EUR/NZD forecast for December 16, 2020

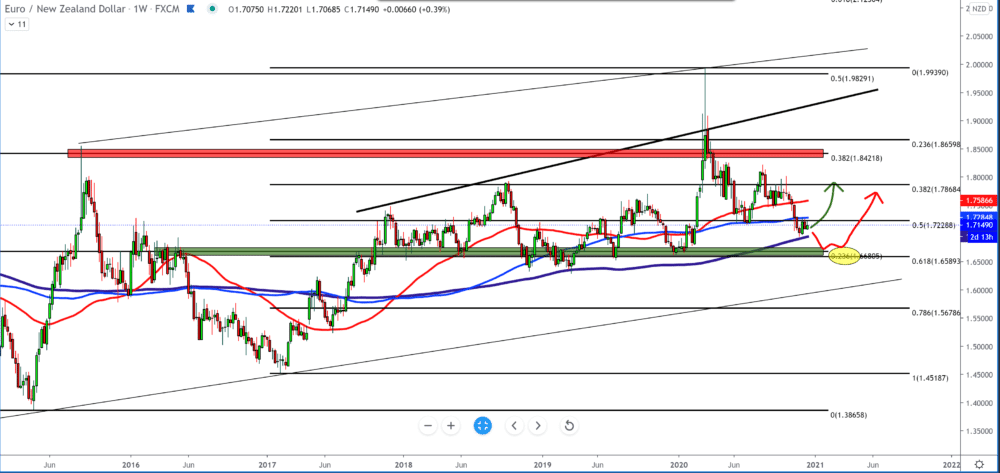

Looking at the chart on the weekly time frame, we can notice that the EUR/NZD pair is on the moving average of the MA200, which has been a support in the last couple of years. Fibonacci levels tell us that the EUR/NZD pair has good support at the 23.6% level at 1.66800-1.67000. To reverse the bulls trend, we need a slightly longer consolidation above the MA200 to confirm the support zone. If we see a break below MA200, we are looking for support at 1.6600-1.6700.

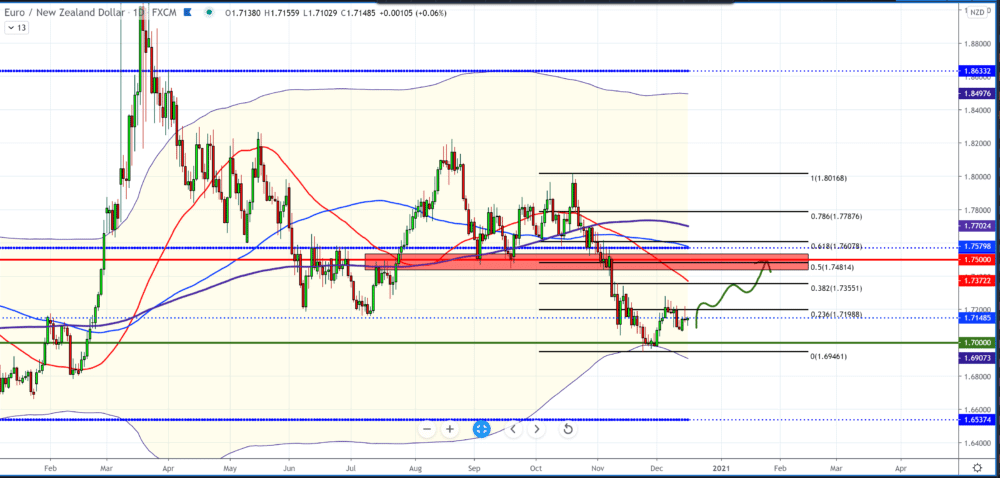

On the daily time frame, we can monitor the Bollinger bands 200 indicators and their channel. The graph shows the EUR/NZD pair bouncing off the bottom edge of the channel and returning up. For better bullish confirmation, we need a break above the Fibonacci level of 23.6%, after which our target can be 1.75000. The goal is to approximate the moving averages of MA50 and MA100.

In the four-hour time frame, we see the EUR/NZD pair trying to pullback to higher levels. As the first support is the moving average MA100, now we also need a break above MA50 for better confirmation for the bullish option. The first target on this time frame may be 1.73000 previous high.

Today is a day full of economic news for both the NZD and the euro. The New Zealand government improved its economic and fiscal outlook on Wednesday when the economy dropped from the Covid-19 limit. According to the latest semi-annual monetary and fiscal update in 2020, the economy will grow 1.5 percent during the year to June 2021 instead of the 0.5 percent decrease estimated in the Pre-Election Economic and Fiscal Report, or PREFU, published in September.

Finance Minister Grant Robertson said the government’s decision to respond quickly to the global Covid-19 pandemic has contributed to a better-than-expected economic recovery. The Treasury said the fiscal outlook improved mainly due to stronger economic activity than previously anticipated.

The German private sector expanded again in December with strength in production that continues to alleviate the service sector’s weaknesses, the results of a survey by IHS Markit revealed on Wednesday, which led to the stability of the euro.

The output composition index unexpectedly rose to 52.5 from 51.7 in November. The reading was predicted to fall to 50.4. A reading above 50 indicates expansion. The procurement manager index reached 47.7, compared to 46.0 a month ago and above the consensus forecast of 44.0. Production PMI advanced to 58.6 from 57.8 in November. The result was seen at 56.4.

-

Support

-

Platform

-

Spread

-

Trading Instrument