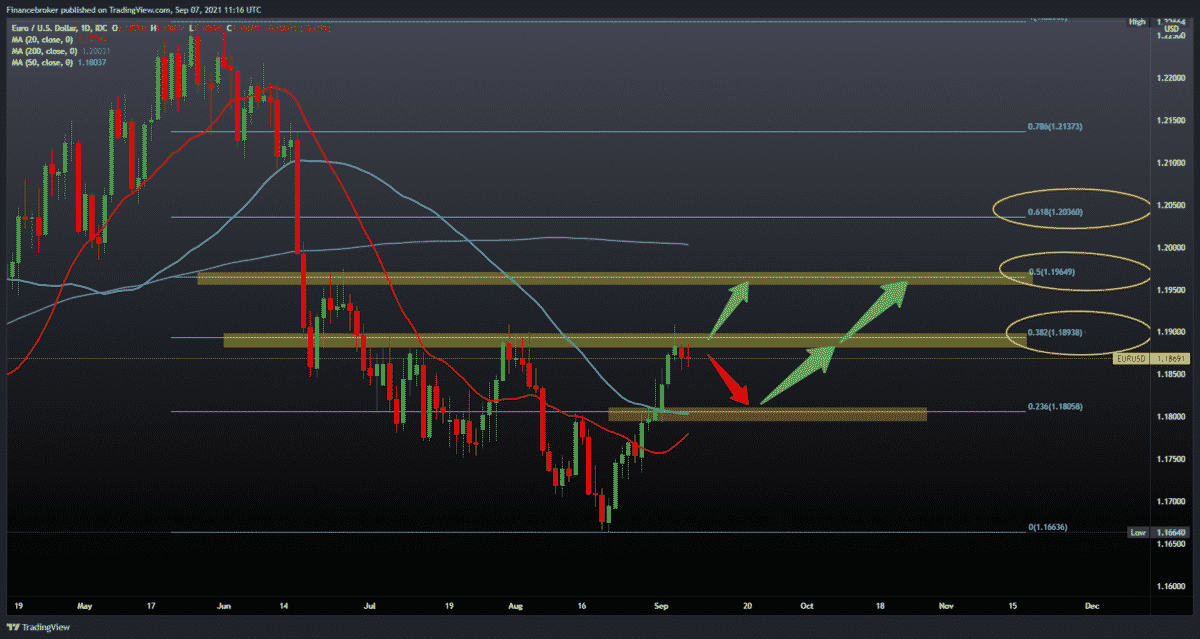

EURUSD and GBPUSD pullback due to strong dollar

Looking at the chart on the daily time frame, we see that the EURUSD pair is stable today. After yesterday’s short pull from 1.19100 to 1.18500, we are now at 1.18750. For a further bullish trend, we need a jump above 38.2% Fibonacci levels to 1.18960. Below above, our next resistance is at 50.0% Fibonacci level at 1.19650, while above that level, our next resistance is in the 200-day moving average. For the bearish scenario, we need a further pull towards the 23.6% Fibonacci level at 1.18050. There we will have additional support in the 20-day and 50-day moving average.

