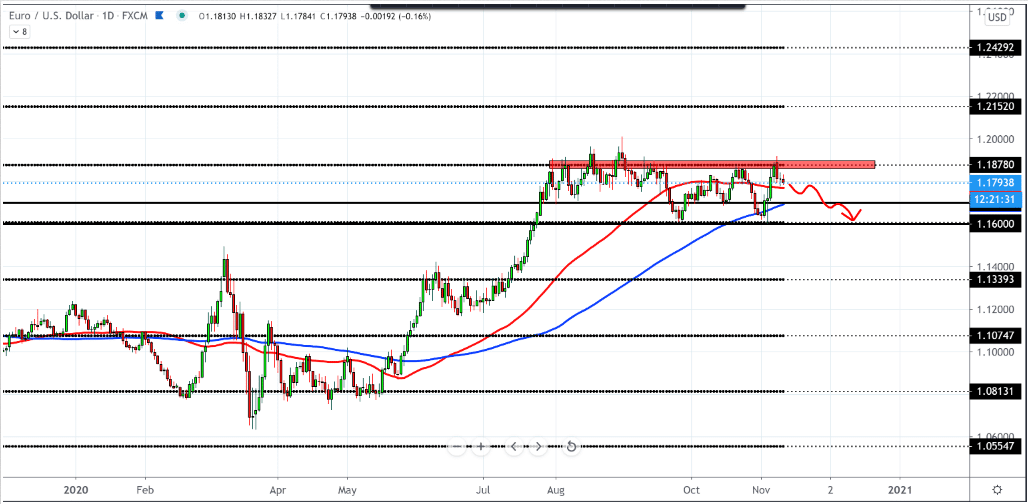

EUR/USD forecast for November 11, 2020

The Euro started this European session badly, and the EUR/USD pair fell below 1.18000, failed to break above 1.19000, and attack 1.20000. The USD regained a share last week after the Biden election and is likely to test the level of 93.00, while the dust has settled on the post-election positioning.

While the background may suggest fewer reasons to buy a safe haven, the market is looking at the euro in the long run and attending a meeting of the European Central Bank (ECB) and a statement from spokeswoman Christine Lagarde who will speak later in the day. She may comment on the news about the vaccine’s progress, but she will probably not give up her intention to expand the bond purchase scheme. Her focus may also shift to economic performance rather than politics.

The German ZEV index fell from 56.1 to 39 in November. This sharp deterioration was worse than expected and reflected concerns about a double recession, marking the start of a series of weaker economic reports that will prevent the currency.

The EUR/USD pair is still more likely to trade closer to 1.16 than 1.20. The US dollar failed to increase profits despite a positive day for returns and stocks.

Part of this has to do with comments from the president and CEO of the Federal Reserve Bank of Dallas. Robert Steven Kaplan is worried about the new lock and believes that the recovery will come only in 2021. Eric Rosengren, the president and CEO of the Federal Reserve Bank of Boston, feels that the economy needs a bigger fiscal and monetary stimulus, but when that package is implemented is still unknown, probably next year.

And experts predict that the new cases of the virus will exceed the number of newly infected and 200,000 in the United States, so the presidents of the central banks have many reasons for concern.

-

Support

-

Platform

-

Spread

-

Trading Instrument