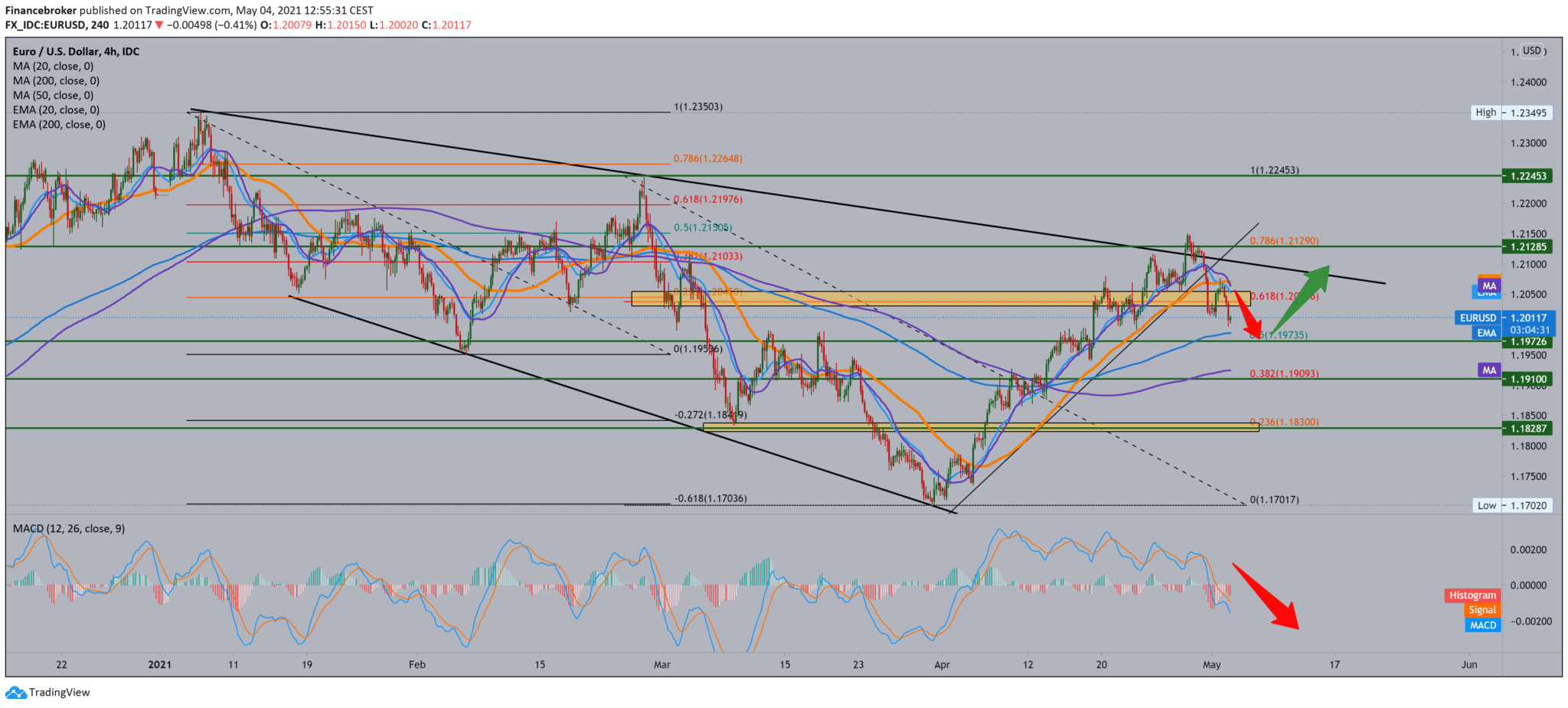

EUR/USD analysis for May 4, 2021

Looking at the graph on the four-hour time frame, we see that the EUR/USD pair bounced off the upper resistance line and made a turn towards the lower support lines. As in the previous pullback, 61.8-78.6% Fibonacci levels occurred in a similar zone. The EUR/USD pair is still under pressure from moving averages from the top with MA20, EMA20, and MA50, directing us towards MA200 and EMA200 in the 38.2-50.0% Fibonacci level zone 1.19093-1.19735.

We can expect the continuation of the pullback in the next period, as well as in the previous period. For the bullish scenario, we need a break above the moving averages and a Fibonacci 61.8% level again to 1.20500. Then we would climb to the upper resistance line again and wait to see if the consolidation would be positive for a continuation above 1.21000. Suppose we pass that we look at the previous high at 1.21500 as the next target and obstacle.

German ten-year bond yields retreated from annual highs of about -0.16% on Monday, returning to -0.20% on Tuesday. The moderate growth on the spot was also supported by the vice president of the ECB, L. De Guindosa, who said that the central bank could start with the gradual abolition of current incentive measures when introducing the vaccine accelerates and the economic recovery. In the absence of data publication in the euro area, the US calendar will take center stage with factory orders, the IBD / TIPP index, trade balance data, and the usual weekly API report to be published later in the NA session.

-

Support

-

Platform

-

Spread

-

Trading Instrument