EUR/USD analysis for April 14, 2021

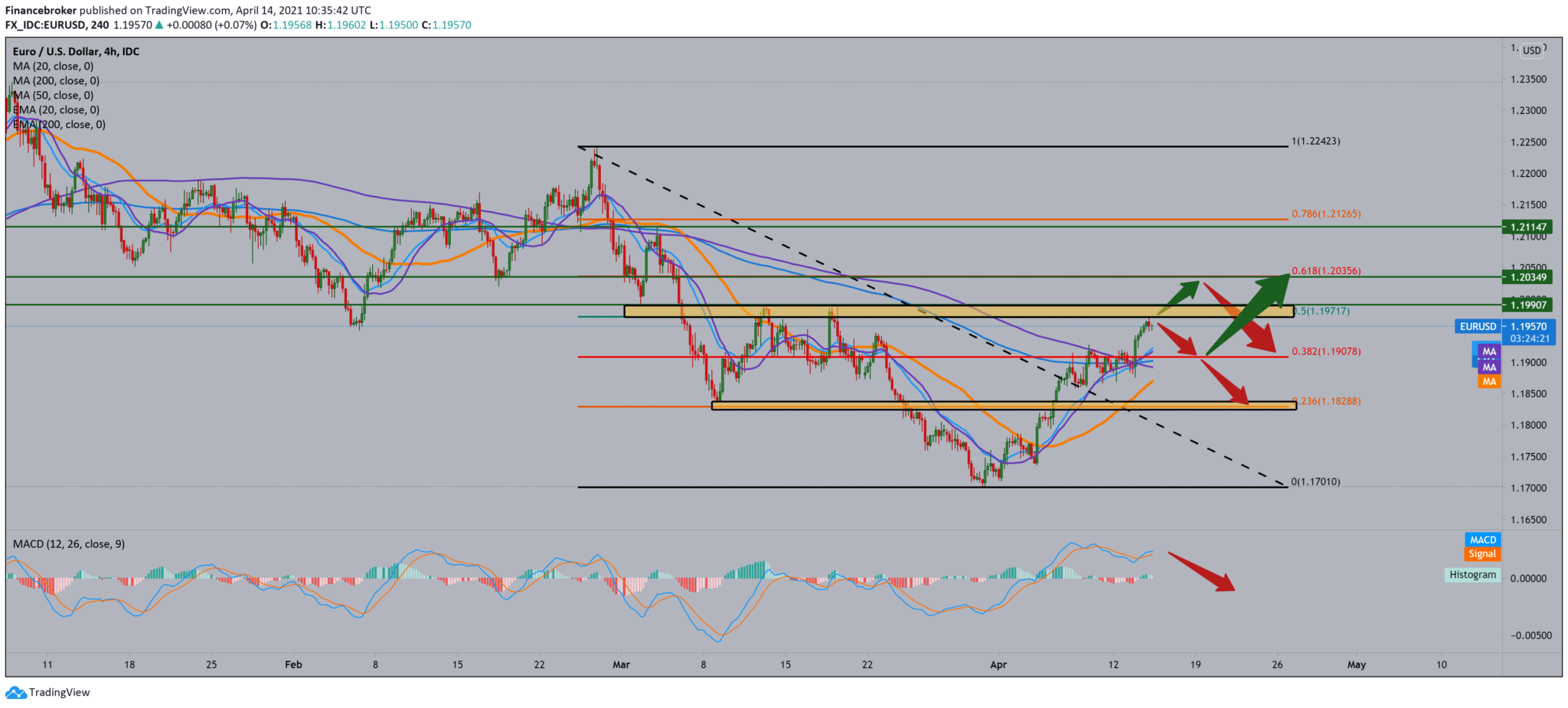

Looking at the chart on the four-hour time frame, we see that the EUR/USD pair is currently testing Fibonacci retracement 50.0% level at 1.19700. This is the place of the previous two rejections at the same level from March this year. Looking at the moving averages, the EUR/USD pair has support. The break was made above the MA200, but the trend on this time frame is bearish, and it is possible to pull at least 38.2% to 1.19080 so that we can test the moving averages again. Following the MACD indicator, we see that the blue MACD line is on the bullish side, but it is slowly slowing down. For now, it is moving sideways, making the last two histograms a weak and potential sign of possible steam weakening and potential pullback.

