EUR/USD analysis for April 28, 2021

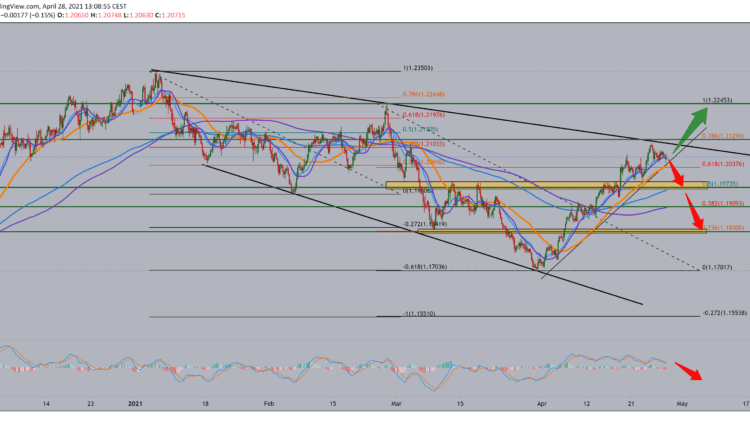

Looking at the EUR/USD pair chart on the four-hour time frame, we see that we have reached the upper trend line, and now here, we can expect some resistance. We can draw a rising support line from below, and if we see a break below it and a stronger break below the moving averages MA20 and EMA20.

By setting the Fibonacci retracement level, we see that we have reached the same resistance zone of 61.8% -78.6% level. A drop below 61.8% leads us to a 50.0% level at 1.19735, seeking that support and support in the moving averages MA200 and EMA200.

Looking at the MACD indicator, we see that the current signal is bearish, but we are still in the green bullish zone, and for a stronger bearish signal, we need to descend to the red zone of the indicator.

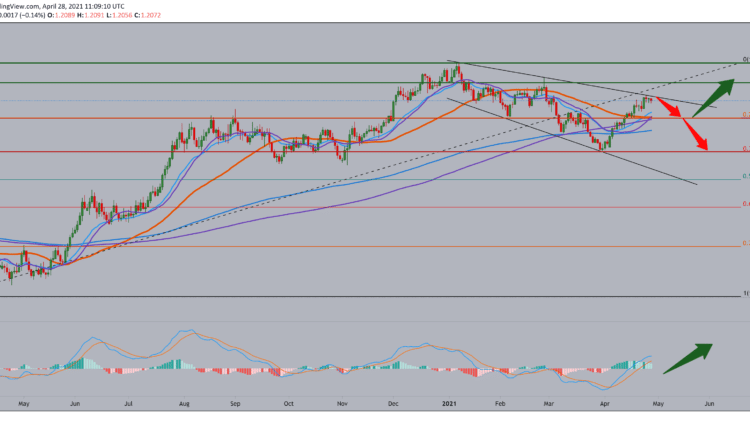

On the daily time frame, we see that we find resistance at 1.21100 and resistance at the top line. It is positive that we are supported by moving averages and that we can expect a shorter pullback that will confirm the continuation of the bullish trend. By setting the Fibonacci level, we see that the first support was found at 38.2% Fibonacci level, and that after that we went above 23.6% level, but that now based on candlesticks. We can expect a pullback and retest to this level of support.

Looking at the MACD indicator, we see that we are in a bullish signal, but with the current weakening of this trend, we can expect a slowdown and confirmation of a smaller pullback.

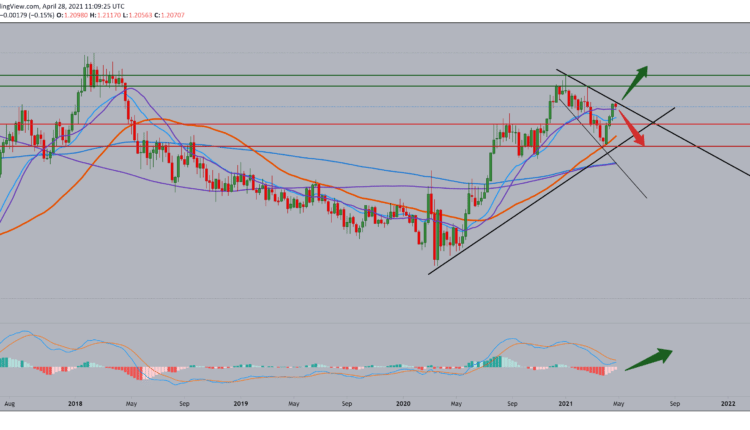

We see that we are currently testing moving averages MA20 and EMA20 to continue the bullish trend on the weekly time frame. If the EUR/USD pair endures in bounces up, then again we can see targets of 1.22000, followed by a potential previous high at 1.23550. If there is a withdrawal, we seek support on the MA50 and the bottom line of the growing trend. Following the MACD indicator, we see that the signal from bearish is slowly switching to the bullish option.

From the economic news for the EUR/USD currency pair, we can single out the following:

German consumer confidence should weaken in May, as growing cases of infections and subsequent tightening of restrictions have dampened income expectations as well as economic prospects, the results of a market research survey showed on Wednesday. The future consumer sentiment index fell to -8.8 in May from a revised -6.1 in April.

The result was predicted to improve to -3.5. French consumer confidence remained unchanged in April, defying mitigation expectations, preliminary data from the INSEE statistical office showed on Wednesday.

The reading of the consumer confidence index was 94.0, as in March. Economists expected 93.0. In February, the result was 91. The level of reliability remains below its long-term average of 100.

From the American market, we will have very important economic news tonight: the Fed is voting on interest rates tonight, each of their statements can affect this chart.

-

Support

-

Platform

-

Spread

-

Trading Instrument