EUR/NZD forecast for February 10, 2021

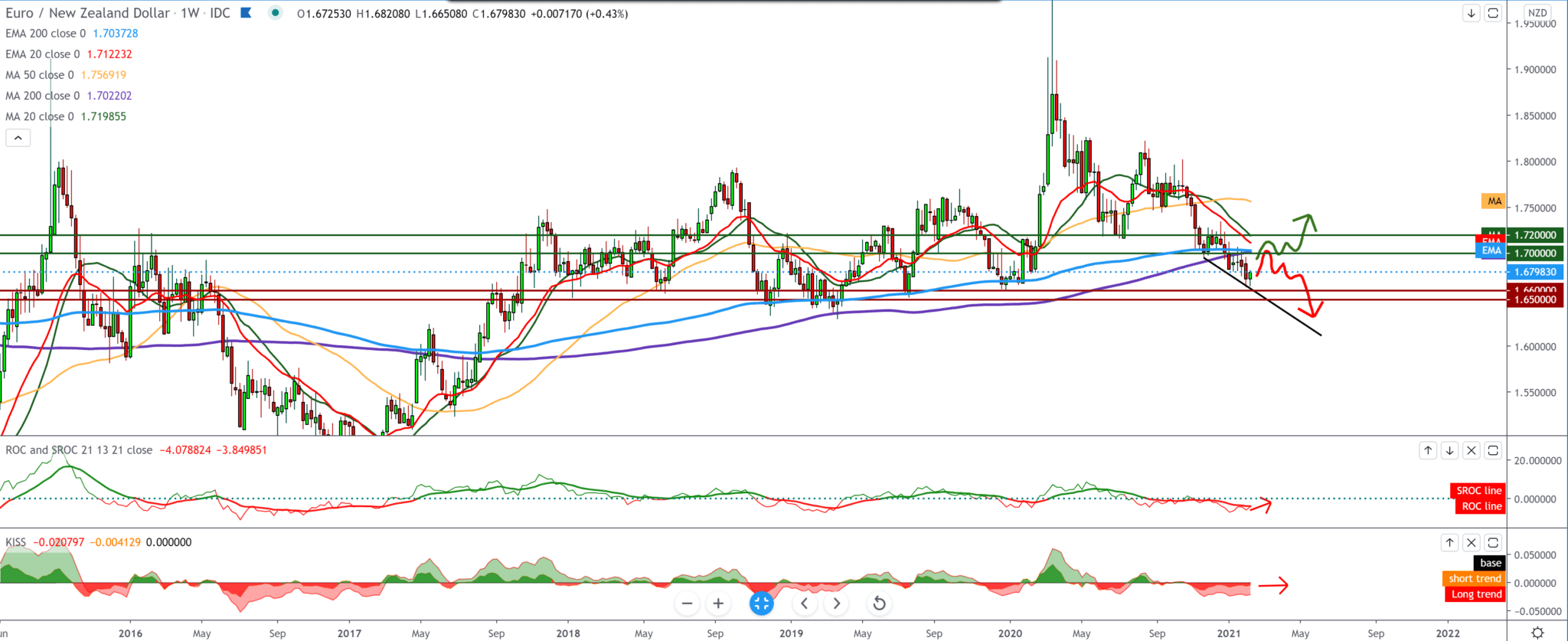

Looking at the chart on the weekly time frame, we see that the EUR/NZD pair finds support at 1.66500, making a now pullback to the current 1.68100. We are still under pressure with moving averages from the top, and based on that, we can conclude that looking at the bigger picture, the couple is still in a bearish trend. This week, the Euro managed to consolidate, and if it continues like that, it can climb to 1.69000. If the Euro fails, we will drop to a 1.65000 psychological level for the EUR/NZD currency pair.