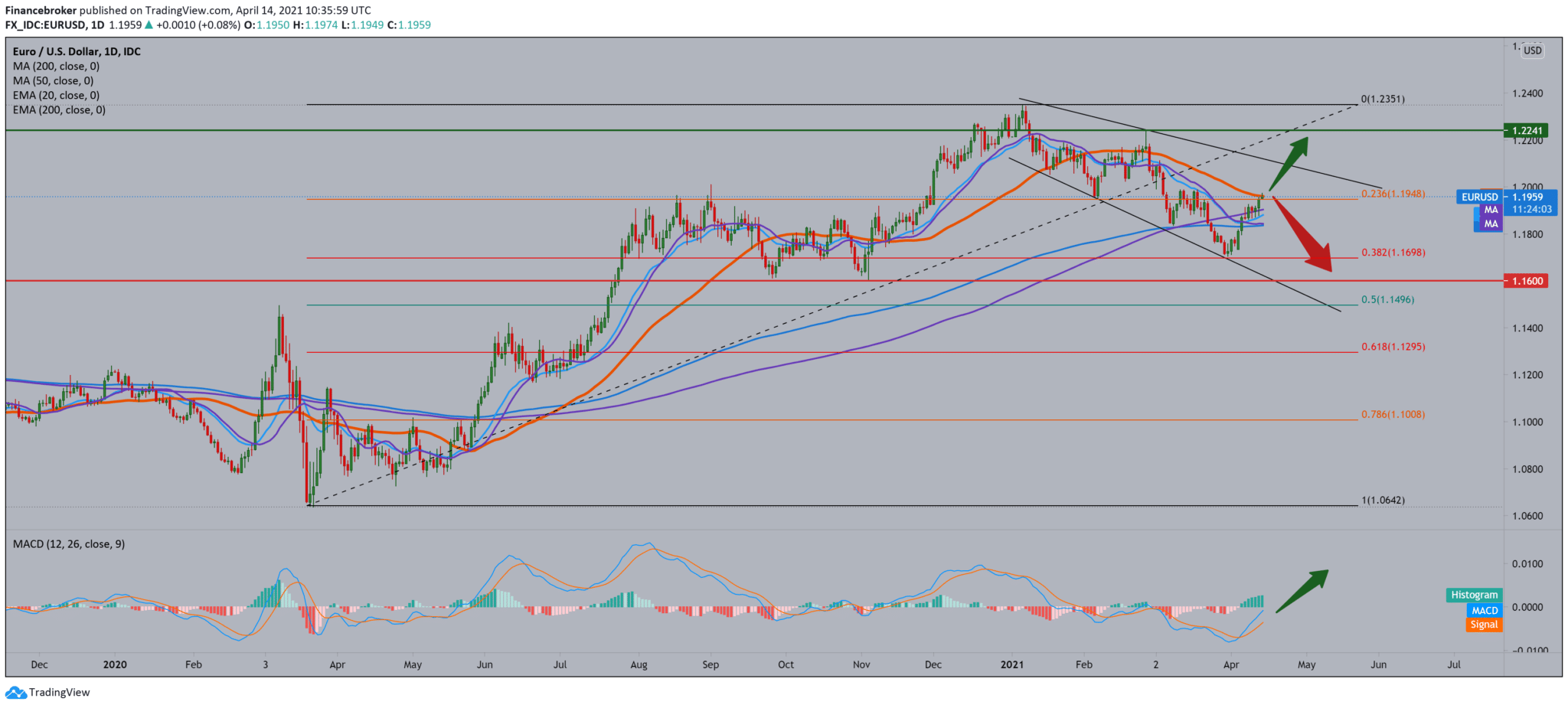

We see that we are in a falling channel on the daily time frame where we test moving averages today. We are focused on MA50 because the previous withdrawal happened on the same moving average. The stronger break above leads us to the top line of the falling channel, and otherwise, if the moving average lasts and bounces off the EUR/USD pair, then we go down to test other MAs with main support and an obstacle to a potential bearish trend at 1.18000. By setting the Fibonacci retracement level, we see testing of 23.6% level at 1.19500, and that the first support was at 38.2% level at 1.17000. Since the bearish trend is, we expect a rejection here where we are now and a re-descent and testing of previous support.

