EURUSD and GBPUSD: Rapid recovery

- Yesterday, the euro tested support at the 1.04000 level, after which we see a rapid recovery to the 1.06000 level.

- After forming its new lower low at 1.19330 on Tuesday, the recovery began over the previous two days.

- Inflation in the eurozone accelerated to a new record level in May, spurred by a jump in energy prices, final Eurostat data showed on Friday.

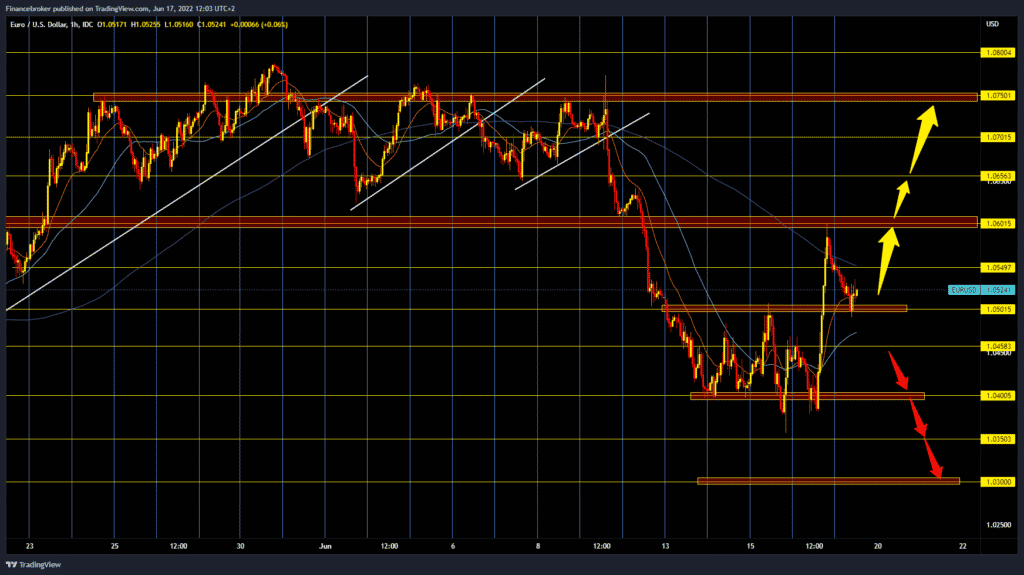

EURUSD chart analysis

Yesterday, the euro tested support at the 1.04000 level, after which we see a rapid recovery to the 1.06000 level. A new pullback from that level soon followed, and the pair found themselves at the 1.05000 level of the support zone. Now we have to monitor the situation to see if the euro will break or manage to find support there and start a new recovery. For the bullish option, we need a new positive consolidation and a return to another 1.06000 level testing. A break above 1.06000 would take us back to the zone of the previous movement. Our potential targets are 1.06500, 1.07000, and 1.07500 levels. We need a negative consolidation and a break below the 1.05000 level for the bearish option. We then look at support at the 1.04000 level as potential support. Potential lower support levels are 1.03500 and 1.03000 levels.

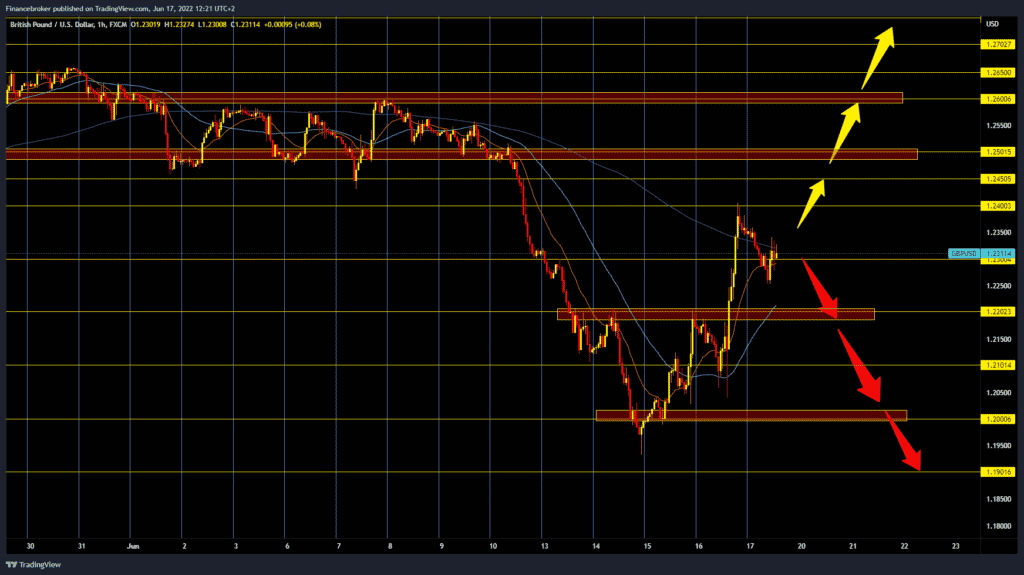

GBPUSD chart analysis

After forming its new lower low at 1.19330 on Tuesday, the recovery began over the previous two days. First, the pound finds support at 1.20000, then at 1.21000 level and makes a jump to 1.24000 level last night. After that, during the Asian trading session, we have a pullback to the 1.22500 level, where we find new support and embark on another bullish attempt. We need positive consolidation and a break above the 1.24000 level to continue the bullish option. After that, the pound could try to test the 1.25000 level. Potential higher targets are 1.25500 and 1.26000 levels. We need a continuation of the negative consolidation from last night to the 1.22000 level for the bearish option. The fall of GBPUSD below this level could once again bring us down to a new test of this year’s low.

Market overview

Eurozone inflation hits record high

Inflation in the eurozone accelerated to a new record level in May, spurred by a jump in energy prices, final Eurostat data showed on Friday.

Inflation rose to 8.1 % in May, according to current estimates, from 7.4 % in April. A year earlier, the rate was 2.0 %.

Core inflation, excluding energy, food, alcohol and tobacco, rose to 3.8 % from 3.5 % in the previous month. The base rate was also in line with the estimate published on 31 May.

Earlier this month, the European Central Bank said it intended to raise key rates by a quarter of a point in July and hinted at another increase in September if the medium-term inflation outlook continues or deteriorates.