EUR/GBP forecast for February 5, 2021

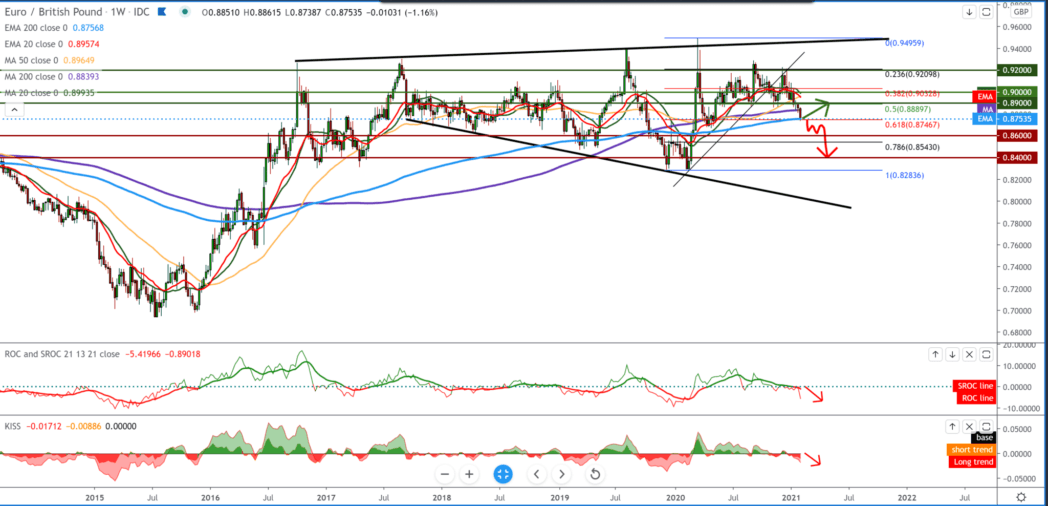

Looking at the chart weekly, we see one bearish trend from the moment the EUR/GBP pair reached 0.92000 and is now at the current 0.87500 testings Fibonacci retracement level of 61.8%. The EUR/GBP pair is also on the moving average of the EMA200, and a break below the MA200 may indicate a potential continuation of the bearish trend. We can ask for support at the essential levels 0.87000, 0.86000. If we look at this pair bullish now, we expect a rejection of 61.8% Fibonacci level with the support of EMA200.

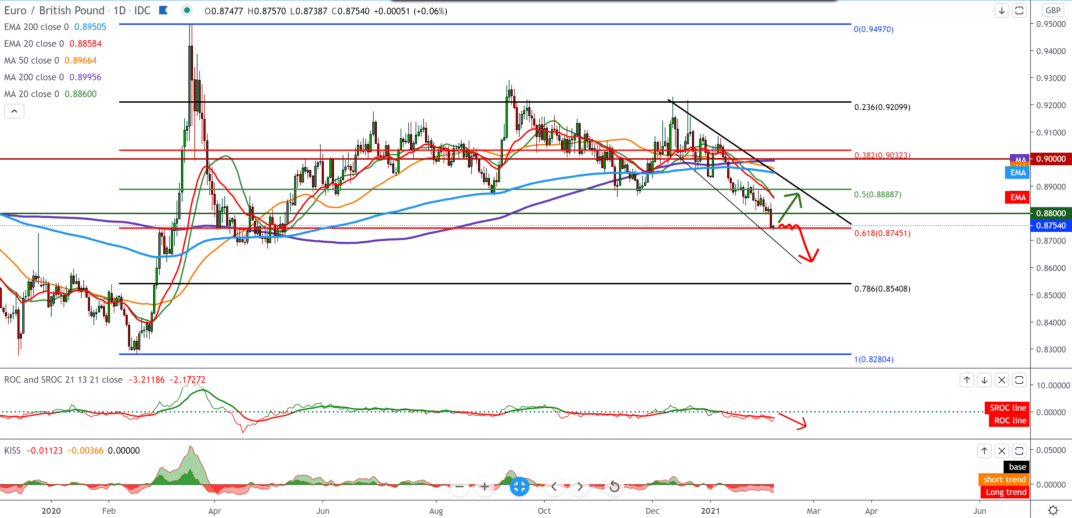

On the daily time frame, we see that the EUR/GBP pair is now testing a Fibonacci 61.8%. We are now monitoring whether there will be a rejection from that level for the pullback to end, or we will see a break below and a continuation towards lower levels. All moving averages are on the upper side and confirm the bearish trend. The MA20 and EMA20 indicators, for now, are good resistances of this pair towards the transition to the bullish trend.

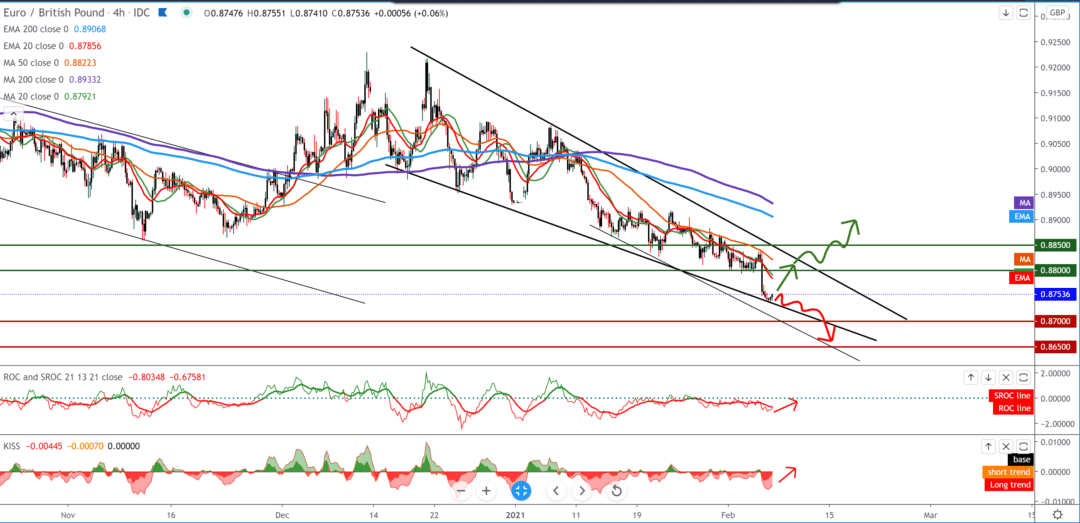

We see that the EUR/GBP pair finds current support at 0.87500 within the drop channel on the four-hour time frame. We can conclude that we will see a smaller pullback to 0.88000 where the EUR/GBP pair will test moving averages MA20 and EMA20 following previous pullbacks within the bearish trend.

From the news for the currency EUR/GBP pair, we can single out the following:

German Minister of Health: The number of viruses is still not falling fast enough. The virus situation in Germany appears to be easing at a gradual pace. However, due to concerns about more contagious viruses spreading, stricter restrictions may remain in place until the Easter holidays.

Despite delays and rush to introduce the vaccine, Europe still aims to vaccinate more than two-thirds of the adult population by the end of the summer. House prices in the UK fell for the first time in six months in January, and they showed on Friday.

Check-out Financebrokerage’s Comprehensive Review on Fundiza

House prices fell 0.3 percent in January after remaining unchanged in December. This was the first drop since May and the biggest drop since April last year. Economists predicted that prices would rise by 0.3 percent.

-

Support

-

Platform

-

Spread

-

Trading Instrument