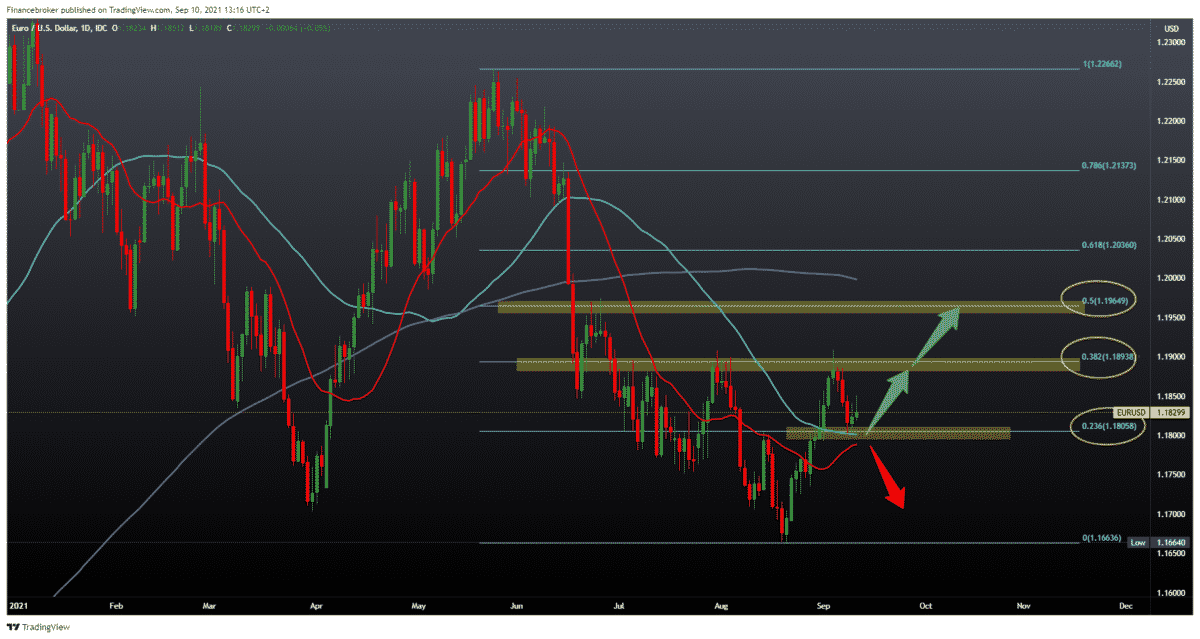

EURUSD, GBPUSD potential for recovery

Looking at the chart on the daily time frame, we see that even today, the EURUSD pair continues with a further recovery to the current 1.18300. For now, we have support at 23.6% Fibonacci level in both the 20-day and 50-day moving averages, which can give us the strength to climb to the next Fibonacci level at 38.2% at 1.18940. A further break above us can take us up to 50.0% Fibonacci level to 1.19650, where we can face the next resistance. This position coincides with the 200-day moving average. For a potentially bearish scenario, we need a break below the moving averages, and after that, we go down to the previous low to 1.16640.

