EURUSD and GBPUSD: bullish euphoria stopped

- During the Asian session, the euro strengthened against the dollar and peaked at 1.07675.

- During the Asian session, the pound advanced against the American currency, and as we approached the European session, the bullish euphoria literally stopped.

- China’s industrial profits fell in April as blockades disrupted production and higher raw material prices reduced margins.

- The Ministry of Trade announced that the real domestic product fell by 1.5 % in the first quarter compared to the previously reported decline of 1.4 %.

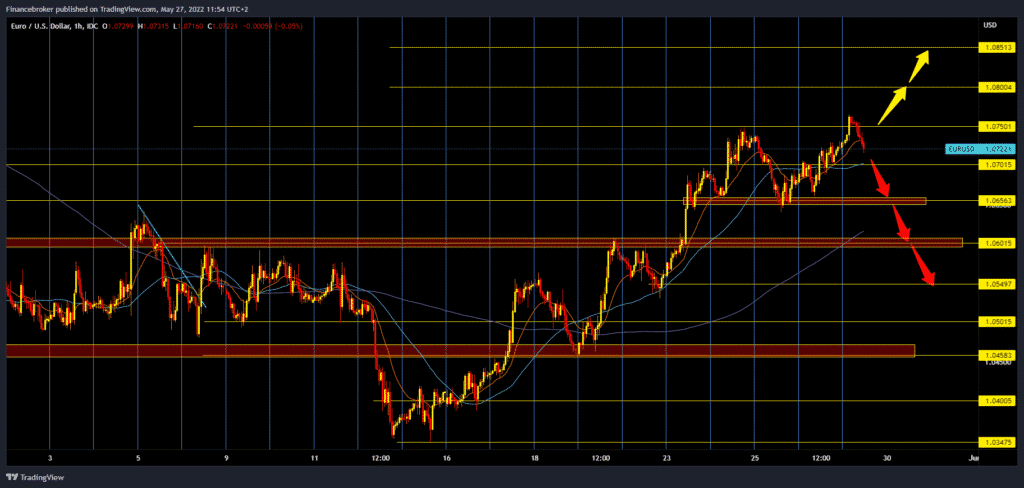

EURUSD chart analysis

During the Asian session, the euro strengthened against the dollar and peaked at 1.07675. The second reading of the US GDP showed a gloomier picture of the state of the American economy in the first quarter yesterday, and the day before yesterday’s notes from the last meeting of the Fed showed a slightly milder hawkish tone. As the European session began, the euro began to retreat and is now at the 1.07200 level: Since the start of trading last night, the euro has been down 0.08% against the dollar.

We need a new positive consolidation and a return to this morning’s level for the bullish option. After that, we need a breakthrough above the 1.07500 level. Our following potential bullish targets are 1.08000 and 1.08500 levels. We need a negative consolidation and a break below the 1.07000 level for the bearish option. Additional support at that level is the MA50 moving average. A fall below this support zone would bring us down to the 1.06500 level. And if the bearish pressure increases, our following potential targets are 1.06000, 1.05500 and 1.05000 levels.

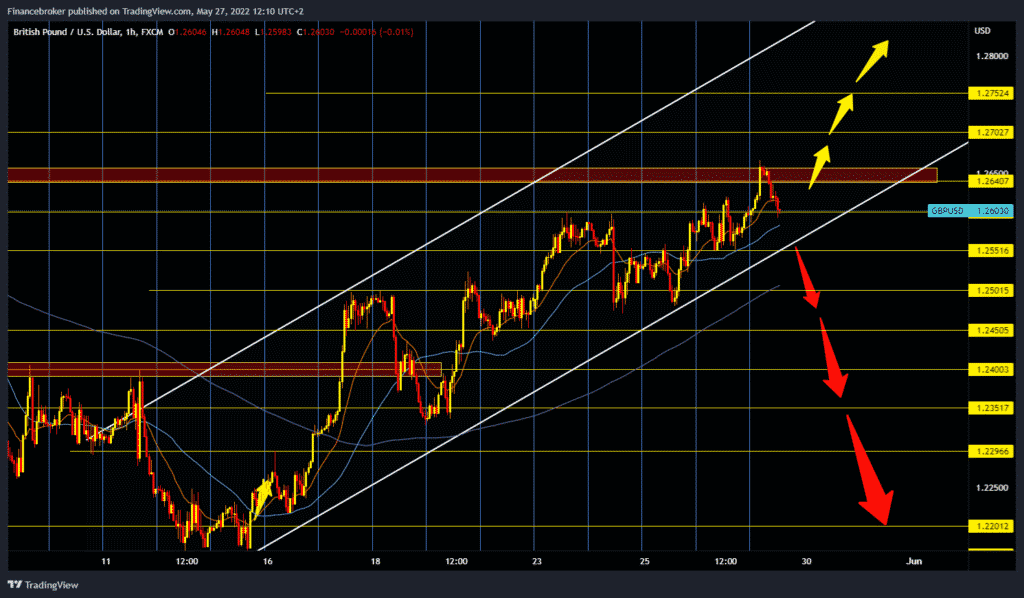

GBPUSD chart analysis

During the Asian session, the pound advanced against the American currency, and as we approached the European session, the bullish euphoria literally stopped. This morning’s maximum was stopped at 1.26670 level, followed by a retreat towards 1.26000 level. We need support at the 1.26000 level for the bullish option, after which we expect a new bullish impulse and a return to the previous resistance zone. If we climb above, our following targets are 1.27000, then 1.27500 levels. For the bearish option, we need the continuation of today’s negative consolidation towards the 1,22500 level. Additional support at that level is the bottom line of the channel. A price break below would direct us to the following targets 1.25000, 1.24500 and 1.24000 levels.

Market overview

Fall in Chinese industrial profits

China’s industrial profits fell in April as blockades disrupted production and higher raw material prices reduced margins, data from the National Bureau of Statistics showed.

In April, the industrial profit was lower by 8.5 % compared to the previous year. This was the biggest drop since the beginning of 2020.

From January to April, industrial profit grew by 3.5 %, slower than the increase of 8.5 % announced in the first quarter.

Data released earlier this month showed industrial production down 2.9 % year-on-year in April. Prolonged closure in Shanghai affected production activity and exports.

US GDP report

The Ministry of Trade announced that the real domestic product fell by 1.5 % in the first quarter compared to the previously reported decline of 1.4 %. Economists expected that the reduction in GDP would be revised to 1.3 %.

A slightly larger-than-expected decline came after GDP rose sharply by 6.9 % in the fourth quarter of 2021. The Commerce Department said the fall in GDP in the first quarter reflected declining private investment in inventories, exports, and government spending, along with increasing imports, which is a deduction in the calculation of GDP.

Details of the report continue to point to an economy with solid core strength that has shown resilience in the face of Omicron, long-term supply constraints, and high inflation, said Lydia Busur, a leading U.S. economist at Oxford Economics.