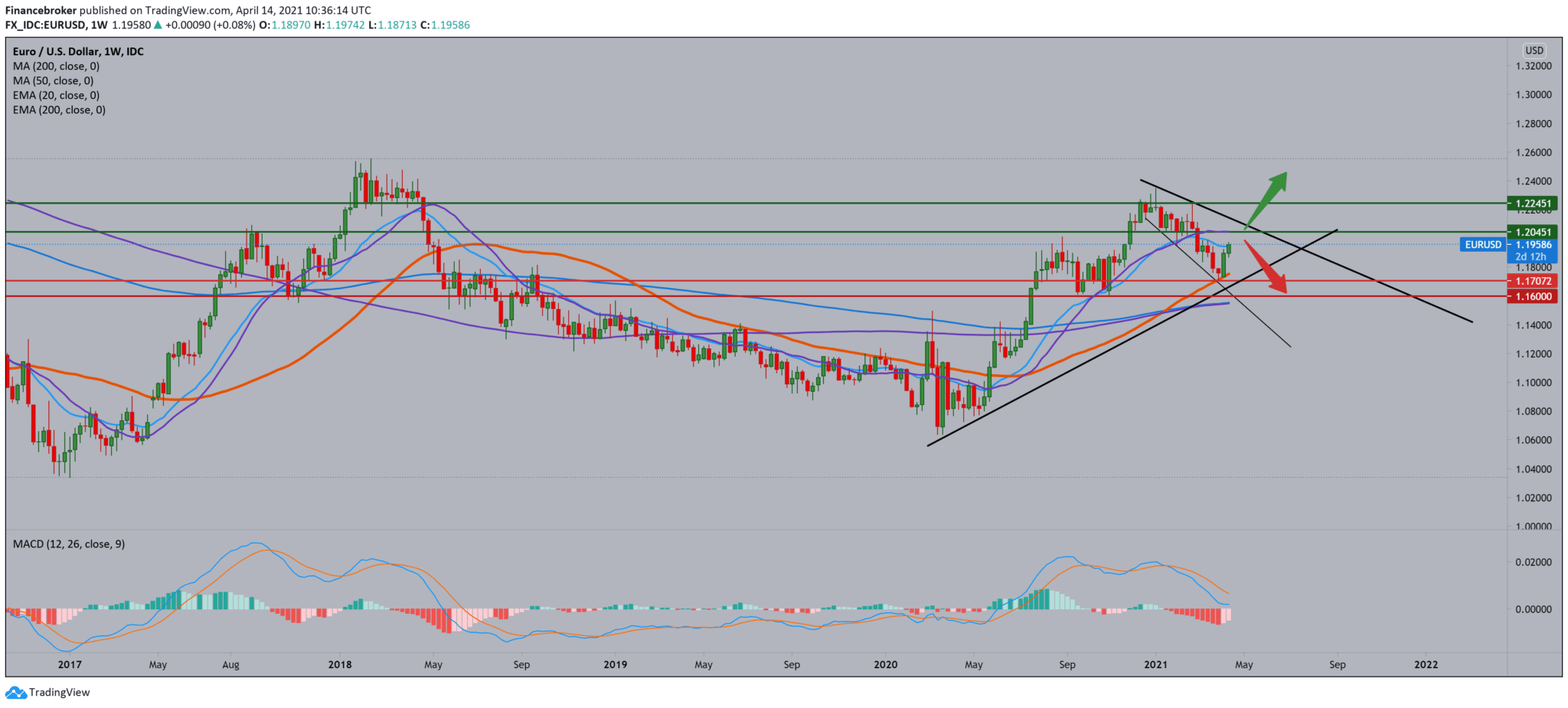

In the weekly time frame, we see that we are approaching the moving averages of MA20 and EMA20 and that we are entering a volatile zone for the Euro, where there may be more pressure and the arrival of a potential new pullback. Just a break above the top trend line will give us a stronger buy signal, while otherwise, we go down around 1.16000-1.17000 to tether the MA200 and EMA200. Looking at the MACD indicator, we see a slowdown in the bearish trend over the last two weeks, but we are still in the red zone.

-

Support

-

Platform

-

Spread

-

Trading Instrument