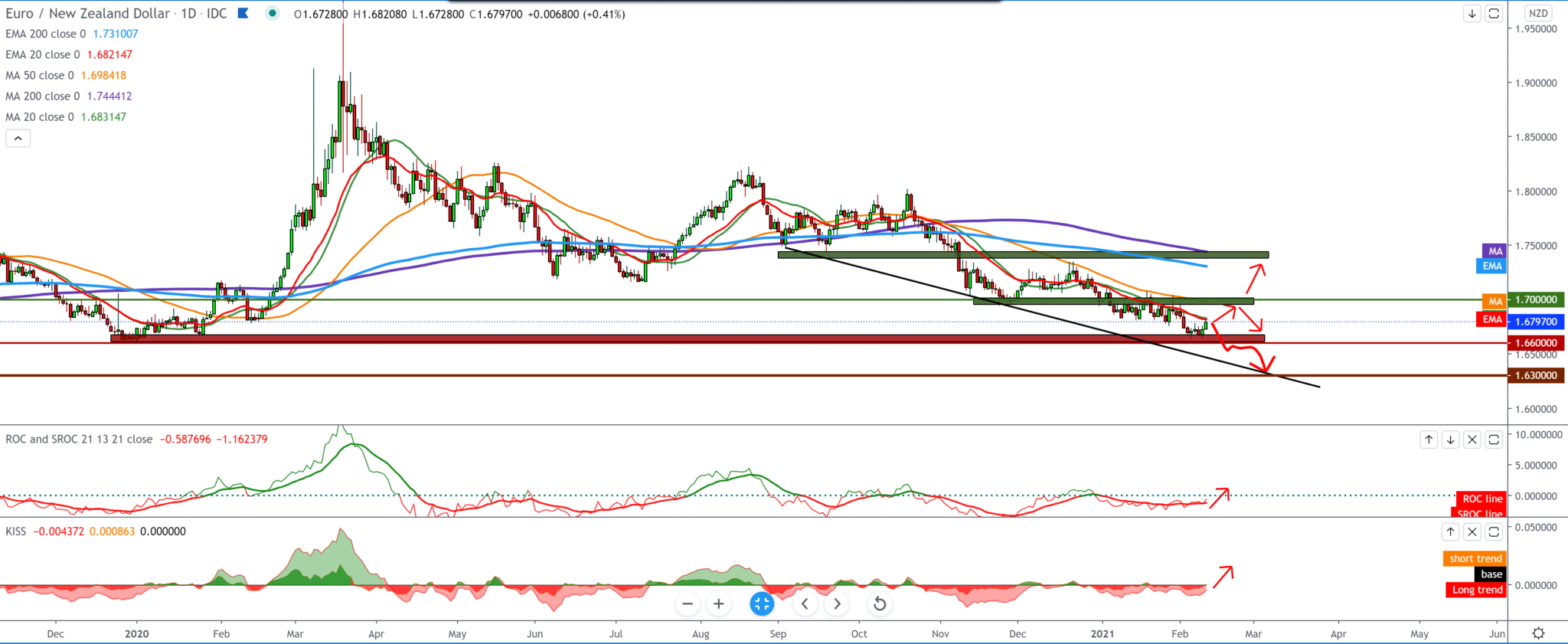

On the daily time frame, we see that the EUR/NZD pair, after finding support, makes a pullback and, for now, tests the moving averages MA20 and EMA20, which are on the bearish side for now. We see that the euro is succeeding and rising to MA50 but is quickly retreating again to lower levels. Looking at the chart like this, we can expect the pair to test 1.70000 also based on the previous candlesticks setting.

