EURUSD and GBPUSD charts for April 01

- The euro is exchanged for 1.1055 dollars, which is a weakening of the common European currency by 0.06% since the beginning of trading tonight.

- The U.K. The Manufacturing Purchasing Managers Index (PMI) fell to 55.2 from 58.0 (February data); the forecast was 55.5. This kind of news will negatively affect the pound.

- The index reached another record high as the Russian invasion of Ukraine pushed fuel and natural gas prices to the highest level in history.

- Production growth in the UK is slowing to its lowest level in 13 months as production and new orders grew less than expected, while new export business fell for the second month in a row.

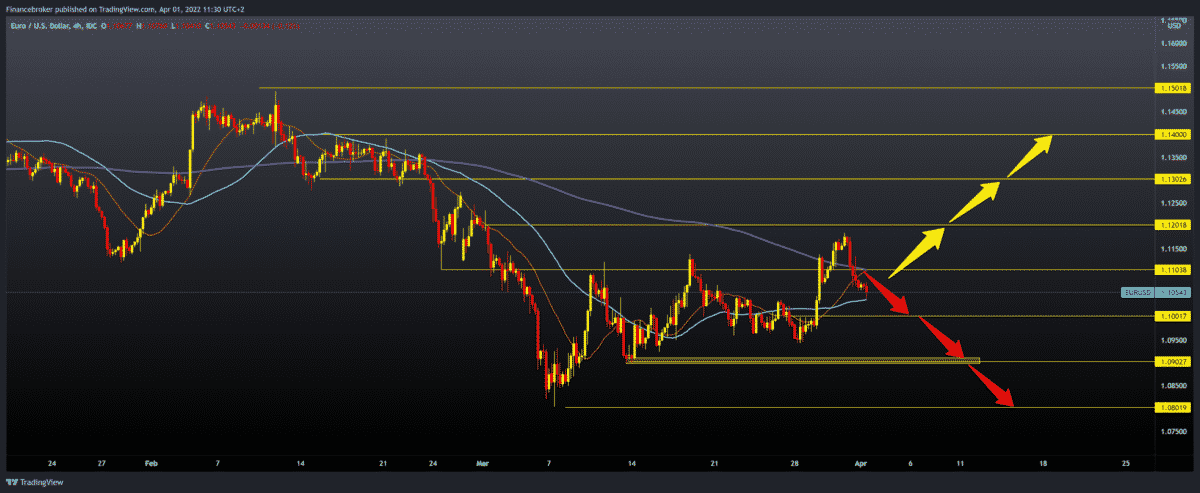

EURUSD chart analysis

During the Asian session, the euro is trying to consolidate after yesterday’s loss against the dollar. Optimism in the financial market has waned, strengthening the dollar as the main transaction safe-haven currency. The euro is exchanged for 1.1055 dollars, which is a weakening of the common European currency by 0.06% since the beginning of trading tonight. A report from the US labour market for March, Nonfarm Payrolls and Unemployment Rate, is expected later at 2:30 p.m. Inflation in the eurozone further accelerated to a new record level of 7.5 % from 5.9 % in February. This kind of news has not shaken the EURUSD pair so far, but it is definitely increasing the pressure on the euro. For the bearish option, we need a break below support at 1.10500. We have additional support at this level in the MA50 moving average. The next lower support is at the 1.10000 level, and then at the 1.09500 level, the previous low of March 28. If the bearish pressure increases, then we can expect further withdrawal, first to 1.09000 and then to 1.08000. We need a EURUSD jump above 1.11000 and above the MA200 moving average for the bullish option. This would form a new higher low on the chart, and based on that; we could expect the recovery to continue until the next resistance at 1.12000 and the formation of a new higher high on the chart.

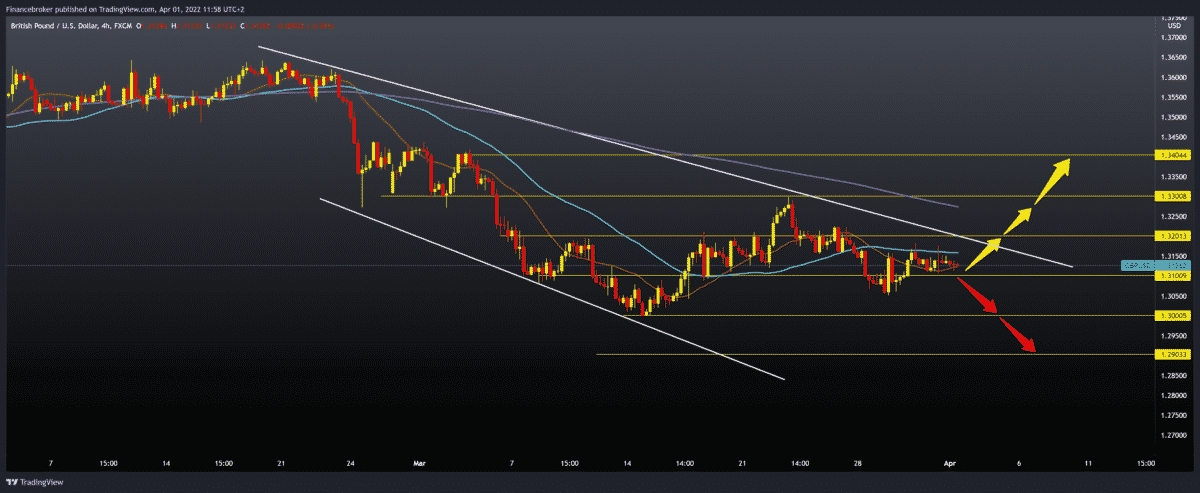

GBPUSD chart analysis

There was a significant slowdown in growth in the U.K. manufacturing sector in March, today’s report showed. New export deals have fallen in a row, with rates of production expansion and new orders easing. The slowdown in the production of consumer goods is particularly pronounced. The U.K. The Manufacturing Purchasing Managers Index (PMI) fell to 55.2 from 58.0 (February data); the forecast was 55.5. This kind of news will negatively affect the pound. For the bearish option, we need a break below 1.31000 with the target to test the previous low at 1.30500. If bearish pressure continues, we will probably see a continuation of the pullback to 1.30000, this year’s low. We need a jump above 1.32000, MA20 and MA50 moving averages for the bullish option. At that level, additional resistance is in our upper trend line. If the pair exceeds that zone, our next target is at the 1.33000 level, and an additional potential resistance is our MA200 moving average.

Market overview

Inflation in the Eurozone

Inflation in the eurozone accelerated further to a new record level in March, Eurostat data showed on Friday. Inflation rose to 7.5 % from 5.9 % in February. The rate was also above the 6.6 % forecast. Core inflation, which excludes energy, food, alcohol and tobacco, climbed to 3.0 % from 2.7 %.

The index reached another record high as the Russian invasion of Ukraine pushed fuel and natural gas prices to the highest level in history.

The decline in the UK manufacturing index

Production growth in the UK is slowing to its lowest level in 13 months as production and new orders grew less than expected, while new export business fell for the second month in a row. Constant supply shortages have led to escalating inflation.

Inflation is defined as a quantitative measure of the rate at which the average level of prices of goods and services in an economy or country increases over time.

Producers are affected by several obstacles at the same time, such as shortages of supply, greater caution among customers, escalating inflationary pressures, current Brexit factors and growing geopolitical tensions.

The inflation picture also shows no signs of reducing inflationary pressures, with already rising rates of increasing input costs and selling prices accelerating again.

-

Support

-

Platform

-

Spread

-

Trading Instrument