EURUSD and GBPUSD: Passed The Level

- During the Asian session, the euro rose against the dollar.

- During the Asian session, the British pound consolidated after withdrawing yesterday against the dollar.

- Australia’s unemployment rate fell to 3.9% in April.

- The value of orders for basic machines in Japan increased by 7.6% in March.

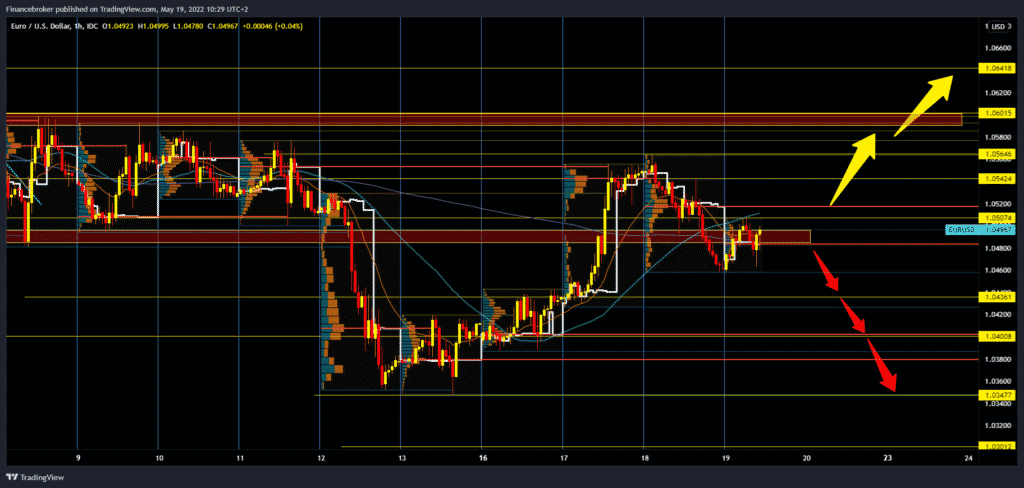

EURUSD chart analysis

During the Asian session, the euro rose against the dollar. Data on inflation in the euro area in April showed that it grew slightly slower than expected. It showed 7.4% year on year; expectations were 7.5%. Positive data on retail sales in the United States in April from yesterday left a positive mark on the dollar. The euro is exchanged for 1.04800 dollars, representing the strengthening of the common European currency by 0.18% since the beginning of trading tonight. Pair EURUSD found support at 1.04600 this morning, after which it started to recover. Today’s resistance is at the 1.05075 level, and we need a break above to continue the euro’s recovery.

Our potential bullish targets are 1.05420 and 1.05646 levels. Above these levels, a rise in the euro would significantly increase optimism for a longer EURUSD recovery. We need a negative consolidation and a break below 1.04600 levels for the bearish option. After that, we can expect to continue to withdraw to lower levels of support. Today’s potential bearish targets are 1.04360 and 1.04000 levels.

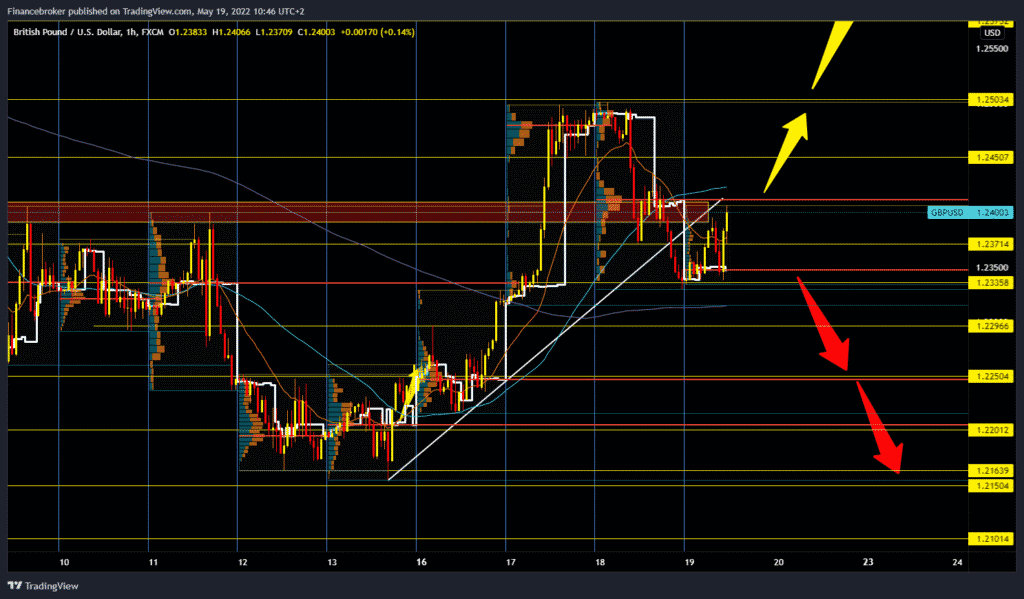

GBPUSD chart analysis

During the Asian session, the British pound consolidated after withdrawing yesterday against the dollar. It was announced yesterday that price inflation in the U.K. in April was significantly lower than expected, which eased expectations from the very aggressive monetary policy of the Bank of England in the coming period. The tightening of the post-Brexit relationship between the U.K. and the E.U. regarding the status of Northern Ireland has affected the movement of this pair. This morning’s decline in ten-year U.S. bond yields helped the British pound recover.

The pound is exchanged for 1.24050 dollars, representing the British currency’s strengthening by 0.53% since the beginning of trading tonight. For the bullish option, we need a GBPUSD break above 1.24250, an additional boost we would get in the MA50 moving average. Our potential bullish targets are 1.24500 and 1.25000 levels. We need negative consolidation and withdrawal of the pound below 1.23500 levels for the bearish option. After that, we could see a further pullback to lower levels of support. Our potential bearish targets today are 1.23350, 1.23000, and 1.22500 levels.

Market overview

Australia’s unemployment rate

Australia’s unemployment rate fell to 3.9% in April, the Australian Bureau of Statistics announced on Thursday. The data aligned with expectations and decreased from 4.0% in March.

The Australian economy added only 4,000 jobs last month. This figure is far below the forecast of 30,000 jobs, after an increase of 17,900 jobs in the previous month.

Japan Core Machine Orders

The value of orders for basic machines in Japan increased by 7.6% in March compared to the previous year; it was announced early this morning and amounted to 869.5 billion yen. That exceeded forecasts by 3.7% and rose from 4.3% in February.

On a monthly basis, orders for basic machines jumped by 7.1%, also above expectations by 3.7% after a decrease of 9.8% in the previous month.