EUR/USD – Poor Outlook for the Euro

Even further, it will not be in the foreseeable future. And that means greater economic contraction or, at best, slow growth. On Sunday, Spain adopted tougher measures to fight the second wave of coronavirus, including a curfew and the declaration of a new state of emergency. The government has declared a state of emergency for 15 days and monitors the situation during that time. The curfew in Brussels will be extended, cultural and sports places will be closed. “The situation is dire. It cannot remain that way,” said Rudy Vervoort, the prime minister of the Brussels region, at a press conference. He called on people to support the new measures.

Another factor for the flight to the safe-haven dollar is the probable breakdown of fiscal stimulus talks. House Speaker Nancy Pelosi and White House Chief of Staff Mark Meadows were busy pointing the figure at each other over the weekend. With so little time until the elections, a deal always had little chance – but now markets seem to come to grips with it. Moreover, Senate Republicans are focused on confirming Amy Coney Barret to the Supreme Court and remain sceptical about the need for further stimulus. The upcoming US elections are also a reason for uncertainty and demand in dollars. Challenger Joe Biden continues to lead President Donald Trump, and Democrats can overturn the Senate.

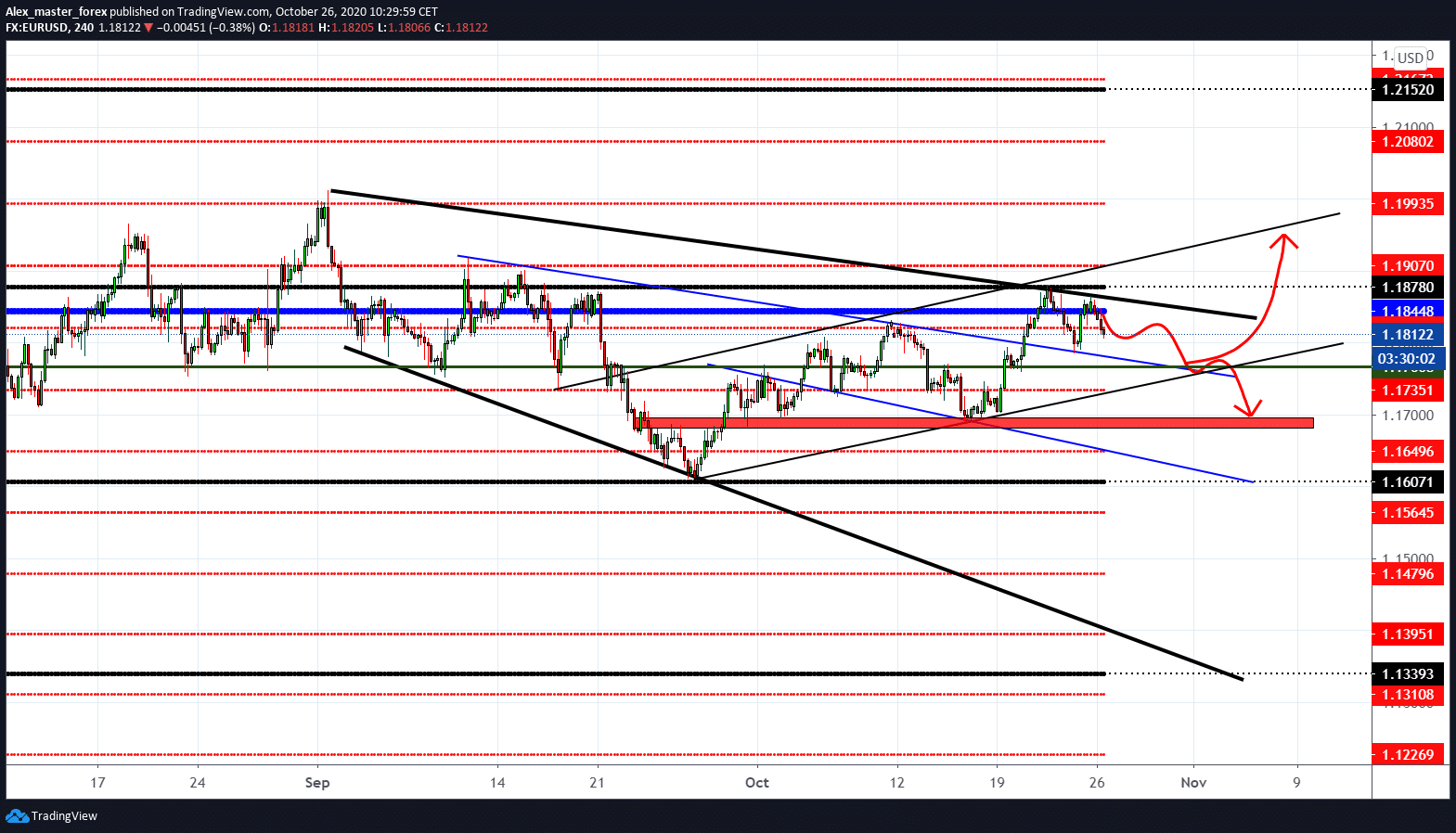

Investors favour such a “blue wave” that would enable adopting a generous package of incentives. Since the afternoon news from the American institutions, we have a New Home Sales report. The EU can ask for better support down around 1.17750.

-

Support

-

Platform

-

Spread

-

Trading Instrument