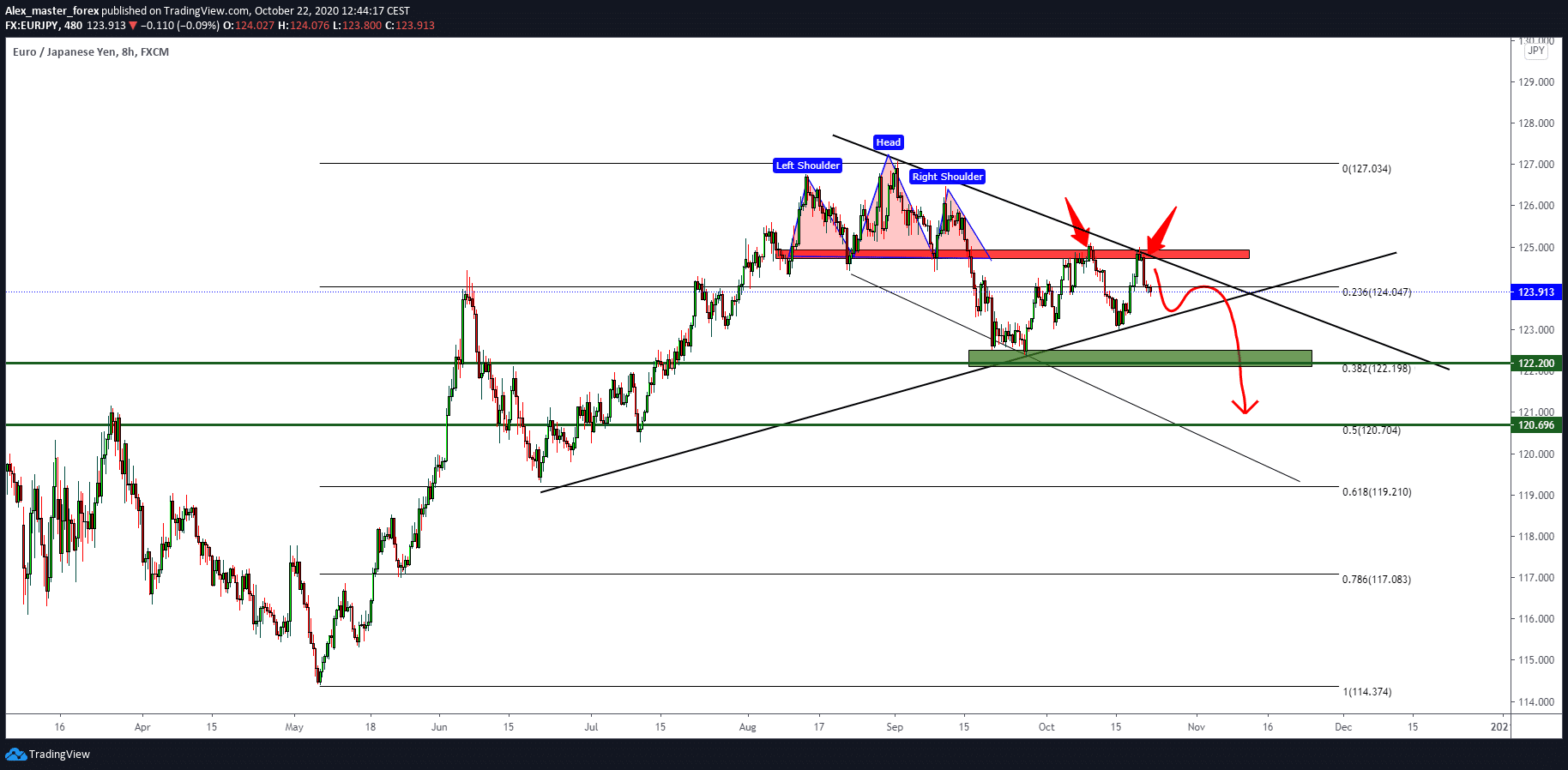

EUR / JPY weak euro in the next period

At the same time, the Japanese yen is certainly a haven for investors. Nothing scheduled data-wise in Euroland, while ECB’s Luis De Guindos said yesterday in the session that early removal of current stimulus carries the potential to hurt the incipient recovery in the region and warned at the same time against financial risks stemming from mounting debt. Later in the session, De Guindos is due, along with a speech by board member Phillip Lane. The Bank of Japan is largely expected to maintain its current monetary policy, with the main rate of -0.10% and a focus on holding yield curves under control.

