EUR/JPY forecast for March 16, 2021

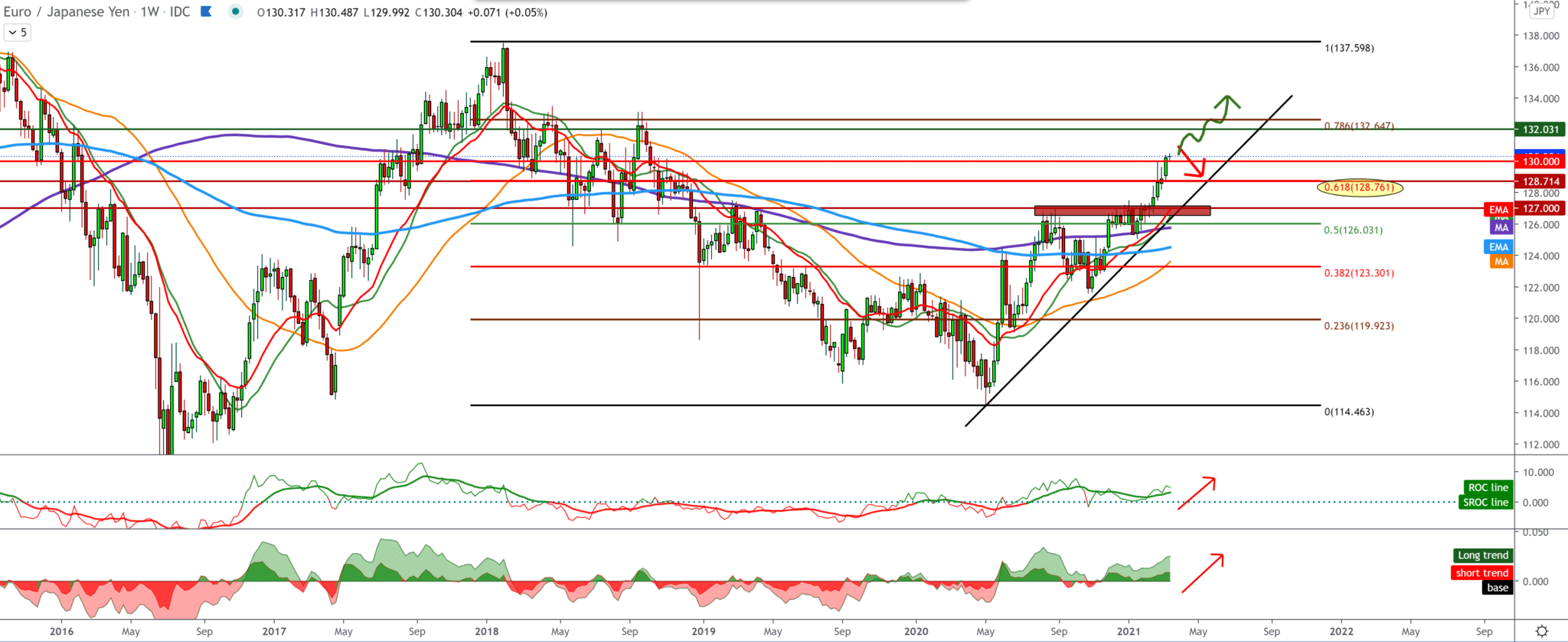

The chart on the weekly time frame shows a strong bullish trend with a break above Fibonacci 61.8% level and breaking the psychological zone at 130.00. Based on the chart’s situation, we can expect the continuation of the bullish trend and the probability that the EUR/JPY pair will climb to the previous high at 133.00 from September 2018. Moving averages are far down on the bullish side, and they are of no use to us for now. The global use of vaccines and the reduction of business risk have led to a decline in the Japanese yen’s strength.

