EUR/JPY forecast for February 19, 2021

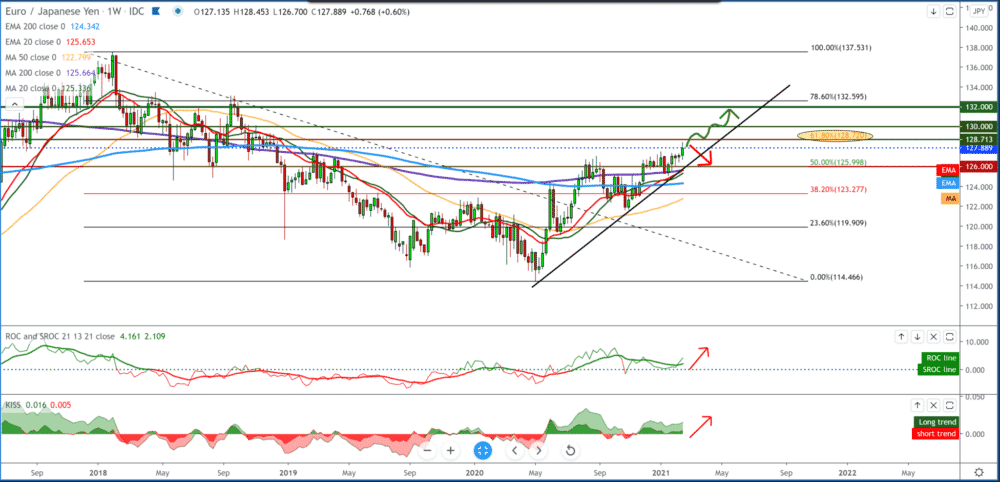

Looking at the graph on the weekly time frame, we see that the EUR/JPY pair is currently testing Fibonacci retracement level 61.8% to 128,700, and here we can expect potential resistance to higher levels.

The continuation of the bullish trend takes us to the 130.00 psychological level from 2018. It took a long time for the pair to break again above the moving averages of the MA200 and EMA200 and to stay above, making a consolidation at 50.0% Fibonacci level and continuing upwards towards higher values the chart. For the bearish scenario, we need to first break below the bottom trend support line.

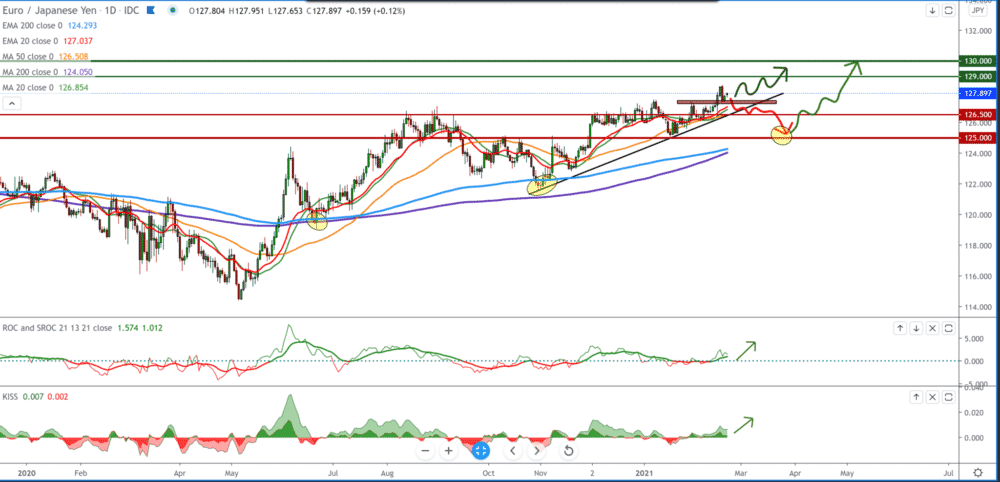

On the daily time frame, we see that the EUR/JPY pair made a break above 127.00 of the previous high, making a potential FLAG pattern based on which we conclude that there will be a continuation of the bullish trend pushing the EUR/JPY pair closer to 130.00.

Moving averages are on the bullish side, and for now, they are a support for the pair and a good indicator of the continuation of the trend. A break below MA20 and EMA20 would show the Euro’s weakness and would bring the pair down, looking for better support on the chart. As the first such support, our zone is around 126.50, and if it does not last, we go to safer support at 125.00.

In the four-hour time frame, we see an ascending asymmetric channel that narrows and reduces the EUR/JPY currency pair’s space of movement.

After reaching the previous high at 128,450, we see a pullback to 127,250, where we were greeted by the support of the moving average MA50, and the EUR/JPY pair then started burning again at the current 127,850.

If we are bullish, we can look at the target previous high and new targets above that all closer to 130.00, while on the other hand, if we expect bearishly, we need a break below the bottom line of support of this growing channel. Such a break below 127.00 drags us towards 125.00, looking for better support on the chart.

From the news for the EUR/JPY pair, we will single out the following: The decline of the Japanese private sector continued in February, despite the recovery in production activity, data from a quick survey by IHS Markit showed on Friday.

The positive sentiment stemmed from the hope that the cessation of the 2019 coronavirus disease pandemic (COVID-19) would trigger a recovery in domestic and foreign demand, said Usamah Bhatti, an economist at IHS Markit.

Nevertheless, the disturbance caused by the pandemic will probably remain in the near future, the economist added.

Marcel Thieliant, an economist at Capital Economics, said the recovery of the composite PMI in February supports the assessment that the economy is coping with the second state of emergency better than most expected.

The eurozone’s private sector continued to contract in February, driven by a further decline in the service sector as restrictions on viruses continued to affect many businesses. The results of a survey by IHS Markit showed on Friday.

The composite production index rose to 48.1 in February from 47.8 in January. The expected reading was 48.0.

However, a score below 50 indicates a contraction. The sector shrank for the fourth month in a row.

-

Support

-

Platform

-

Spread

-

Trading Instrument