A pandemic, like any other economy, hit the Japanese economy. The country recorded its worst GDP decline in K2, and although there are some signs of recovery, it is slow and painful. The number of coronavirus infections in Japan is at a stable level and is currently stagnant. If the price breaks the trend line as support below, we can watch the Fibonacci level 38.2% at 122,200, essentially bearish consolidation in the next week.

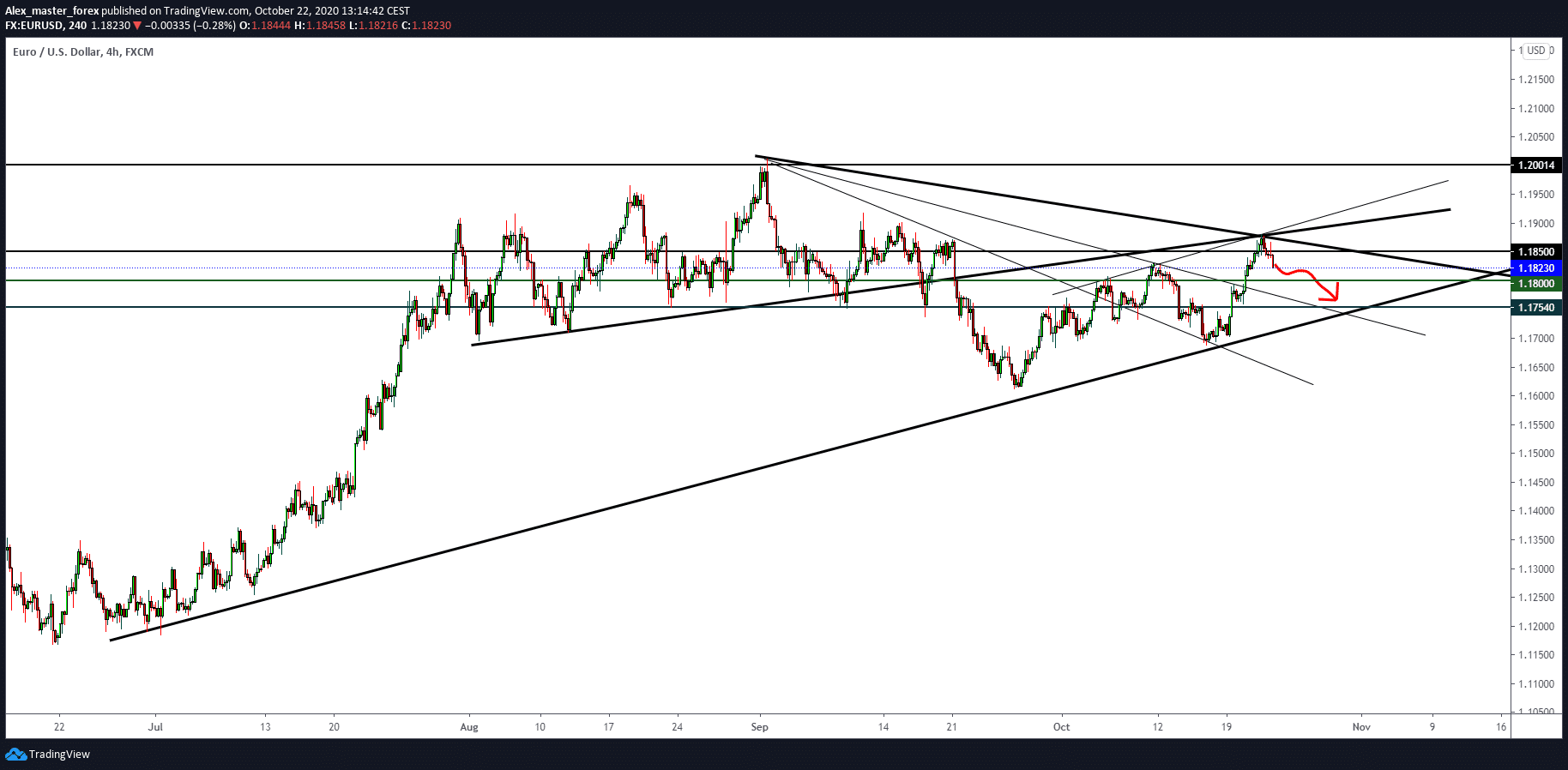

EUR / USD pullback to the trend line

During that time, the corona spread to European soil, and the number of infected people increased dramatically in almost all European countries. Brexit is a day of respite today. There are no political statements for now, maybe in the afternoon.

Technically, the pair retreats to a level of about 1.18000 and a maximum of 1.17500. At the session in New York, we will have news from American soil, measures for initial demands for the unemployed, and existing measures for selling houses. The impact is likely to be.

-

Support

-

Platform

-

Spread

-

Trading Instrument