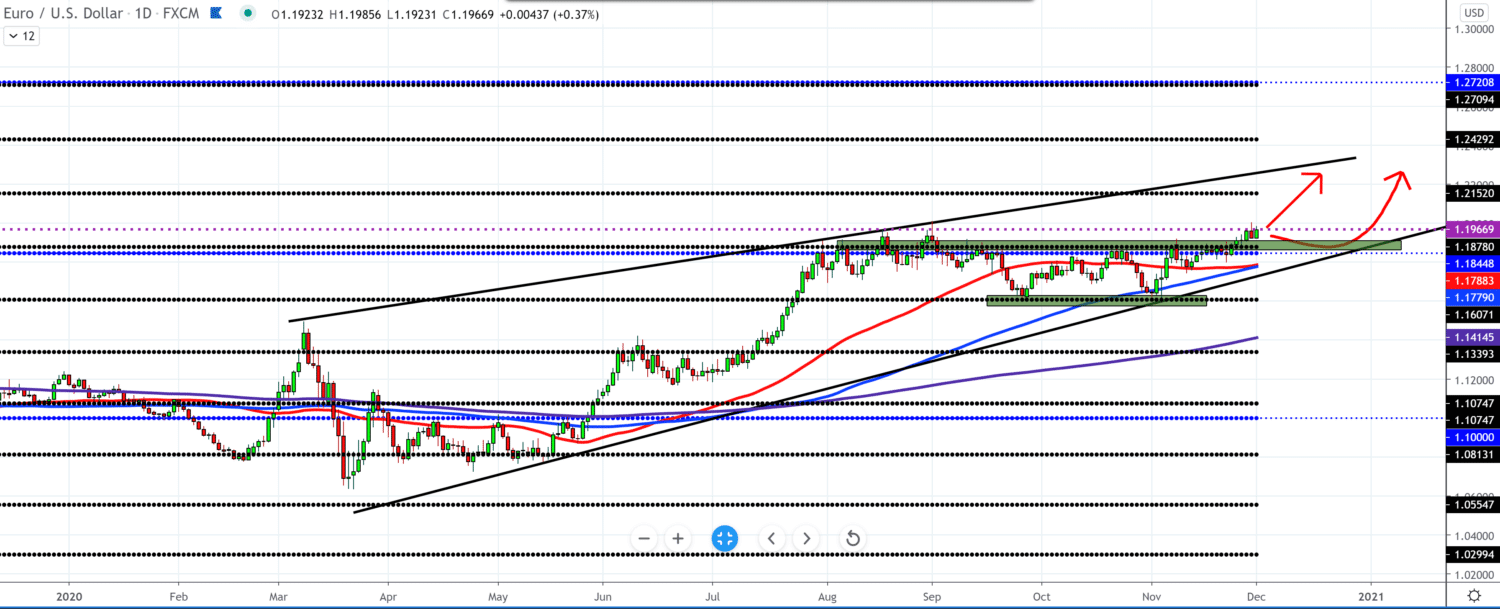

EUR/USD forecast for December 01, 2020

Following the chart on the weekly time frame, we see that a long-term trend line break was made, and a retest was made at the breaking point. The weak dollar could easily continue next year, and we can see the EUR/USD pair at higher levels. Last year’s resistances of moving averages MA50, MA100, and MA200 are now supporting the bullish scenario’s continuation.

On the daily time frame, we see one growing parallel channel with support for moving averages MA50, MA100, and MA200. A step above 1.18000 gives a new boost to the euro to move towards higher targets on the chart and above 1.20000. If we see a pullback, we can expect it to the bottom line of the trend where we also have support for moving averages MA50 and MA100 at 1.18000.

In the four-hour time frame, we have a different picture where we see the resistance at 1.20000, which is also the psychological limit, and that it is possible to pullback to zone 1.18500-1.190000 with the support of moving averages MA50 and MA100.

On the upper side, we have a trend line that connects the previous peaks, and we can use it as a line of resistance to higher levels on the chart. The euro’s pressure is due to the lockdown of European countries to mitigate the spread of coronavirus. Lockdown has slowed the economy, leading to rising unemployment, and the ECB now needs to take measures and actions to help and recover the economy. The advent of the vaccine has helped the euro by distracting investors from investing in the dollar.

GBP/USD forecast for December 1, 2020

The problem is that the vaccine is not yet in commercial use, and vaccination is expected to begin in mid-December. Today’s news about The Consumer Price Index (CPI) was worse than forecast, and its impact can be seen in the chart, which slowed down today’s growth of the euro. Consumer prices in the eurozone fell for the fourth month in a row in November.

-

Support

-

Platform

-

Spread

-

Trading Instrument