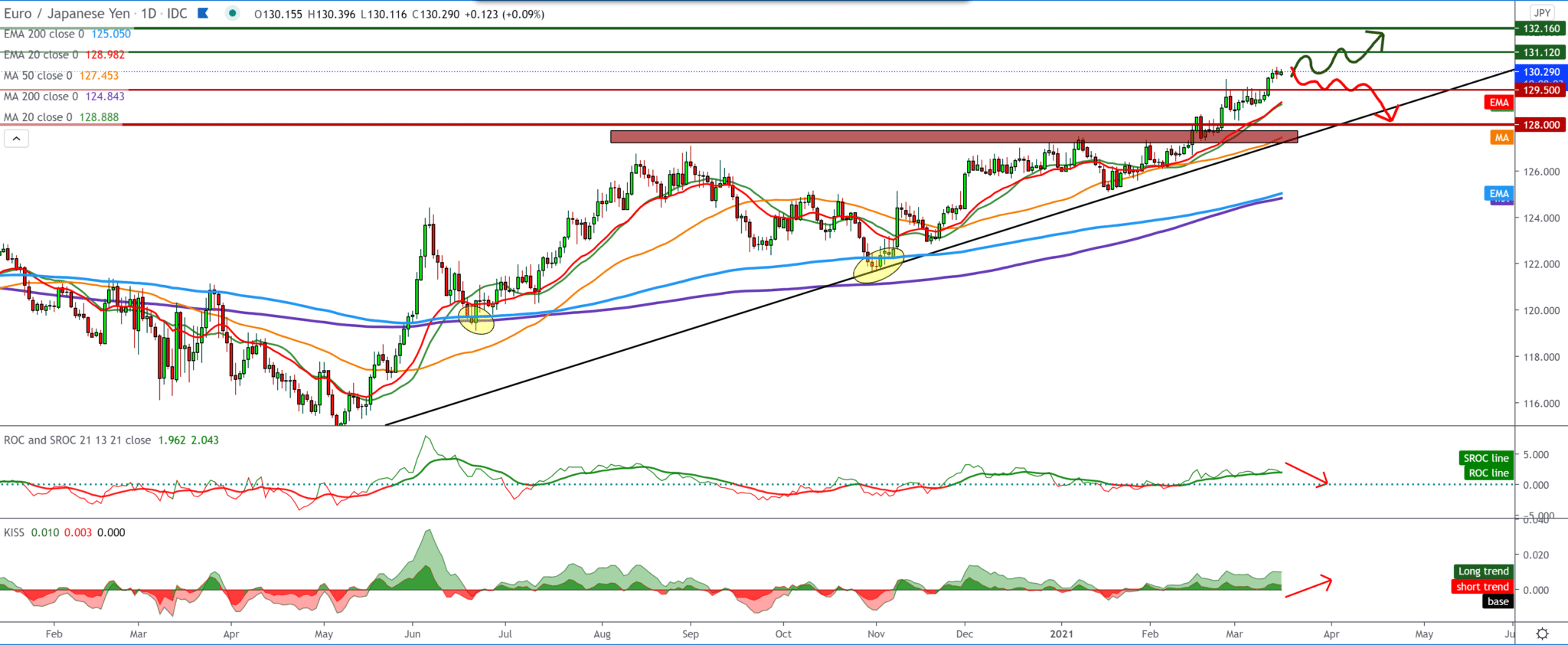

On the daily time frame, we can set the trend line from the bottom, and it gives us support to continue the bullish trend. Moving averages are on the bullish side and, for now, represent a good support pair. If we look up our first target is 131.00, we aim for 132.00, and the next maximum target is 133.00 previous high. For some stronger signal for the bearish trend, we need a break below the trend line and a drop to 128.00, and after that, our targets are moving averages MA200 and EMA200.

