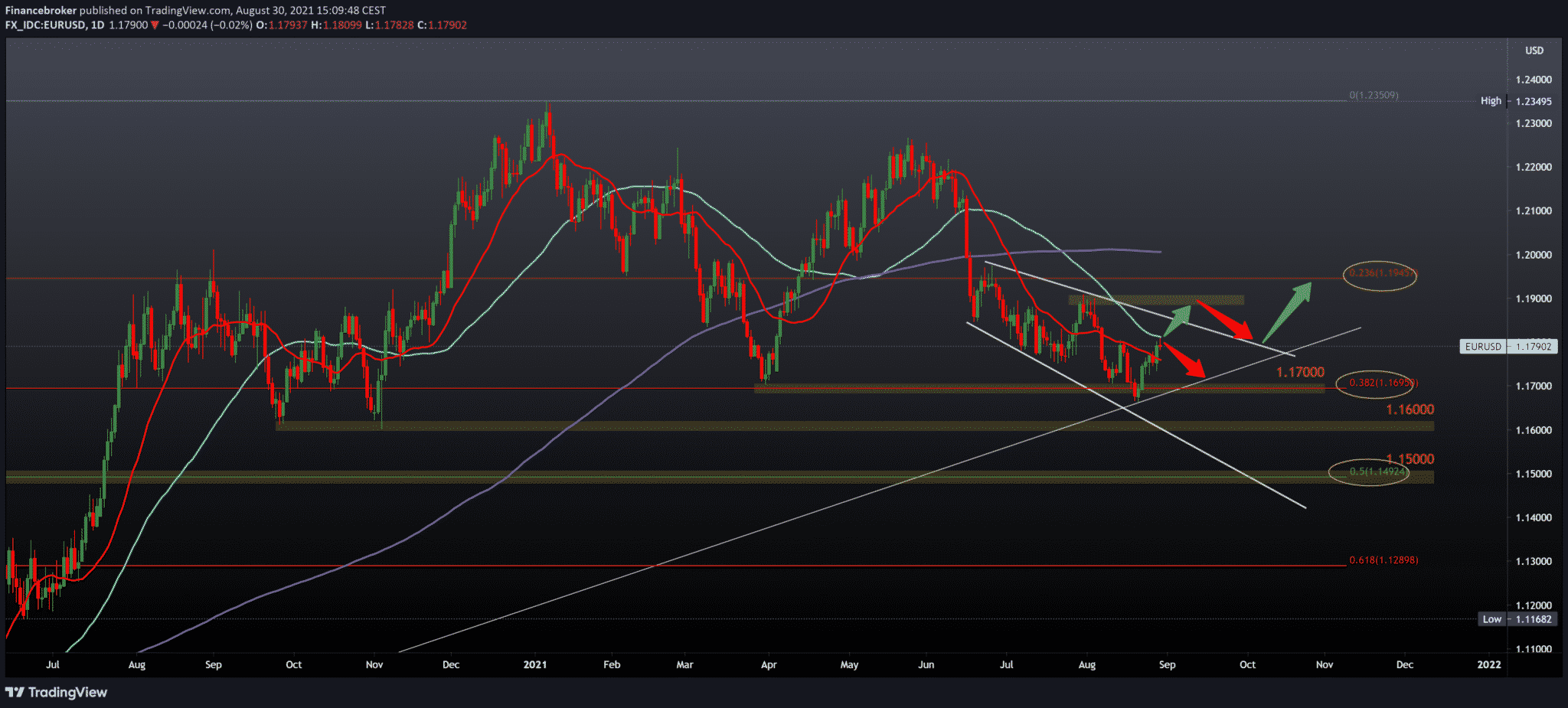

EURUSD and GBPUSD daily chart view

Looking at the daily time frame chart, we see that the EURUSD pair encounters current resistance at the 50-day moving average at 1.18000. To continue on the bullish side, we need a break above to climb to the next level at 1.19000, the site of the previous resistance in early August. To continue the bearish declining consolidation, we need a negative set of candlesticks on the chart to get a signal for a further drop in EURUSD nan new testing of 38.2% Fibonacci levels to 1.16950.

