EUR/USD forecast for March 5

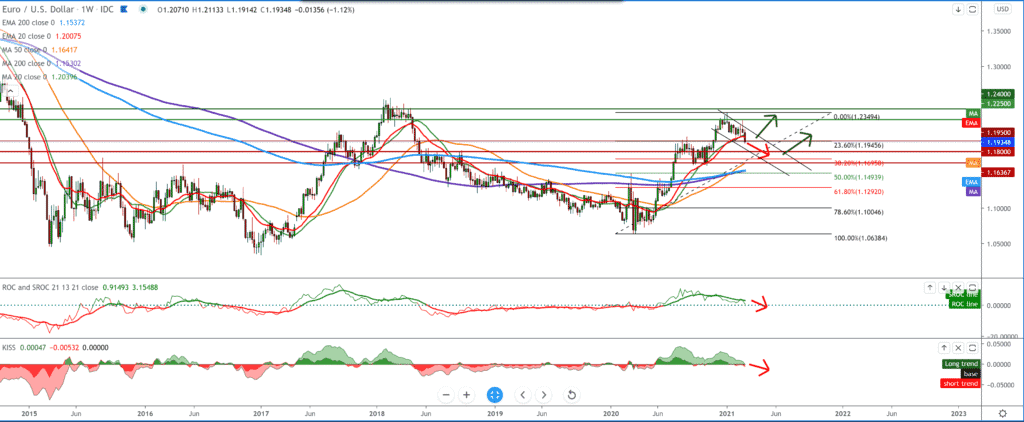

Looking at the graph on the weekly time frame, we see that the pair is now testing Fibonacci retracement level 23.6% at 1.19450, and that pair made a break below MA20 and EMA20. We last had testing of these two moving averages in early November 2020. We see that the pair, after a strong momentum last year, is now making a pullback. The dollar has started to strengthen since the beginning of this year and is stable for now. In the previous Fibonacci setting with the previous high, we bounced and continued up to higher levels. So even now, we can expect the pair to bounce again and continue up again towards the higher levels on the chart.

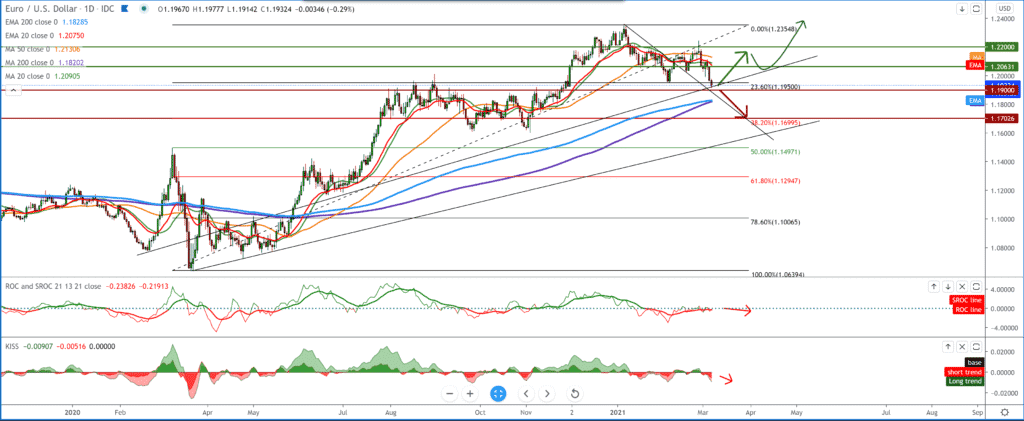

On the daily time frame, we see that the pair has fallen below the moving averages of MA20, EMA20, and MA50 and that MA200 and EMA200 are approaching better pair support on the chart. We also test Fibonacci retracement level 23.6% at 1.19450. A stronger break down below pushes the pair to 38.2% Fibonacci level at 1.17000; otherwise, we return to above 1.20000.

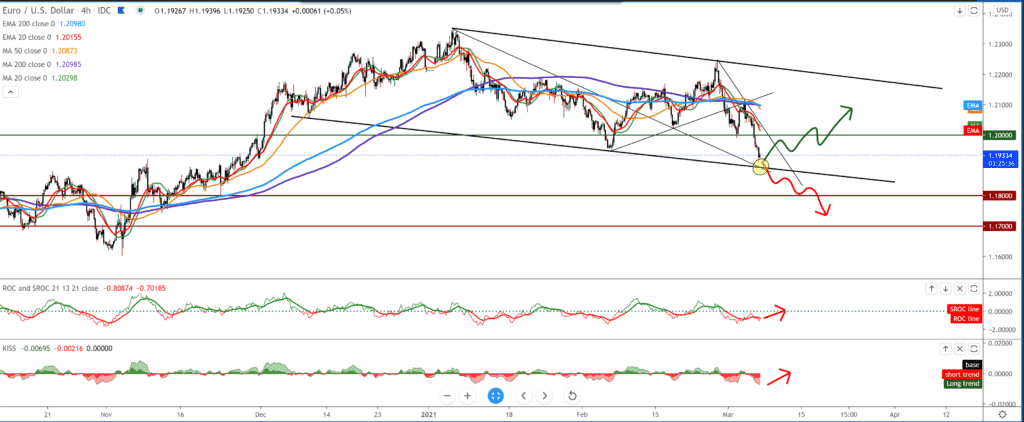

On the four-hour time frame, the pair forms a decedent channel and is now located on the channel’s bottom line. Such a line can be seen as a line of resistance of the vapor to falling towards lower levels. If we see a bounce up, we will pay attention to moving averages to see a break and a sequel to the bullish side. Otherwise, a drop below this line pushes us towards 1.18000 previous support levels.

From the economic news for this currency pair, we can single out the following: German factory orders grew more than expected in January, driven by foreign demand, Destatis data revealed on Friday. Factory orders rose 1.4 percent on a monthly basis in January, reversing a revised decline of 2.2 percent in the previous month. Orders were forecast to increase by 0.7 percent. On an annualized basis, factory orders’ growth slowed to 2.5 percent from 6.1 percent in the previous month. Federal Reserve Chairman Jerome Powell acknowledged that the reopening of the U.S. economy could lead to higher inflation but reiterated that the central bank would remain “patient” with monetary policy. to grow, to see how inflation will move through the basic effects, “Powell said in carefully monitored statements during the summit of The Wall Street Journal Jobs. “It could put pressure on prices to rise.” However, the head of the Fed said that he expects the growth of inflation to be “temporary,” noting that the acceleration of the annual inflation rate will largely reflect the comparison with the low prices seen a year ago. Powell stressed that there is “a lot of bases to cover” before price growth reaches a sustainable level above the Fed’s 2 percent target. The Fed recently hinted that interest rates would remain at almost zero levels until inflation is on track to moderately exceed 2 percent for some time. Investors have been following Powell’s comments closely after the recent rise in bond yields, which has raised concerns about inflation and the outlook for interest rates.

-

Support

-

Platform

-

Spread

-

Trading Instrument