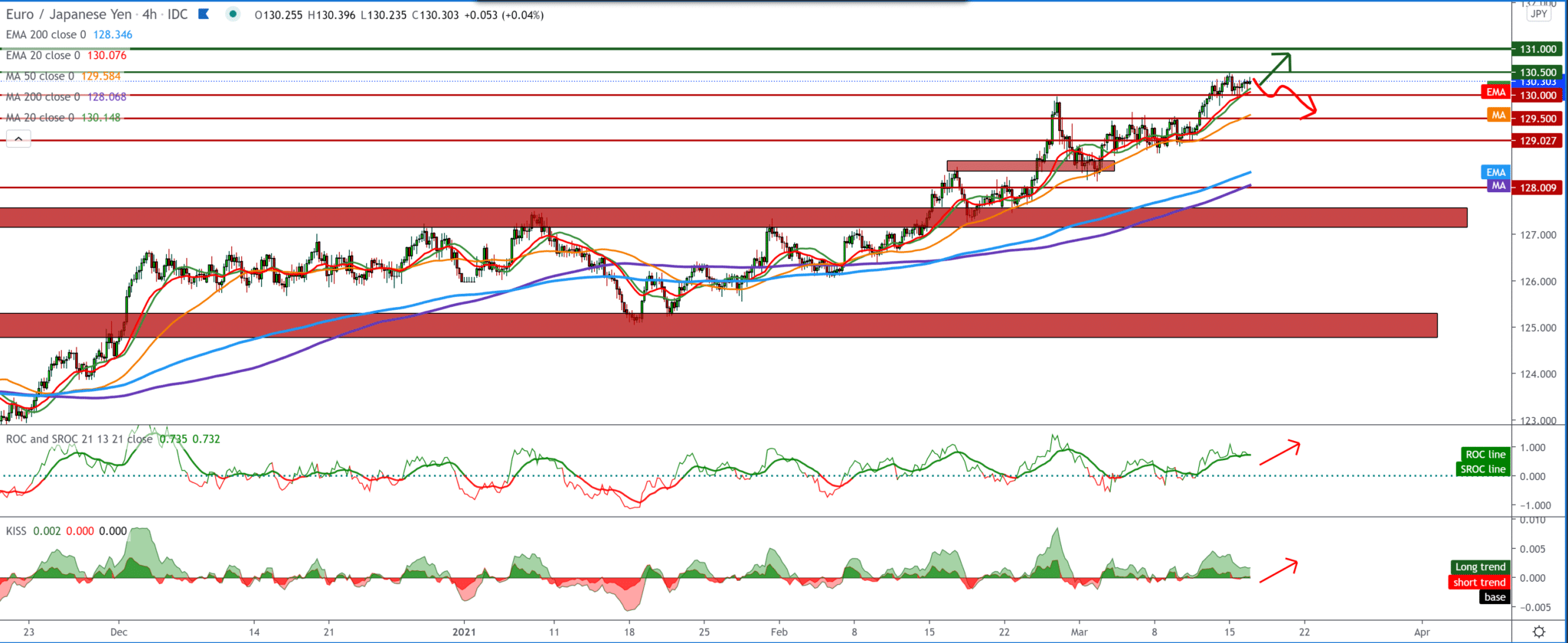

On the four-hour time frame, we see a strong bullish trend from mid-February. The EUR/JPY pair is supported from below by moving averages MA20, EMA20, and MA50. Based on this, we can expect the EUR/JPY pair to cross 130.50 first and then approach 131.00. We can look at the bearish scenario as a pullback, and first, we need a break below MA50, which would be a stronger signal to continue down towards MA200 and EMA200.

From the news for these two currencies, we can single out the following: German economic confidence improved in March. Data from the ZEV – Leibniz Center for European Economic Research showed on Tuesday. The ZEV economic sentiment indicator rose 5.4 points to 76.6 points in March. The reading was above the economist forecast of 74.0. The current index of the economic situation rose to 6.2 points in March from -61.0. The expected level was -62.0. “Economic optimism continues to grow,” said ZEV President Achim Wambach. Experts expect the German economy to recover on a broad basis. Japanese Bank Governor Haruhiko Kuroda said he should prepare to respond to new payment and settlement systems and future digital currency needs.

Although the bank has not changed its position that “it does not currently plan to issue the central bank’s digital currency,” it is important that we thoroughly prepare to respond to changes in circumstances in an appropriate manner, Kuroda said in a video message. Japanese industrial production rose more than estimated in January, the Ministry of Economy, Trade, and Industry announced on Tuesday. Industrial production rose seasonally adjusted by 4.3 percent on a monthly basis in January. In the initial estimate, production rose 4.2 percent.

-

Support

-

Platform

-

Spread

-

Trading Instrument