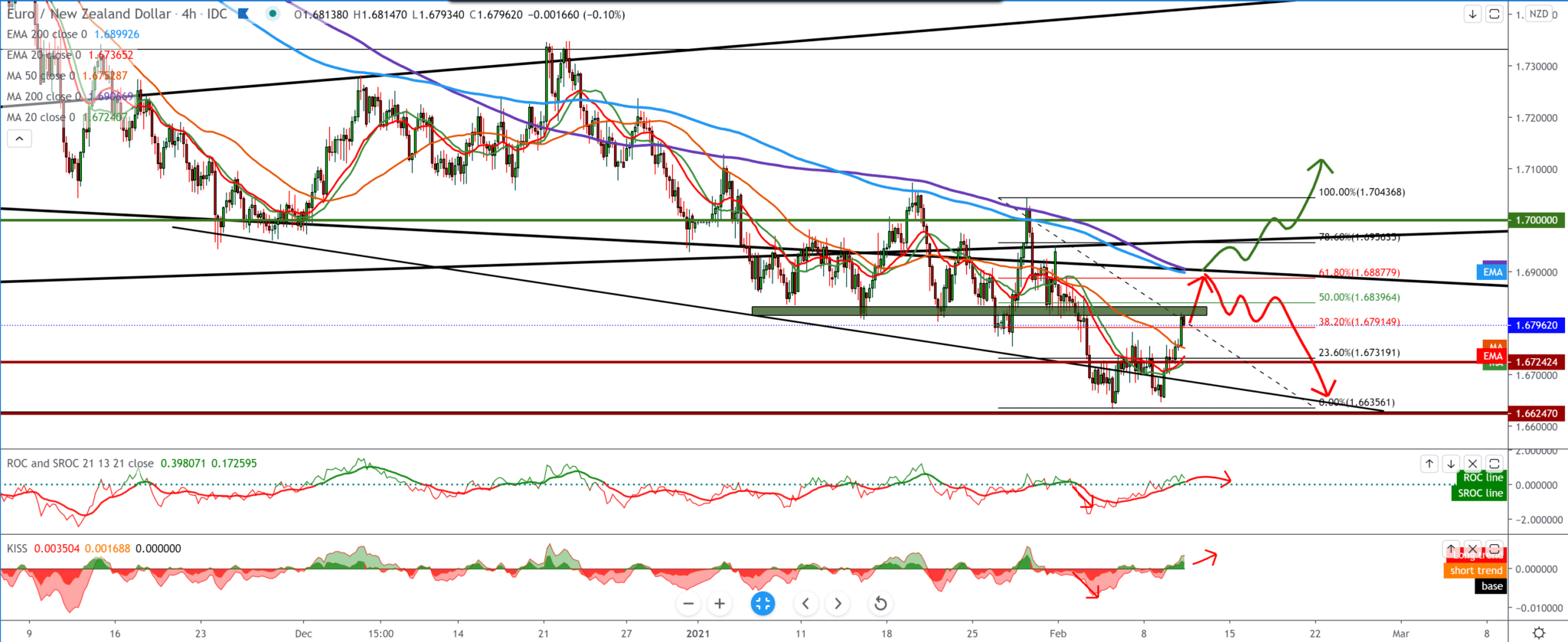

On the four-hour time frame, we see how the EUR/NZD pair found support at 1.66300; for now, it has support for moving averages MA20, EMA20, and MA50. Based on that, we can say that the EUR/NZD pair will climb to MA200 and EMA200, expecting potential resistance to 1.68880. Also, both of the indicators below show us that we can see the pullback’s continuation to higher levels on the chart.

From the news for these two currencies, we can single out: French industrial production fell for the second month in a row in December, data from the statistical office Insee showed on Wednesday. Industrial production unexpectedly declined by 0.8 percent from December to December, slower than the decline of 0.7 percent in November. Production was expected to increase by 0.2 percent.

Compared to February, the last month before the first general lock, production remained significantly lower in the manufacturing industry by 5.7 percent and in the industry as a whole by 4.9 percent. In the fourth quarter, production was 4.4 percent lower than the same quarter in 2019 and 3.8 percent in the entire industry.

Consumer price inflation in Germany was positive for the first time in seven months in January. The temporary reduction in VAT rates ended in December, the final data from Destatis showed on Wednesday. The consumer price index rose 1.0 percent year-on-year after falling 0.3 percent in December.

The Bureau of Statistics confirmed the preliminary estimate published on January 28. The positive inflation rate was last seen in June 2020, when prices rose 0.9 percent. Higher tax rates from January 2021 were passed on to consumers, which was one reason for the growth of consumer prices, Destatis said. For the New Zealand dollar, we only have news about Electronic Card Retail Sales tonight.

-

Support

-

Platform

-

Spread

-

Trading Instrument