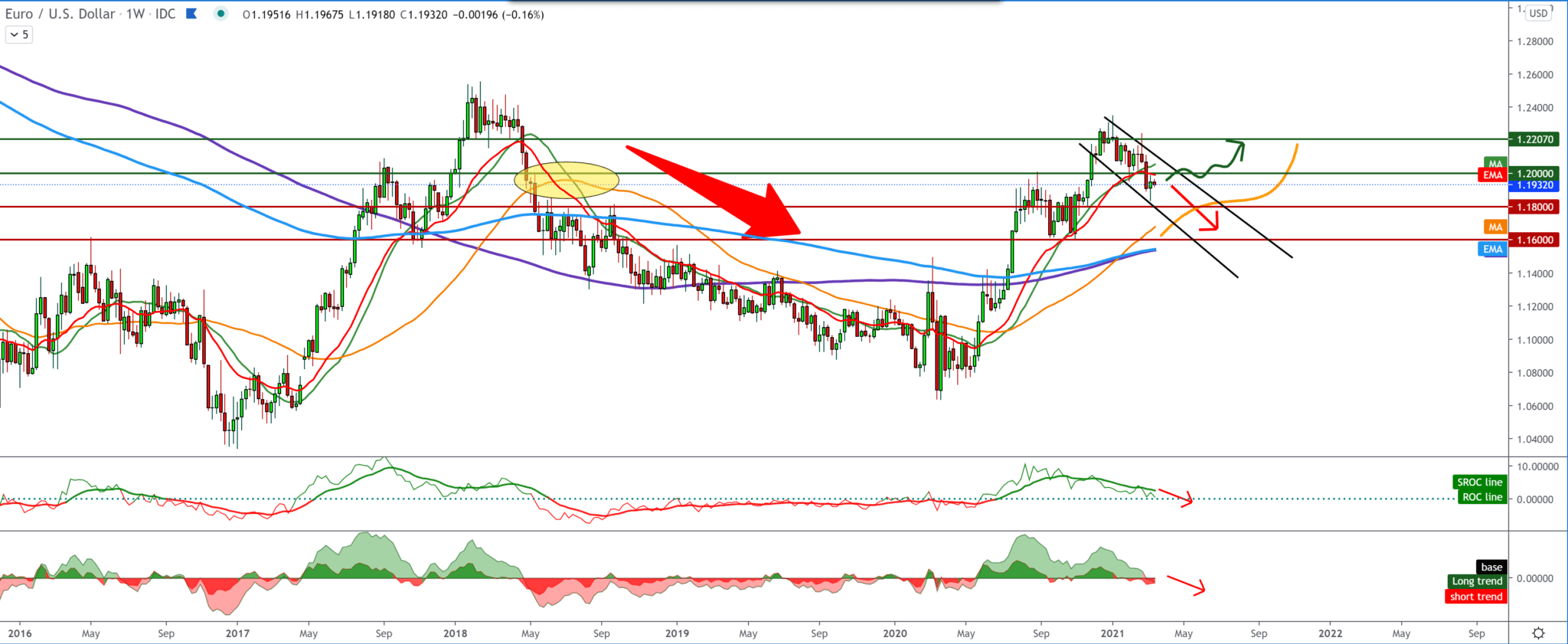

EUR/USD forecast for March 15, 2021

Looking at the chart on the weekly time frame, we see that the EUR/USD pair has fallen below the moving averages of MA20 and EMA20, forming a potential bearish trend in the next short term. We have dropped below the psychological level to 1.20000, and we are looking towards 1.18000; our target is MA50.

Here we are now is a very important place on the chart because it represents the place of the previous break and the continuation of the bullish trend. The only way to help the euro is to quickly adapt and implement the package of financial aid that the US government wants to distribute to citizens, which would reduce the dollar’s strength by the impact of the new money supply on financial flows.

