EUR/JPY forecast for February 10, 2021

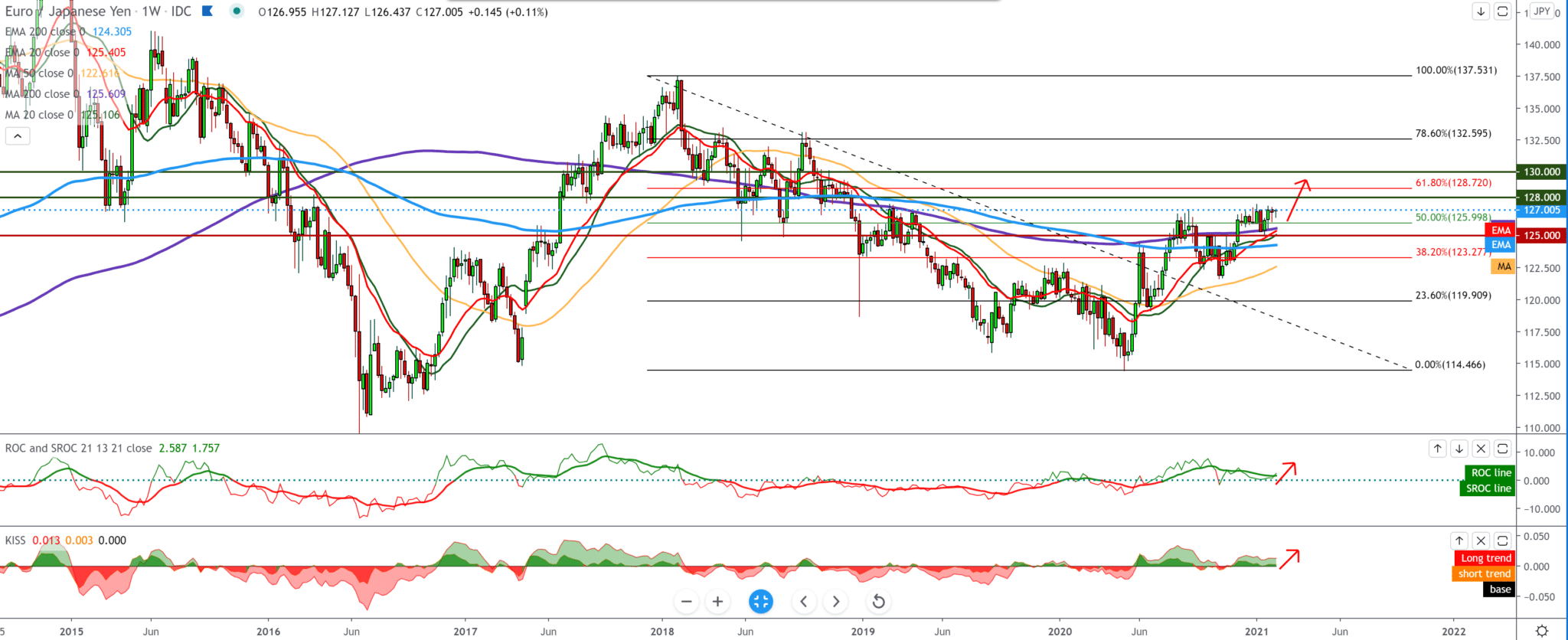

Looking at the chart on the weekly time frame, we see how the EUR/JPY pair progresses to higher levels on the chart. The pair made a break above the moving averages of the MA200 and EMA200 very important indicators for determining the trend’s next direction. By setting the Fibonacci retracement level, we see how the pair finds support on the Fibonacci 50.0% level n 126.00. We can now expect the EUR/JPY pair to continue further towards the Fibonacci 61.8% level at 128.70. For something like that, we first need a break above 127.50. The bearish scenario only comes into play if the pair drops below 125.00 and by moving averages to the bearish side.

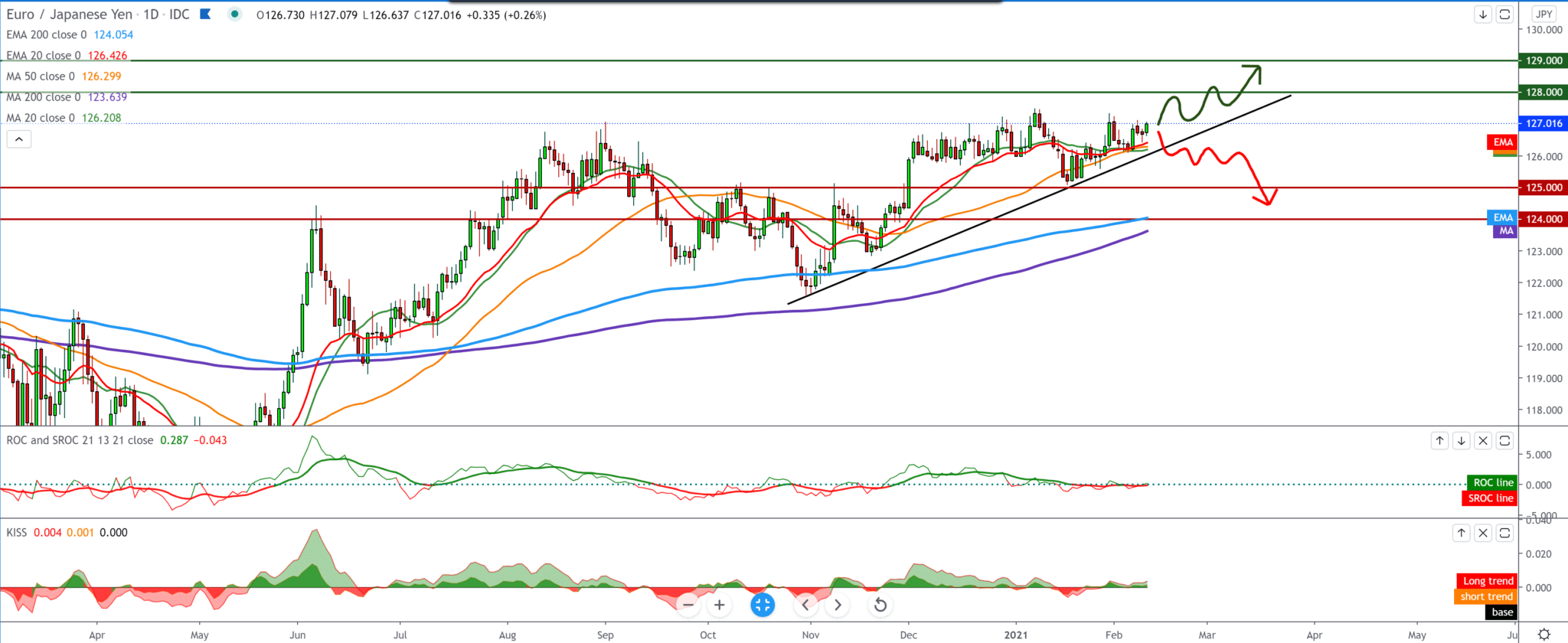

On the daily time frame, we see that the chart forms a trend line merging the previous lows at the bottom. The EUR/JPY pair has support in the moving averages MA20 and EMA20, and MA50, which is a good sign for further continuation of the bullish trends. We can look at the bearish side if we see the break trend line and how the pair will behave if it falls to the 125.00 level. We are on the bullish side for now, and so we can look at the chart, and now we expect a break above the previous high at 127.50. after that, we can expect the pair to climb close to 128.00.

EUR/NZD forecast for February 10, 2021

-

Support

-

Platform

-

Spread

-

Trading Instrument