EUR/USD – pullback as an option

The Federal Reserve will leave its policy unchanged on Wednesday, but some expect it to provide a subtle hint of narrowing the bond-buying scheme later this year. With approximately 7.6 million unemployed and inflation, which could be labeled as temporary – or linked to reopening – the bank is likely to remain in place.

“After a bipartisan group of lawmakers concluded a $ 1.2 trillion compromise infrastructure agreement, reports suggest President Joe Biden could face opposition from his party. Any delay in spending is negative for the dollar because it reduces inflation expectations. Eurozone industrial production in Germany grew higher than expected in April, official data showed on Monday, suggesting that the recovery in the manufacturing sector is gradually accelerating.

Industrial production in the block reached 0.8% in months compared to the expected increase of 0.4% and the last by 0.4%.

On an annual basis, industrial production jumped an incredible 39.3% in April, compared to expected growth of 37.4% and 11.5% in March. Eurostat publishes industrial production. It shows the volume of production in industries such as factories and manufacturing. Uptrend is considered an inflationary situation that can predict rising interest rates. Usually, if there is a high industrial production growth, it can generate a positive feeling (or bullish) for the EUR. In contrast, low industrial production is seen as a negative feeling (or bearish).

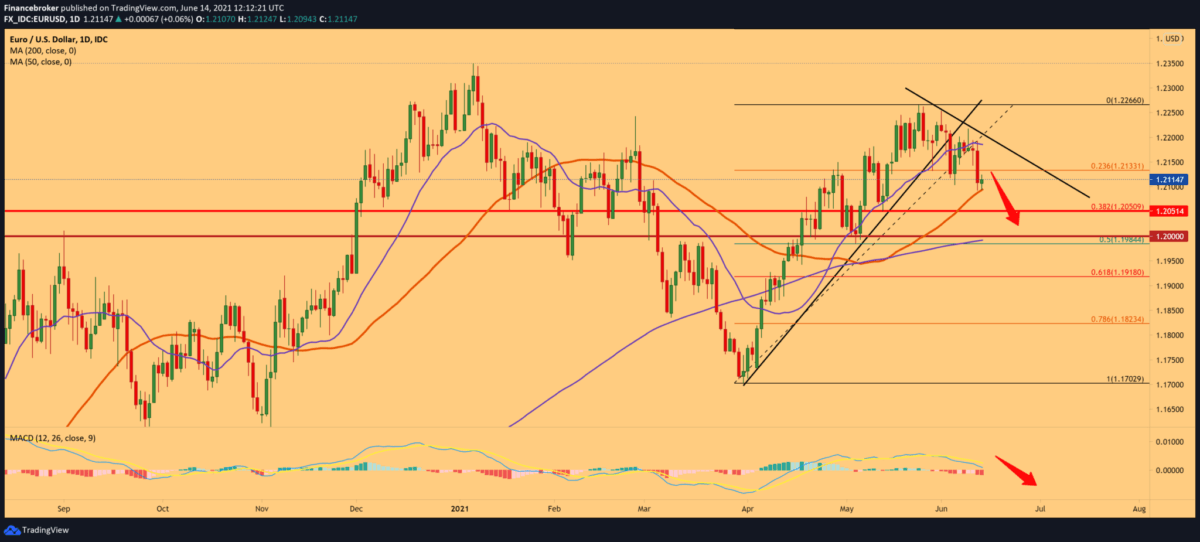

Looking at the chart on the daily time frame, we see that the EUR/USD currency pair is still pullback with a drop below 23.6% Fibonacci level to 1.21330. The dollar managed to consolidate, which affected this EUR/USD currency pair. Our bearish target is 38.2% Fibonacci level at 1.20500, while we currently have support at the moving average of MA50, and MA200 is at 1.20000 at 50.0% Fibonacci level. Today, the euro has progressed slightly, and if it continues, we can expect the EUR/USD currency pair to climb to the upper resistance line and the MA20. Following the MACD indicator, we are still in a bearish trend, and we can see this as a short-term consolidation.

-

Support

-

Platform

-

Spread

-

Trading Instrument