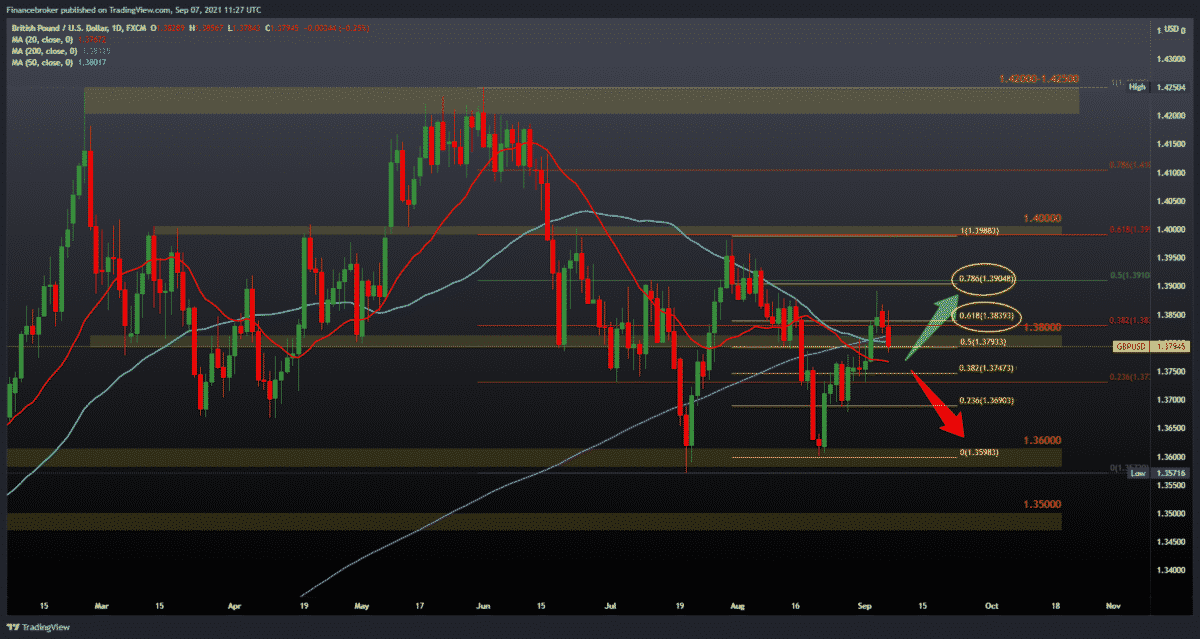

GBPUSD chart analysis

Looking at the chart on the daily time frame, we see that the pair is recording losses for the second day in a row and again falls below the 200-day moving average and 61.8% Fibonacci level to 1,38400. Our potential support could be a 20-day moving average and 38.2% Fibonacci level at 1.37500. If support fails, we continue down with potential testing of previous lows in the 1.35750-1.36000 zone. To continue on the bullish side, we need a positive consolidation above 1.38400 in order to expect further growth of GBPUSD towards the previous high to 1.40000.

Market overview

German economic confidence slowed for the fourth month in a row in September. This is because of the global shortage of chips and the lack of stocks of construction materials, burdened profit expectations, the results of the research of the Center for European Economic Research ZEV – Leibniz showed on Tuesday.

ZEV’s economic sentiment indicator for Germany fell more than expected to 26.5 in September from 40.4 in August. The expected level was 30.0.

The current results suggest that in the next six months, economic growth will be only slightly higher than the current rate, the institute said.

On the other hand, the current situation index increased by 2.6 points to 31.9 in September. The stock indicator has been steadily rising since February 2021. However, the reading was below economists’ expectations of 34.0.

Although financial market experts expect further improvements in the economic situation in the next six months, the expected size and dynamics of improvements have been significantly reduced, said ZEV President Achim Wambach.

Wambach added that the global shortage of chips in the automotive sector and the shortage of construction materials in the construction sector had caused a significant reduction in profit expectations in these sectors. This has a negative impact on economic expectations.

Further, the research showed that economic confidence in the eurozone also weakened for the fourth month in a row in September. The corresponding index fell by 11.6 points to 31.1.

In contrast, the indicator of the current economic situation rose by 7.9 points in September to a level of 22.5 points.

Conclusion

Inflation expectations continued to fall. The inflation rate in the Eurozone in September fell by 22.1 points to 20.1. Experts, therefore, expect inflation to fall in the next six months.

Annual house price inflation in the UK slowed further in August. Still, the average residential property price reached a record level, according to a survey by Lloyds Bank Halifax this morning.

The house price index rose 7.1 percent from last year after increasing 7.6 percent in the previous month, said IHS Markit, which publishes the results of the Halifax survey.

The annual rate has been declining every month since it peaked at 9.6 percent in May. The last increase was the least in the last five months.

-

Support

-

Platform

-

Spread

-

Trading Instrument