EUR/USD Forecast for February 1, 2021

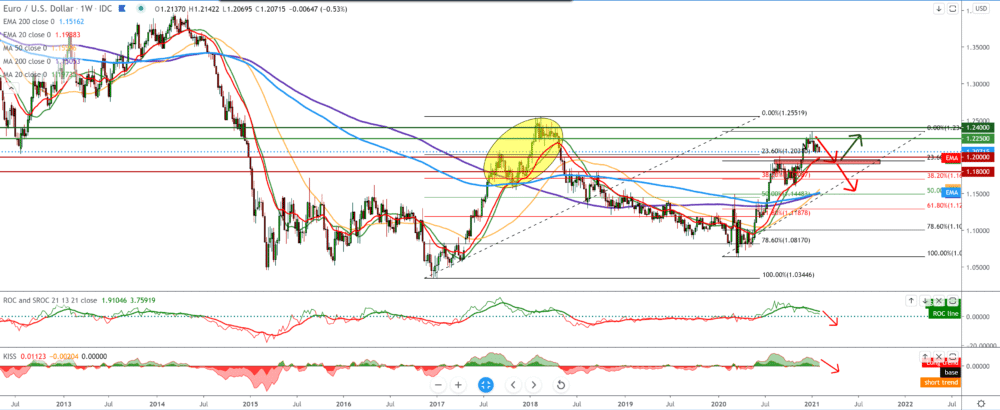

The EUR/USD pair chart on the weekly time frame shows that the euro is slowly slowing down and making a pullback from 1.23400 to the current 1.20930. As we predicted in previous analyzes for a pullback, it is now being realized, and we are looking at the psychological level at 1.20000. For some parallel, we can look at the previous pullback from 2018, where we first had a big bullish momentum and then consolidation, and then another smaller bullish momentum and then a pullback again. By setting the Fibonacci retracement level as the first support, we can expect at 1.19500 23.6% level.

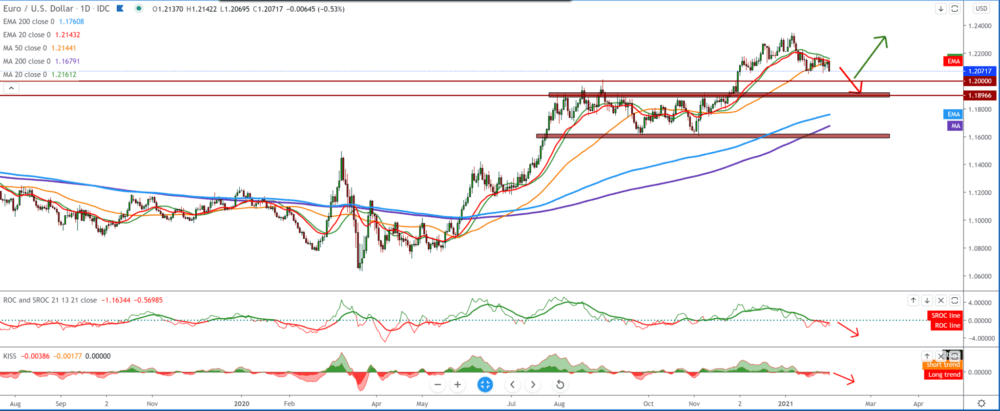

The image is cleaner on the daily time frame, and we see the bearish momentum being increasingly controlled over this pair. Moving averages have crossed from the top and are now on the bearish side, showing us the EUR/USD pair’s current direction towards the lower levels. As on the weekly time frame, the daily first bearish targets us, not psychological level 1.20000. Although the chart looks on the daily TF, the pair may well go below that looking for better support. We see better support at 1.19000. We can expect our strong support to MA200 and EMA200 (blue and purple line) in the bearish scenario.

On the four-hour time frame, we see that the EUR/USD pair has fallen below all moving averages, and based on that, in the next period, we can expect the pair to continue to the first support at 1.20500. By setting the Fibonacci retracement level, we see that the pair will soon test 38.2% level at 1.20655. To continue the bullish scenario, we need a break above 23.6% level, a hold above 1.21700, and a break above MA200 and EMA200. For now, our focus is on the Fibonacci level 38.2% and the 1.20000 psychological level.

From the news for the EUR/USD pair, we can single out the following: German retail sales fell sharply in December due to restrictions imposed on controlling the spread of coronavirus, Destatis data revealed on Monday. Retail sales fell 9.6 percent monthly in December, reversing the growth of 1.1 percent in November.

This was the first drop in three months and much higher than the economists’ forecast of -2.6 percent. Meanwhile, the momentum in the dollar seems to have been fueled by investor suspicions about an immediate debate over additional fiscal stimulus by U.S. makers (due later this week) and a potential impact on the prospect of a slow, slower vaccine introduction.

-

Support

-

Platform

-

Spread

-

Trading Instrument