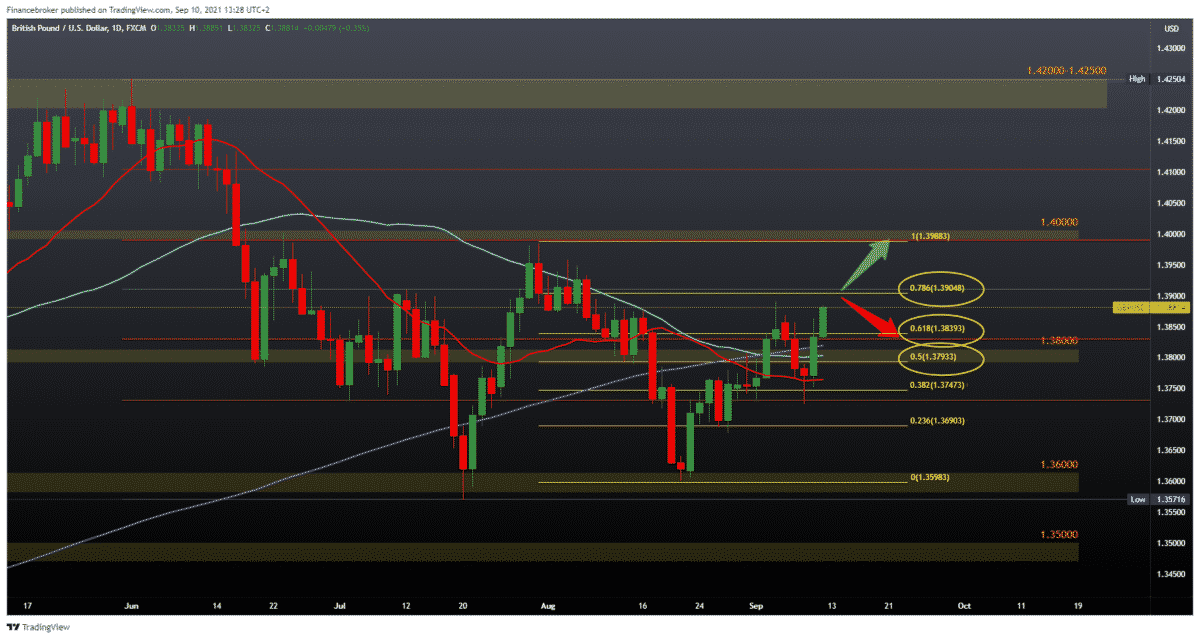

GBPUSD chart analysis

Looking at the chart on the daily time frame, we see that the pound is already gaining gains on the second day. We managed to climb above the 200-day moving cut and gain stronger support for the potential continuation of the bullish trend. If the price continues in the current direction, we will soon test the 78.6% Fibonacci level at 1.39000, and the way of consolidation around that level will show us whether we climb to the previous high at 1.40000 or return to the zone around 1.36000. For the bearish scenario, we need a withdrawal below 50.0% Fibonacci levels and a 50-day and 200-day moving average, after which we are looking for potential first support in the 1.37500-1.38000 zone. For now, we do not have a lower low on the chart, and we expect the bullish trend to continue.

Market overview

IN JULY, the UK economy recorded weak growth as production remained the same in services and further declined in construction due to lack of supply. Data from the Bureau of National Statistics showed on Friday.

Gross domestic product rose 0.1 percent in July from June when the economy grew 1 percent. This was also slower than economists had predicted growth of 0.6 percent.

Although the economy grew for the sixth month in a row, production remained 2.1 percent below pre-pandemic coronavirus levels.

In the three months to July, GDP grew 3.6 percent, largely due to the performance of the services sector. However, the expansion was also weaker than the expected rate of 3.8 percent.

After many months during which the economy grew strongly, compensating for a large part of the lost soil due to the pandemic, there was a small growth in July, said Jonathan Athov, the deputy national statistician of the ONS for economic statistics.

The rise in COVID-19 cases and the shortage of products/labor are likely behind the stalemate in the UK economy’s recovery in July, said Paul Dales, an economist at Capital Economics. But most of the downtime due to lack of products and labor will be temporary.

With the announcement of the CPI next week, which will reveal a jump in inflation from 2.0 percent to about 3.1 percent, there is a breath of stagflation in the air, the economist added.

On the production side, the performance of services remained largely the same in July, after rising 1.5 percent in June.

Industrial production rose 1.2 percent in July and was a major contributor to GDP growth, spurred by the reopening of the oil field production facility. Mining production rose 21.9 percent, while production remained up from a 0.2 percent increase in June.

Construction was contracted for the fourth consecutive month, with production falling by 1.6 percent.

On an annual basis, industrial production rose 3.8 percent in July but weaker than the growth of 8.3 percent in June. Similarly, the increase in production in production was reduced to 6 percent from 13.9 percent.

-

Support

-

Platform

-

Spread

-

Trading Instrument