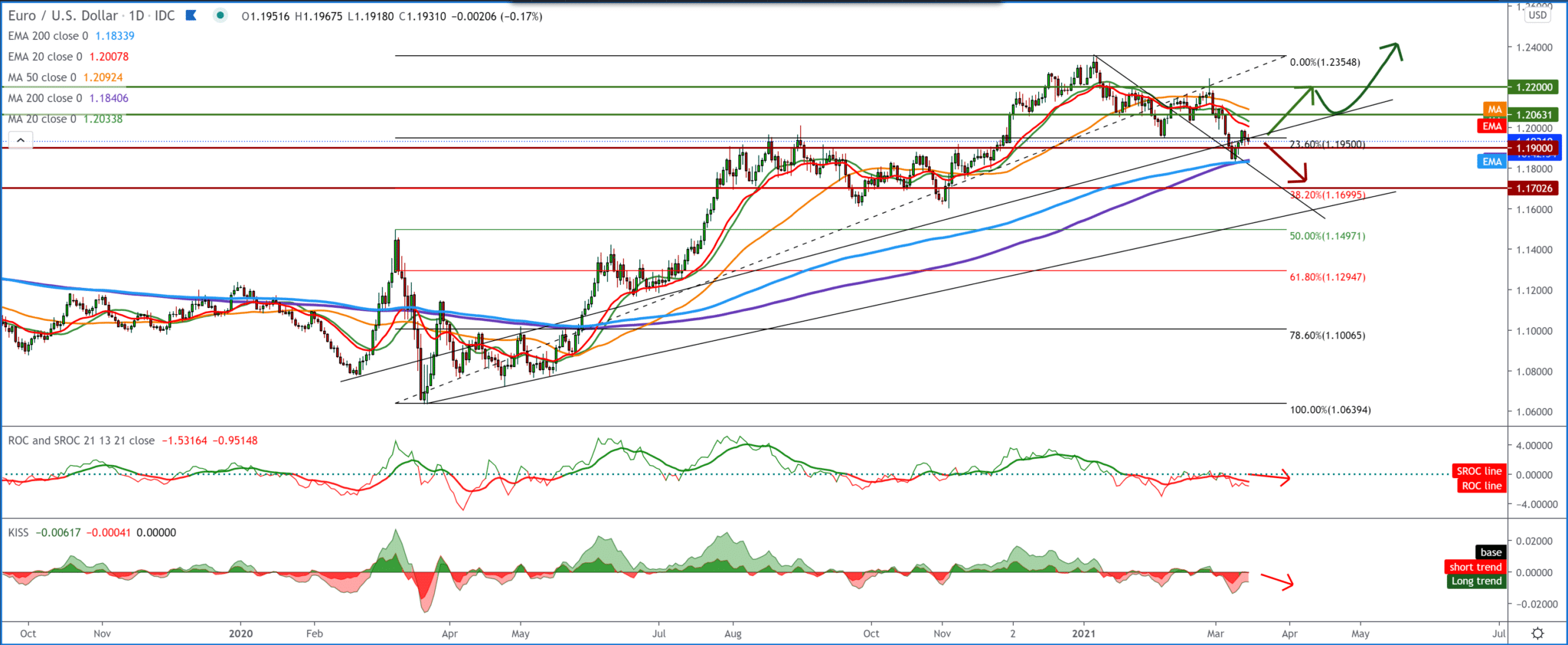

On the daily chart, we go that the pair EUR/USD has dropped below MA50 and will again test MA200 and EMA200 at 1.18200-1.18400. We can also use Fibonacci retracement levels to make it easier to predict potential supports on the chart. Based on that, the EUR/USD pair is currently testing a 23.6% Fibonacci level at 1.19500 and based on the look of the chart, and we can expect a potential break below by dropping closer to 38.2% Fibonacci level at 1.17000. To continue the bullish scenario, the EUR/USD pair should first return above the moving averages of MA20 and EMA20 by testing 1.20000 again, and only then can we think of levels around 1.22000.

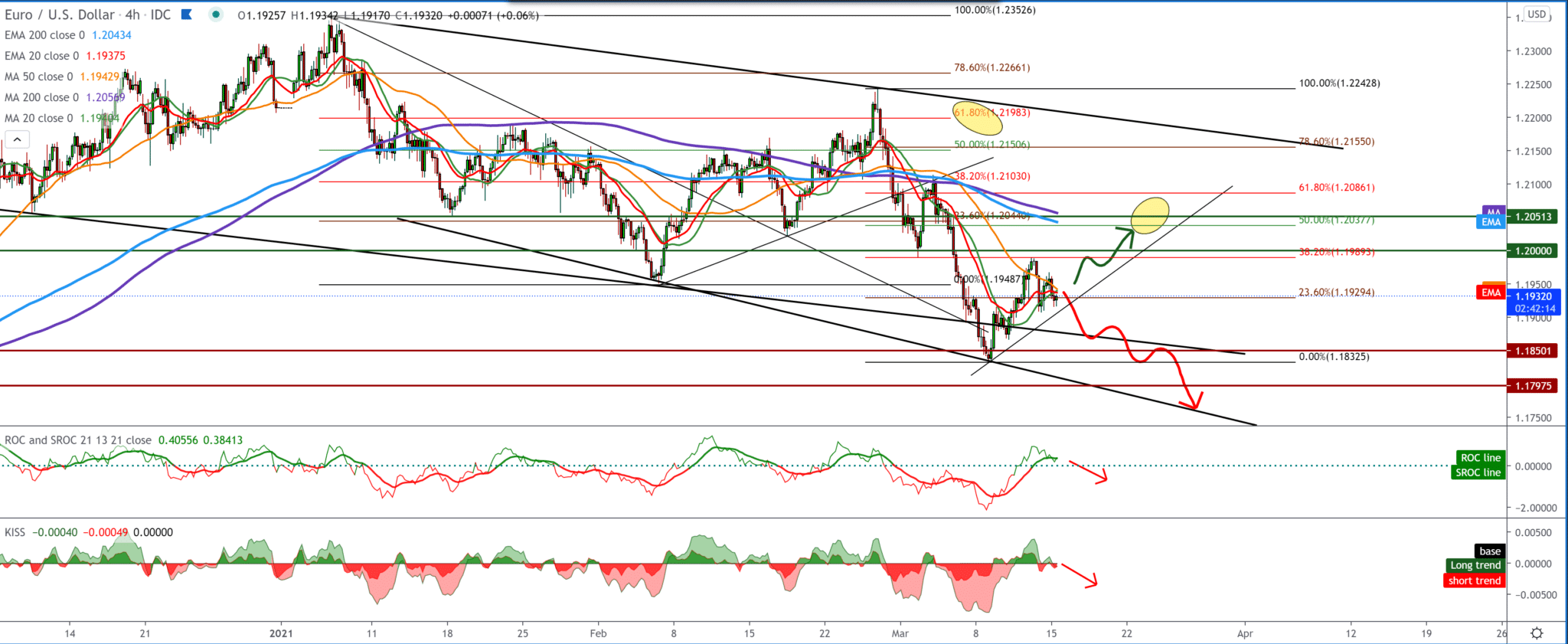

We see the EUR/USD pair moving in a descending channel bouncing off the bottom trend line on the four-hour time frame, making a pullback upwards directing the EUR/USD pair towards 1.20000. We see that the previous rejection was at a 61.8% level by setting the Fibonacci retracement level. There is again a probability that we see another rejection at the same Fibonacci level. For the bearish scenario, we look at if the EUR/USD pair reaches 1.20000, where we can expect potential resistance.

-

Support

-

Platform

-

Spread

-

Trading Instrument