slide to the bearish side. It is now at the 1.05700 level, and we are looking towards the previous low at the 1.03500 level. Potential support for the pair GBPUSD could be found at the 1.05000 level because two days ago, we managed to consolidate at that point and saw a bullish recovery up to the 1.09000 level. For a bullish option, we need a new positive consolidation and a return above the 1.07000 level. Then we need to stay at that level in order to move from the following consolidation to a bullish impulse and continue the recovery. In the zone around 1.07500, we have resistance in the MA50 moving average, and we need to move above it to gain its support. Potential higher targets are yesterday’s resistance at 1.08000 and the 1.09000 high from the day before.

Market Overview

The Bank of England announced this morning that it will buy enough long-term government bonds as needed between today and October 14 to stabilize financial markets. The BoE also said it would delay the start of a program to sell its $891 billion in government bonds.