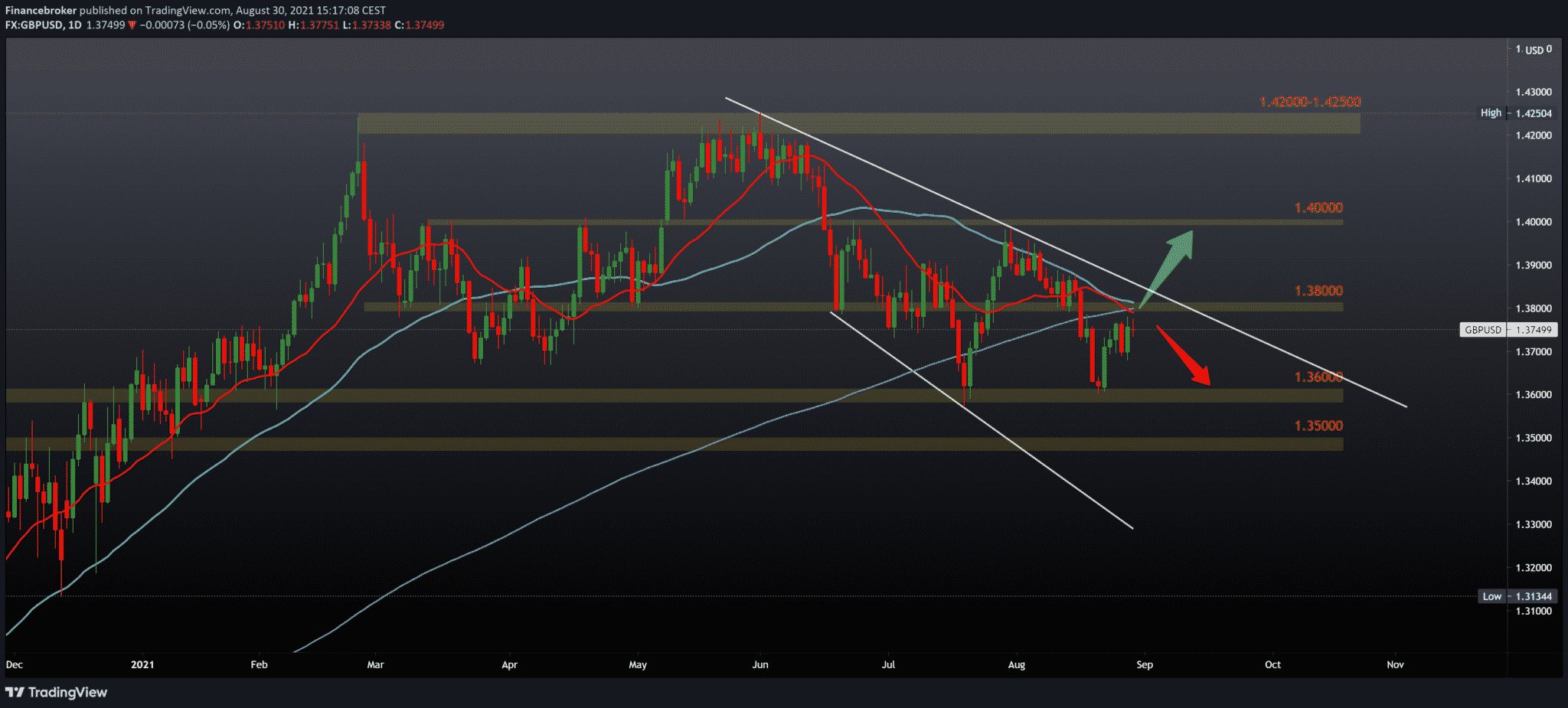

GBPUSD chart analysis

Looking at the chart on the daily time frame, we see that GBPUSD is still consolidating around 1.37500 today while moving averages are still pressing above us. The 200-day moving average is crucial to us. We can expect the pair to climb to 1.38000 first to test both the 20-day and 50-day moving averages, and after that, we are more likely to see the price continue to fall to 1.36000 and perhaps make a new lower low to 1.35000. For the bullish trend, we need a break above this above the resistance zone and the upper trend line, and that would be a sign that we can expect the pair to climb up to 1.40000 psychological level, where we were at the end of June.

Market overview

Inflation in Germany accelerated in August to its highest level since 2008 due to energy prices; preliminary Destatis data showed on Monday.

Consumer price inflation rose to 3.9 percent in August, as expected, from 3.8 percent in July.

EU-harmonized inflation rose to 3.4 percent from 3.1 percent a month ago. The annual HICP rate also met economists’ expectations. The final data for August is due on September 10.

Inflation of 3.4 percent was the highest since 2008.

The consumer price index remained unchanged on a monthly basis, while a price increase of 0.1 percent was expected. The HICP rose 0.1 percent in August, as economists expected.

Switzerland’s economic sentiment weakened for the third month in a row and at a rapid pace in August, indicating that recovery from the pandemic will continue, albeit at a slower pace, according to the results of a survey conducted on Monday.

According to a monthly survey by the KOF Economic Institute, the economic barometer fell to 113.5 from 130.9 in July, revised from 129.8. Economists forecast a score of 125.0.

The reading remained well above the long-term average.

“Accordingly, the economic recovery from the consequences of the pandemic is expected to continue in the coming months,” KOF said.

The European Central Bank should consider the recent improvement in financing conditions in the debate on the future of its monthly purchases of pandemic-related assets, ECB policymaker Francois Villeroi de Galhau said on Monday.

The governor of the Bank of France, Villeroy said there was no urgency to decide on the future of the emergency purchase program in the event of a pandemic at the September ECB meeting because, unlike the US Federal Reserve, the ECB could adjust its monthly purchases according to financing conditions.

Villeroy said financing conditions in the eurozone have improved since the last ECB meeting in June. He also noted that the economies in France and the eurozone should return to the level before COVID in early 2022 or maybe earlier. There is no risk of permanently higher inflation at this stage.

-

Support

-

Platform

-

Spread

-

Trading Instrument